- PENDLE may soar by 20% to the $5 degree and even larger.

- PENDLE’s future open has elevated by 4.5% over the previous 24 hours, and seven.8% over the previous 4 hours.

Over the previous few days, BitMEX ex-CEO and co-founder Arthur Hayes has been within the highlight, following his important selloff of Pendle [PENDLE] tokens.

On the twenty fourth of September, Hayes as soon as once more dumped a large 240,000 PENDLE tokens, value $957,600, in response to on-chain analytics agency Lookonchain.

Arthur Hayes’s PENDLE sell-off

Lookchain famous that Arthur Hayes dumped over 1.83 million PENDLE tokens, value $6.58 million at a mean worth of $3.58, within the final 4 days.

Given this important selloff, it seems that PENDLE might expertise a considerable worth decline within the coming days.

The potential cause behind this important token selloff is Hayes’s curiosity in one other token.

Lately, an on-chain analytic agency made a submit on X, revealing that Hayes had amassed a considerable 62.258 million Aethir (ATH) tokens, value $4.08 million, over the previous month.

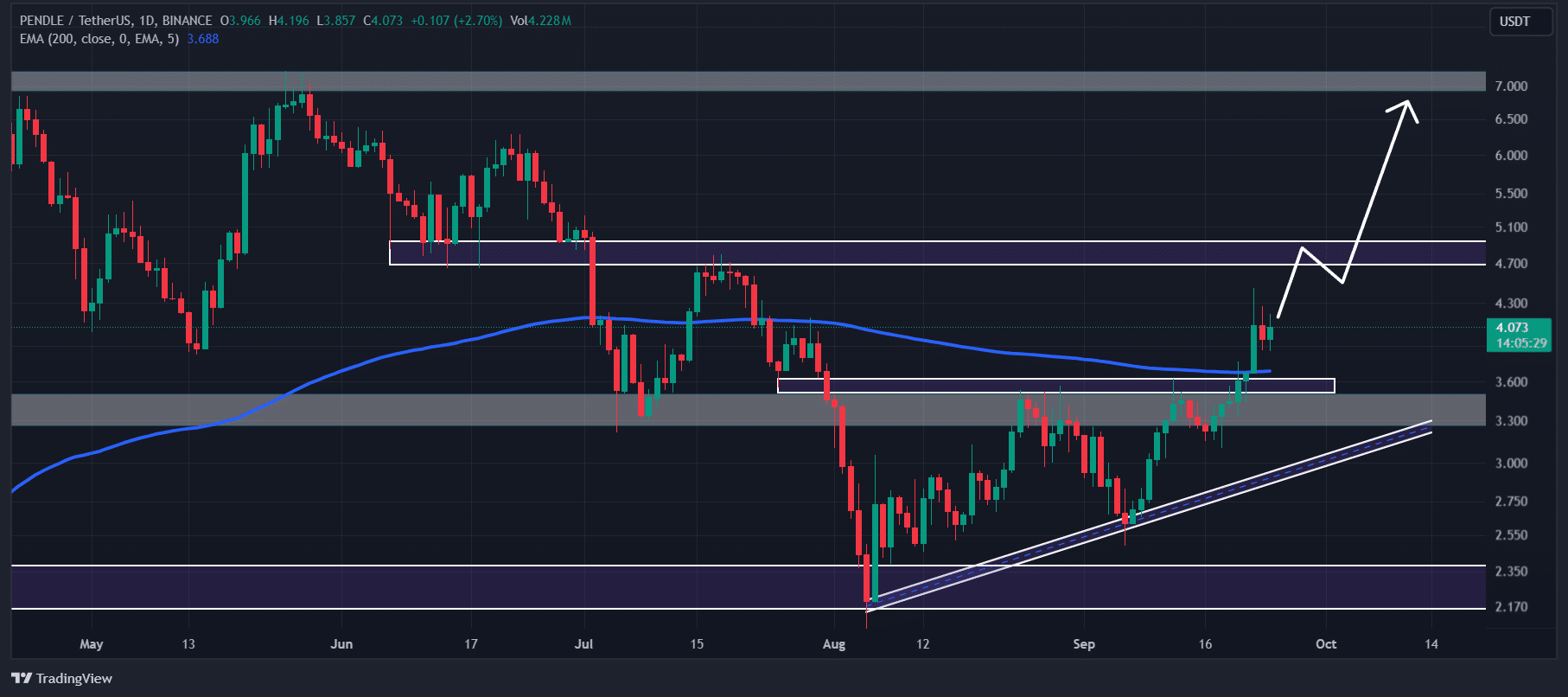

PENDLE’s worth motion and key ranges

In accordance with AMBCrypto’s technical evaluation, regardless of the numerous selloff, PENDLE nonetheless appeared bullish.

Primarily based on historic worth momentum and present market sentiment, there’s a sturdy chance that the PENDLE worth may soar by 20% to the $5 degree and even larger within the coming days.

Moreover, it’s buying and selling above the 200 Exponential Transferring Common (EMA) on a day by day time-frame.

The 200 EMA is a technical indicator that merchants and traders use to find out whether or not an asset is in an uptrend or downtrend.

Bullish on-chain metrics

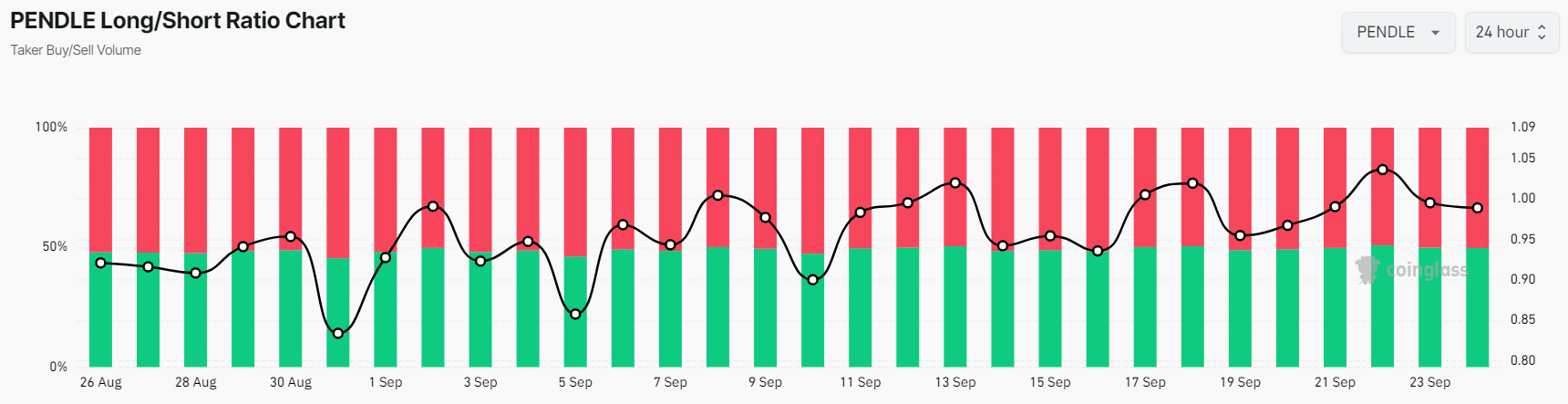

This bullish outlook is additional supported by on-chain metrics. In accordance with the on-chain analytic agency Coinglass, PENDLE’s Lengthy/Brief Ratio was 1.005 at press time, indicating bullish market sentiment amongst merchants.

The coin’s future open has elevated by 4.5% over the previous 24 hours, and seven.8% over the previous 4 hours. This rising Open Curiosity means that merchants are probably constructing extra lengthy positions.

Learn Pendle’s [PENDLE] Value Prediction 2024-2025

Merchants and traders usually use the mixture of rising open curiosity and a Lengthy/Brief ratio above 1 whereas constructing lengthy positions. At press time, 50.5% of high merchants held lengthy positions, whereas 49.5% held quick positions.

PENDLE was buying and selling close to $4.14 presently after a worth surge of over 3.5% within the final 24 hours. Throughout the identical interval, its buying and selling quantity dropped by 51%, indicating decrease participation from merchants amid this selloff.

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)