- BONK has a strongly bullish short-term outlook.

- The potential for a bearish divergence may see volatility and a value dip within the coming days.

Bonk [BONK] was one of many widespread meme cash that held up nicely whereas the vast majority of the market skilled elevated promote strain. BONK additionally noticed a big short-term dip, however the bulls have been fast to purchase it.

This inflow of shopping for noticed Bonk coin regain 10.8% after the dip. A resistance degree that has not been breached since July stood in the best way of the bulls- will they clear this degree quickly?

Vary breakout and retest boosts bullish hopes

Bonk coin confirmed exceptional power regardless of the market-wide value drop up to now three days. This panic promoting noticed BONK retest the previous vary highs and proceed its uptrend.

At press time the token was buying and selling at $0.0000248, simply beneath the $0.000025 resistance degree.

Regardless of the robust bullishness of Bonk coin in current weeks, it ought to be remembered that the upper timeframe development is downward. That is exemplified by the Fibonacci retracement degree resistances at $0.000025 and $0.0000293.

The RSI was at 73, nevertheless it risked forming a bearish divergence if it fails to climb previous 74.69 within the coming days. If this occurs it could possibly be an early sign of an area high and an impending retracement.

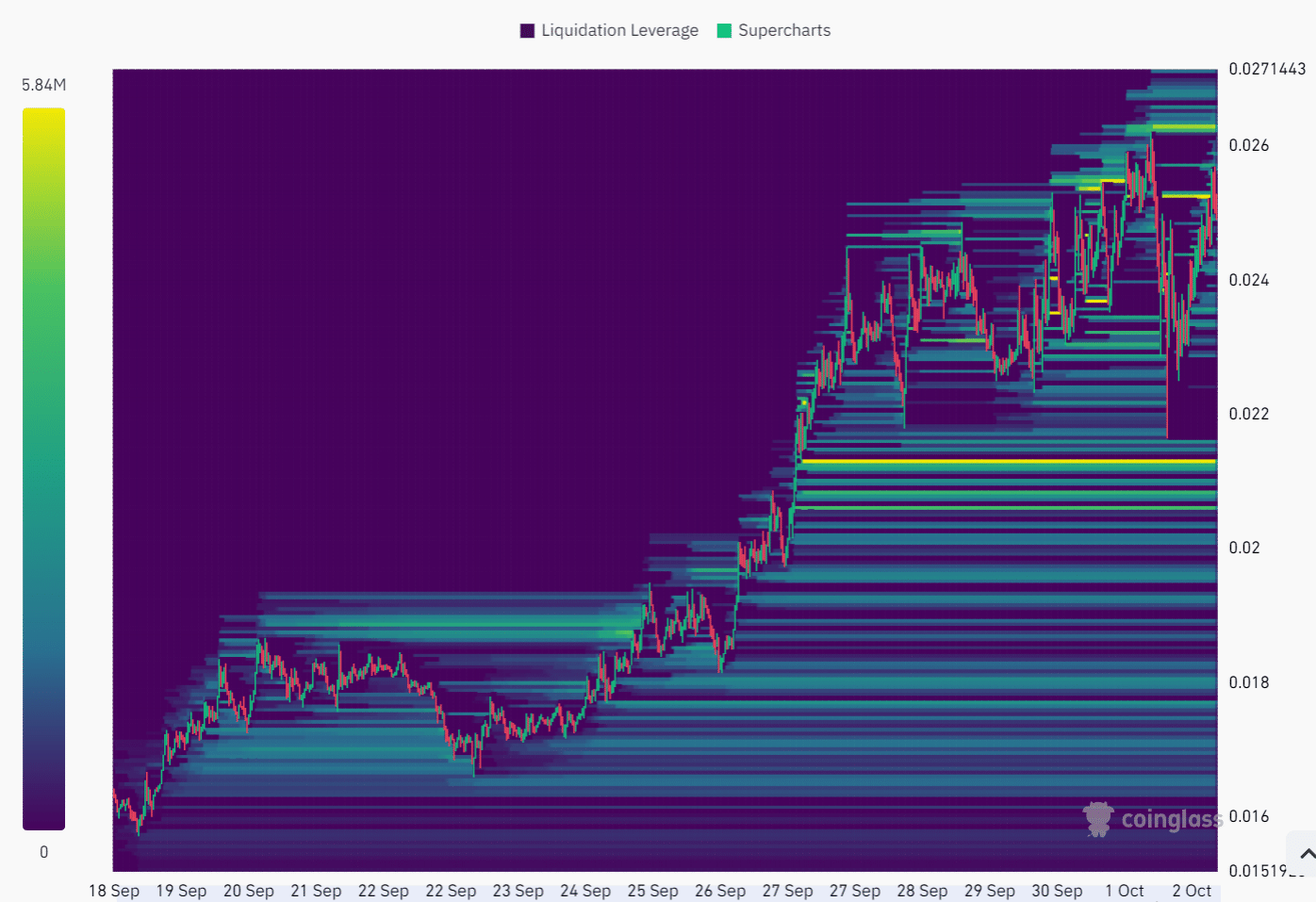

Liquidation heatmap exhibits upside goal

Supply: Coinglass

The liquidation heatmap of the previous two weeks confirmed that the $0.0000263 zone is the following short-term goal for Bonk coin. The technical indicators have been strongly bullish and the current volatility that rocked the market didn’t have an effect on BONK too badly.

Life like or not, right here’s BONK’s market cap in BTC’s phrases

Whereas unlikely, within the case of rejection at $0.0000252 and a short-term downtrend, the $0.0000211 is the following magnetic zone of curiosity to the south.

AMBCrypto’s evaluation confirmed {that a} transfer towards and previous the $0.0000263 is the expectation for this week.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)