From time to time, I’ll test in to point out gadgets floating round Wall Road circles and blogs.

-

Long term tendencies within the markets and economic system.

-

Further particulars on what appears underappreciated or overhyped.

-

Hyperlink to some nice explainers on the ideas.

**All the things as of 9/12/2024

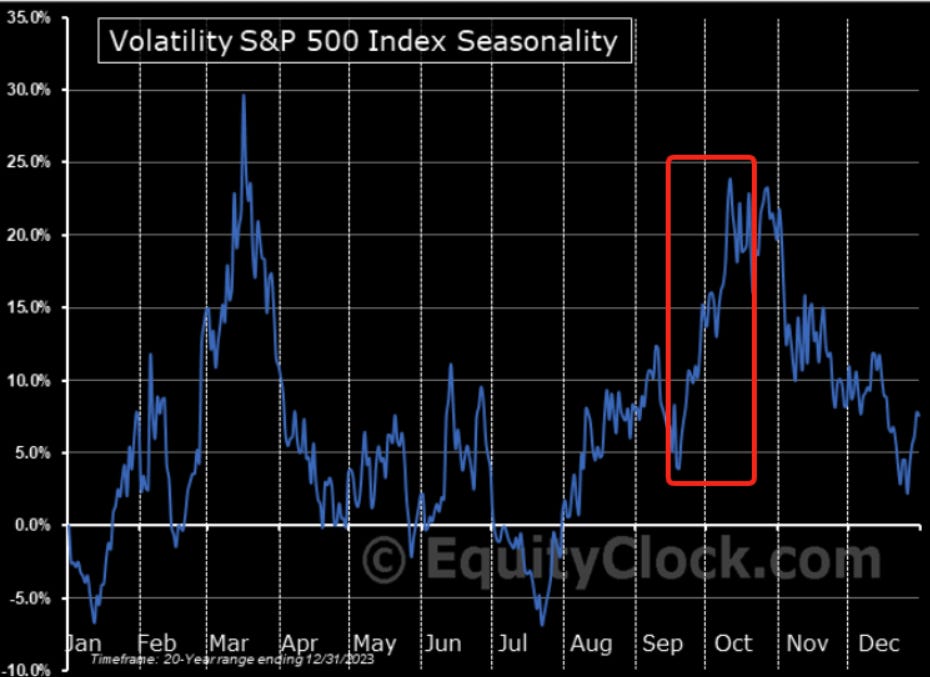

Welcome to October! Shocktober? Rocktober? Another unhealthy pun for October being risky?

Essentially the most well-known Historic Inventory Market Crashes have all occurred within the September/October timeframe. With a measly n=4 for well-known market crashes although, it’s robust to say if this can be a actual phenomena, Dealer PTSD or simply coincidence. Maybe it was a factor as soon as however fashionable arbitrage killed it?

Let’s have a look –

First, a micro abstract of the agreed upon trigger behind every October crash.

Panic of 1907 (October 14 1907)

You don’t bear in mind the Knickerbocker Disaster? A failed try to nook the market on United Copper shares led to a collection of financial institution runs. As belief in banks eroded, the inventory market crashed 50% inflicting J.P. Morgan (the person) to step in and orchestrate a rescue effort. The disaster in the end led to the creation of the Federal Reserve in 1913 to supply stability and oversight to the U.S. monetary system.

Black Thursday (October 24 1929)

A mix of speculative inventory shopping for and extreme use of margin made inventory costs soar all through the Twenties till issues over declining financial development and rising rates of interest triggered worry. When giant buyers began promoting off their shares, it sparked widespread panic, main to an enormous sell-off that marked the start of the crash and Nice Despair.

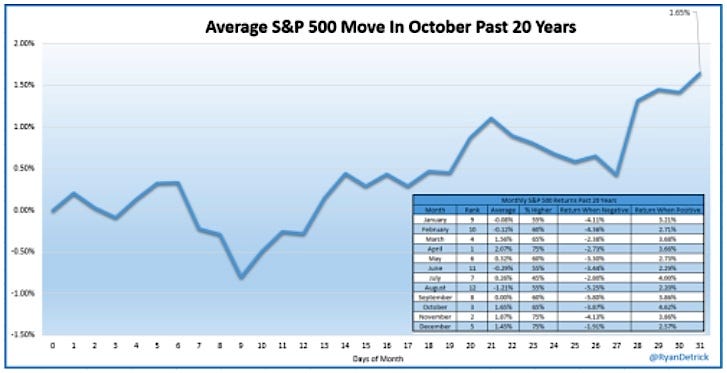

Black Monday (October 19 1987)

Rising financial uncertainty from rising inflation, fears of upper rates of interest, and a weakening U.S. greenback started creating skepticism of excessive inventory valuations. When markets started to say no First-Era automated buying and selling applications triggered a cascade of promote orders, inflicting the Dow Jones to plummet by over 22% in a single day.

Nice Monetary Disaster (October 2008)

Banks packaged dangerous loans into advanced monetary devices, which unfold instability throughout world monetary markets when householders started defaulting. The failure of main monetary establishments similar to Lehman Brothers and a freeze in credit score markets led to a extreme financial downturn and authorities intervention to stabilize the system.

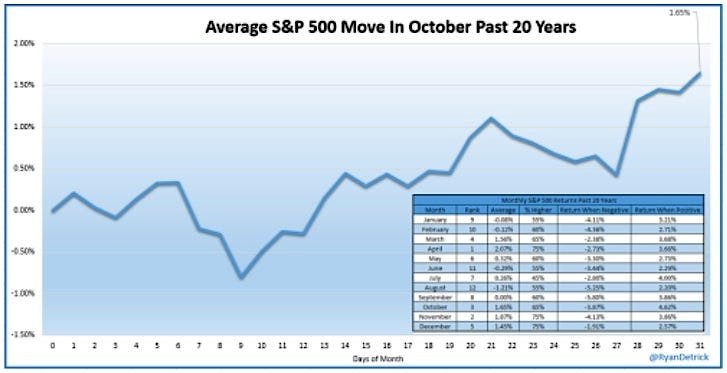

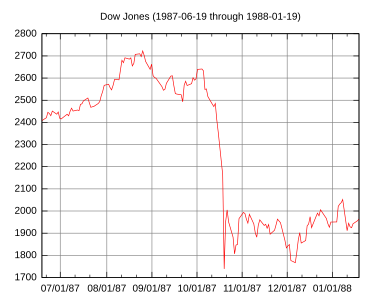

So are market crashes in October an actual factor to fret about or only a fable based mostly on crashes of the previous? Seems The October impact is an actual dealer heuristic invoked to lift warning however statistically, it doesn’t maintain up.

Whereas volatility does transfer greater into the Fall, on common, value route is simply as distributed as every other month.

So why does the thought linger?

My very own ideas on why October seasonal sentiment shifts dramatically-

-

Labor Day weekend marks the tip of a lazy August and a return to an aggressive posture and positioning of portfolios into 12 months finish.

-

The Federal Reserve’s annual Jackson Gap Summit in late August creates an additional stir of the financial pot the place coverage pivots or reiterations typically happen

-

Each 2 years we’ve elections in early November creating an increase in anxiousness and uncertainty within the weeks previous election day.

-

Quarterly/Annual portfolio rebalancing for tax functions and authorized guidelines pop up on everybody’s Outlook reminder beginning This fall (October 1st)

So after a lazy August I feel everybody wakes up in September, appears round and reads the tea leaves of fixing coverage. They make a plan to both lock in beneficial properties or re-position themselves into year-end to shore up their state of affairs. 4 occasions previously 100 years, its gone terribly unsuitable leading to a crash so now everybody holds their breath in case it occurs once more.

Fascinated about being on the Dealer Dads Podcast in 2024? Shoot me an electronic mail! I’d like to have subscribers on to sit down for a dialogue

Ideas? Questions? Feedback?

Attain out! Possibly I’ll do a full submit on the subject or as a Q&A

traderdads@substack.com