- XRP noticed a fast improve in dormant exercise that was adopted by a 12% value drop.

- The falling MDIA gave long-term holders some bullish hope.

Ripple [XRP] noticed elevated whale exercise final week, and whales holding greater than $5 million are in possession of 55% of the token provide. This focus amongst whales can result in wild value swings, such because the one we noticed on the tenth of July 2023.

The value was additionally in a consolidation section in current months and struggled to beat the vary highs at $0.7 that has been in place since August 2023. The on-chain metrics confirmed that short-term promoting stress on XRP might improve.

Largest dormant circulation spike in over a yr

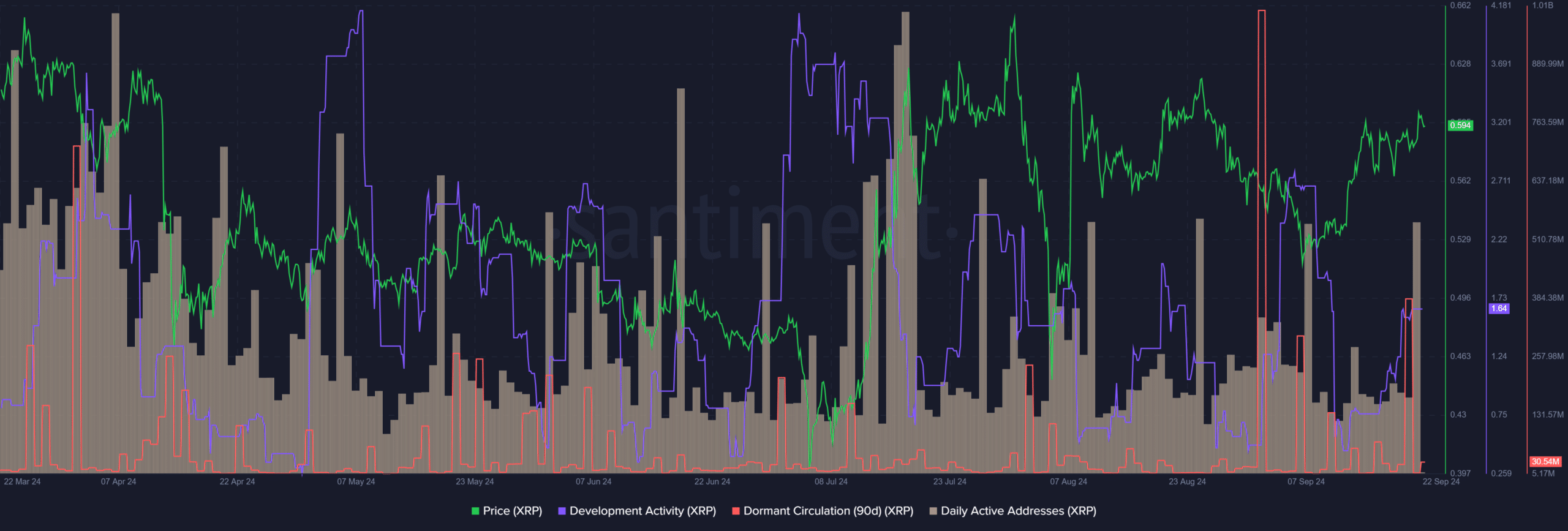

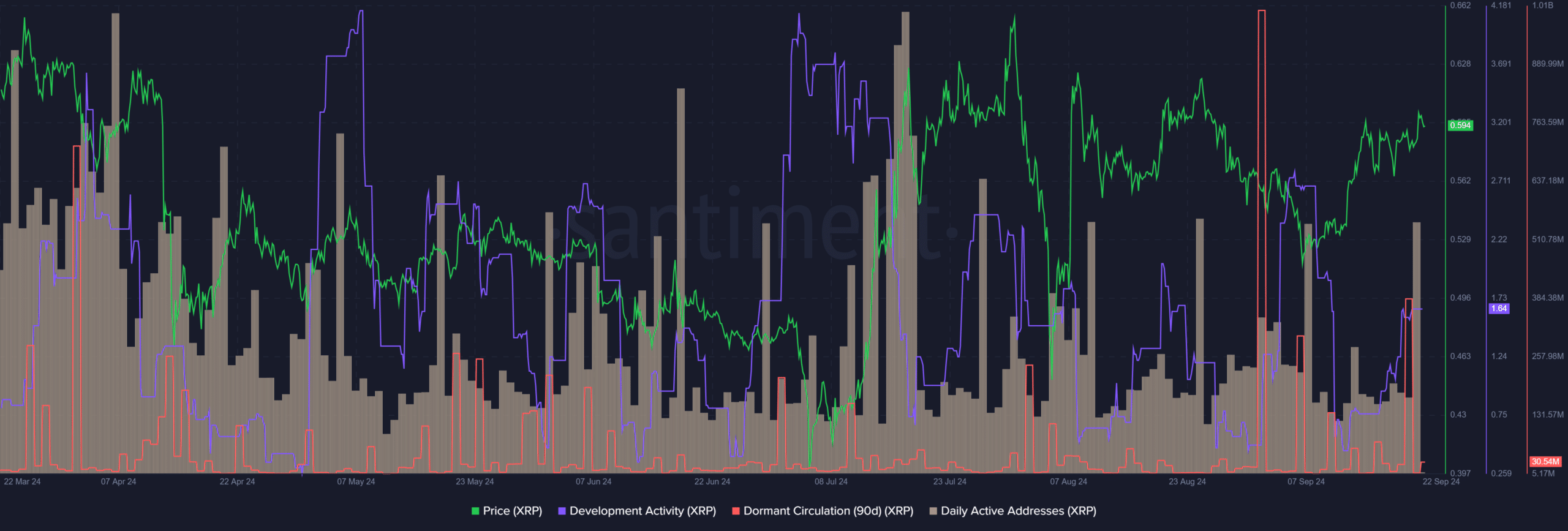

Supply: Santiment

On the 2nd of September, the dormant circulation noticed an enormous spike. This confirmed an infinite storm of exercise amongst XRP addresses. A surge in exercise that eclipsed this was seen in June 2023.

Normally, a rise on this metric precedes a serious value correction. XRP noticed such a correction inside the subsequent 4 days, dropping 12.18% from $0.572 to $0.502.

The event exercise was going apace for XRP, however its worth was surprisingly low in comparison with large-cap trade leaders resembling Cardano [ADA]. In the meantime, the each day energetic addresses remained comparatively steady up to now six weeks.

Assessing the probabilities of capital circulate into the community

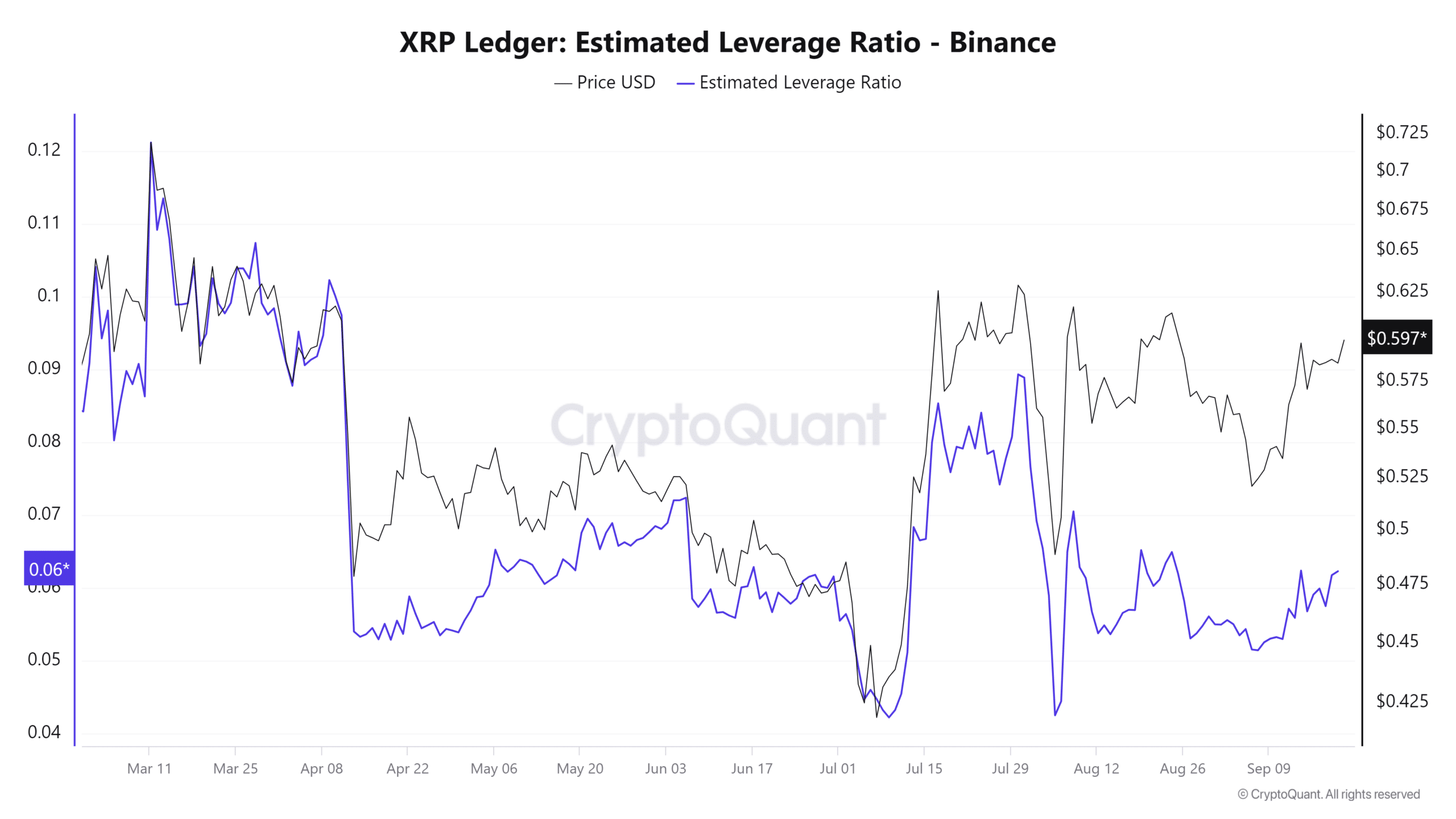

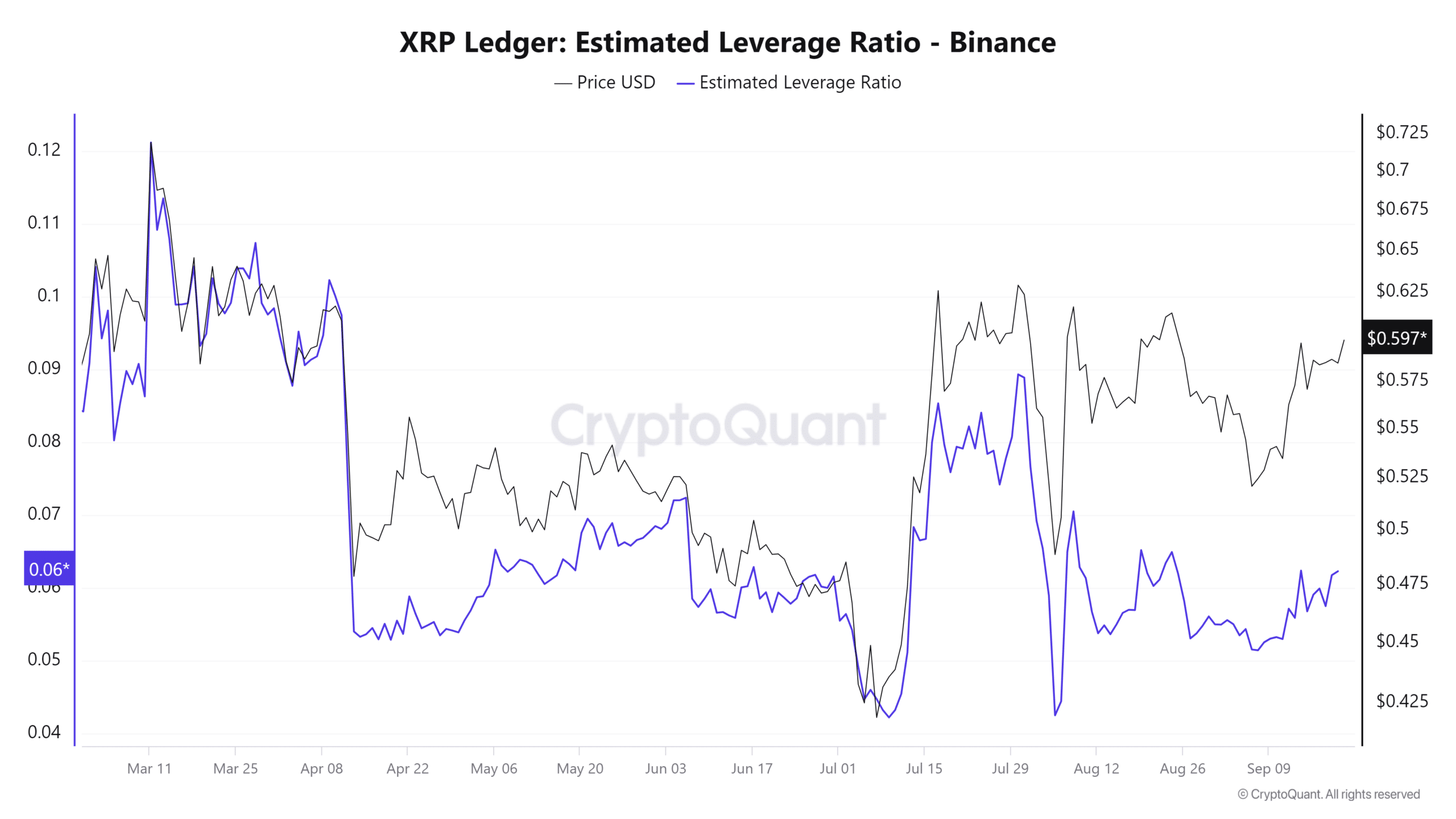

Supply: CryptoQuant

The estimated leverage ratio spiked increased alongside costs in mid-July however has quietened down since then. This lack of motion over the previous month confirmed that speculators weren’t eager to enter margin positions.

The discovering bolstered the concept XRP is present process consolidation.

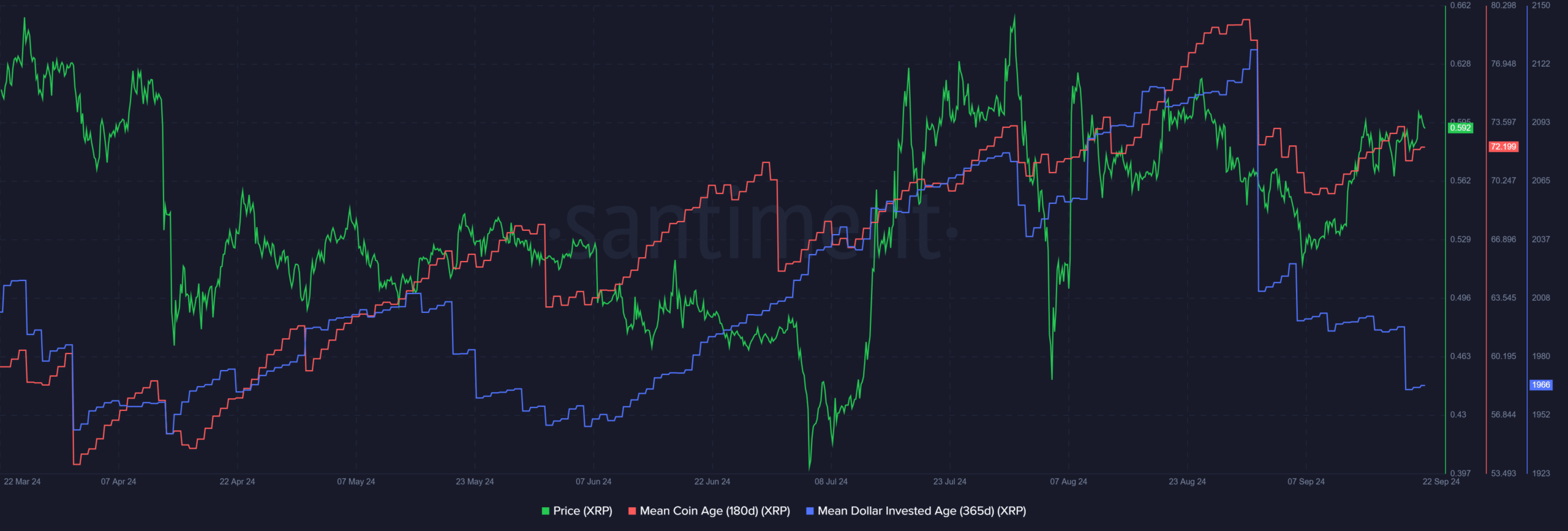

Supply: Santiment

In September, the imply coin age dived decrease, corroborating the discovering from the dormant circulation. This elevated distribution has slowed down over the previous two weeks, and the imply coin age was making an attempt to development increased.

Lifelike or not, right here’s XRP’s market cap in BTC’s phrases

Extra important was the fast lower within the imply greenback invested age (MDIA). When the MDIA developments increased, it implies that investments are getting extra stagnant and previous cash stay in the identical wallets.

A downtrend often indicators that the token is prepared for value appreciation. It implies that investments are flowing again into circulation and hints at elevated community exercise.

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)