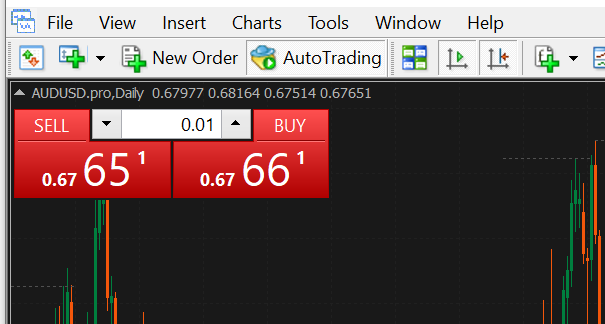

While you first opened your buying and selling platform, it most likely seemed one thing like this…

You assume to your self:

“What the heck am I imagined to do with this??”

So, you conquer your first hurdle by studying technical evaluation and discover ways to navigate round your platform.

Now, you face your subsequent hurdle…

What number of models must you purchase?

And then you definitely begin pondering:

“Ah, I often purchase 100 shares within the inventory market so I’ll simply purchase 10 simply to be protected”

The following factor you realize?

Your account hits zero straight away.

Why?

As a result of none that you realize…

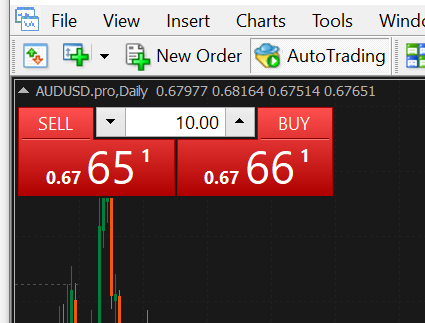

Shopping for 10 heaps implies that you’re getting into with 1,000,000 models!

This will likely not have occurred to you however I do know a ton of merchants who skilled the same case.

And for this reason an important assume to be taught first in buying and selling is to discover ways to apply danger administration in foreign exchange first.

Above the rest!

Because of this in right this moment’s information you’ll discover ways to apply danger administration in foreign exchange.

Particularly, you’ll be taught…

- A exact danger administration methodology that lets you be versatile together with your danger on the foreign exchange market

- Accessible place sizing calculators that you need to use anytime with out registering or downloading something

- A secret to figuring out when and the way you need to change your danger administration parameters

This information shall be fast and snappy.

However the purpose is to make sure you instantly apply the learnings after you’re performed.

Sounds good?

Then let’s get began…

Learn how to apply danger administration in foreign exchange: Share danger administration methodology

Now, earlier than I share with you some formulation right here I would like you to know a few issues first.

On this planet of foreign exchange we at all times use the time period “heaps” just like what I shared with you.

And as a fast cheatsheet, right here’s what all of them imply:

- 100,000 Items = 1.00 Lot

- 10,000 Items = 0.10 Lot

- 1,000 Items = 0.01 Lot

- Under 1,000 Items = 0.001 Lot

So, sure…

Please don’t put 1.00 in your buying and selling platform!

However for those who actually wish to maintain it protected, place 0.01 for each commerce you do, particularly you probably have a foreign currency trading account beneath $500.

Now, as you develop your account…

You’ll begin to have extra flexibility over your danger administration.

Because of this it is advisable to be taught the share danger administration methodology!

In precept, right here’s how this danger administration methodology works:

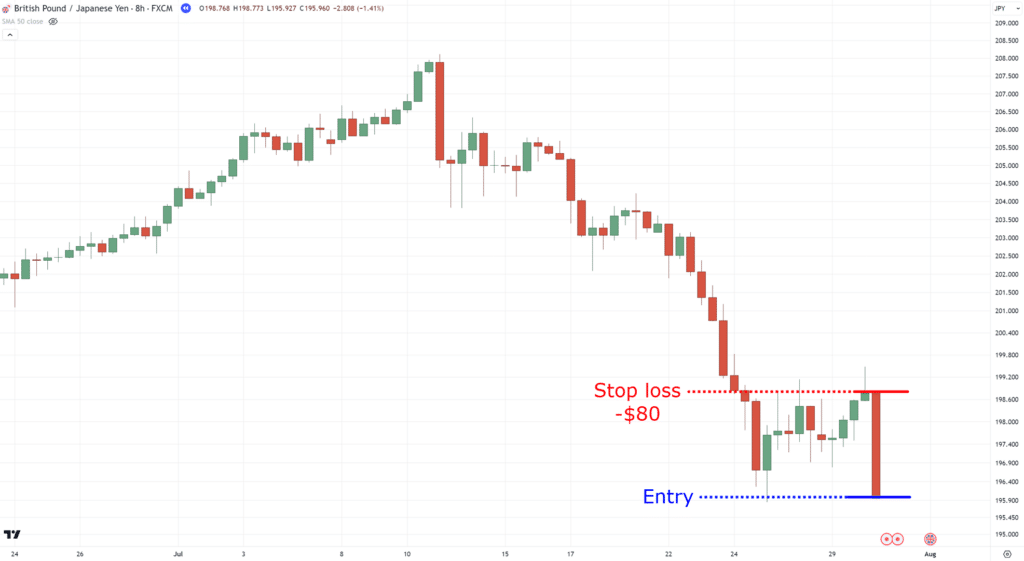

In case your cease loss is hit, you place dimension in a approach that you simply solely lose 1% of your account stability

This place sizing methodology is often finest used:

- For buying and selling the decrease timeframes

- For putting exact cease loss whereas sustaining danger

- For any type of buying and selling or investing that has to take care of leverage

So, for instance…

You’ve gotten an $8,000 account.

1% of that capital is $80.

Which means that if my cease loss is hit, I wish to guarantee that I don’t lose greater than $30 on my general portfolio.

Once more, this so-called “1%” is completely different from the allocation, although we’ve touched on it a little bit earlier than ending the earlier part.

However you would possibly ask:

“What makes this place sizing methodology good?”

Effectively, the great thing about this place sizing methodology is which you could be versatile on the place you place your cease loss.

You may place a decent cease loss, and nonetheless just remember to solely lose 1% when your cease loss is hit:

You may have a large cease loss, and nonetheless just remember to solely lose 1% when your cease loss is hit:

See what I imply?

This provides you flexibility on the place you wish to place your cease loss as your potential loss will stay static!

So, again to the query:

How do you apply danger administration in foreign exchange?

Effectively, utilizing this method…

Items to purchase = Threat quantity / (cease loss in pips – worth per pip)

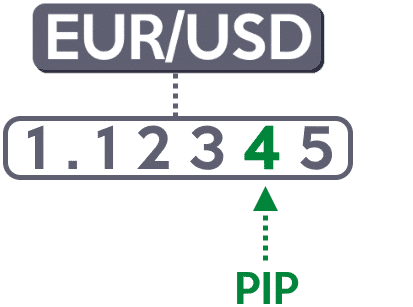

You see, now we have the time period “pip” in foreign exchange, which is just about simply the 4th decimal place of a cross-currency pair!

Nevertheless, we even have the time period “pip worth.”

Now, what’s it?

Merely put, a pip worth is how a lot you make or lose cash if the value strikes 1 pip for those who purchase 1 customary lot of models.

It’s just like fueling your automobile:

Asking “How a lot is the gasoline per 1 liter?”

Can also be just like asking “How a lot is the pip worth per 1 customary lot?”

The query now’s:

“How will we determine the worth per pip?”

Sadly, it’s a calculation of its personal…

Worth per pip = (1 pip / present value) x 1 customary lot

So, if the present value of EURAUD is 1.62932 for instance, the calculation would look one thing like this:

Worth per pip = (0.0001 / 1.62932) x 100,000 models

When you end the calculation, the numbers will find yourself as $6.14

Which means that for those who purchase 100,000 models of EURUSD, you’ll acquire $6.14 if the value strikes 1 pip in your favor.

However then once more!

The pip worth is simply part of our general equation, so bear with me right here, my pal!

Going again to our calculation:

Items to purchase = Threat quantity / (cease loss in pips – worth per pip)

We now know what our price per pip is, which is $6.14

And together with your $3,000 capital…

You wish to danger 1% of that account in your commerce on EURUSD which is $30.

Lastly, for this instance, you determined to position your cease loss 50 pips beneath the world of assist:

Given all the small print now we have collected the method now ought to look one thing like this:

Items to purchase = $30 danger per commerce / (50 pips – $6.14 pip worth)

After the calculations, the heaps you’d want to purchase to enter the commerce is 0.68 heaps or 6,800 models.

Which means that for those who enter EURAUD with 0.68 heaps, you received’t lose greater than $30 when your cease loss is hit.

Is sensible?

Now, bear in mind!

I’m sharing these formulation in order that if all the things goes incorrect, you’ll nonetheless be unbiased sufficient to execute trades and apply danger administration.

So, you might be at all times free to refer again to this information.

Now that you realize the ins and outs of learn how to apply danger administration in foreign exchange…

How can we automate this?

Absolutely you don’t wish to crunch all these numbers within the foreign exchange market proper?

So, let me share some instruments with you within the subsequent part…

Learn how to apply danger administration in foreign exchange: What instruments must you use?

Listed below are some primary standards I’ll lay down on what sort of danger administration instruments we’ll use:

- The danger administration software have to be free (no registration required)

- The danger administration software have to be straightforward to make use of and perceive

- The danger administration software should require no set up or obtain

That simply sounds fairly superior, proper?

That’s why I meant it once I stated which you could apply all the things you discovered instantly as quickly as you end this buying and selling information.

So, what are the instruments that meet these standards?

One of the best place sizing software for foreign exchange

Clearly, for foreign exchange, we received’t want the portfolio allocation methodology.

As you’d want leverage to start out buying and selling foreign exchange!

So, which platform to make use of to use danger administration in Foreign exchange?

Effectively, this one you need to already be conversant in…

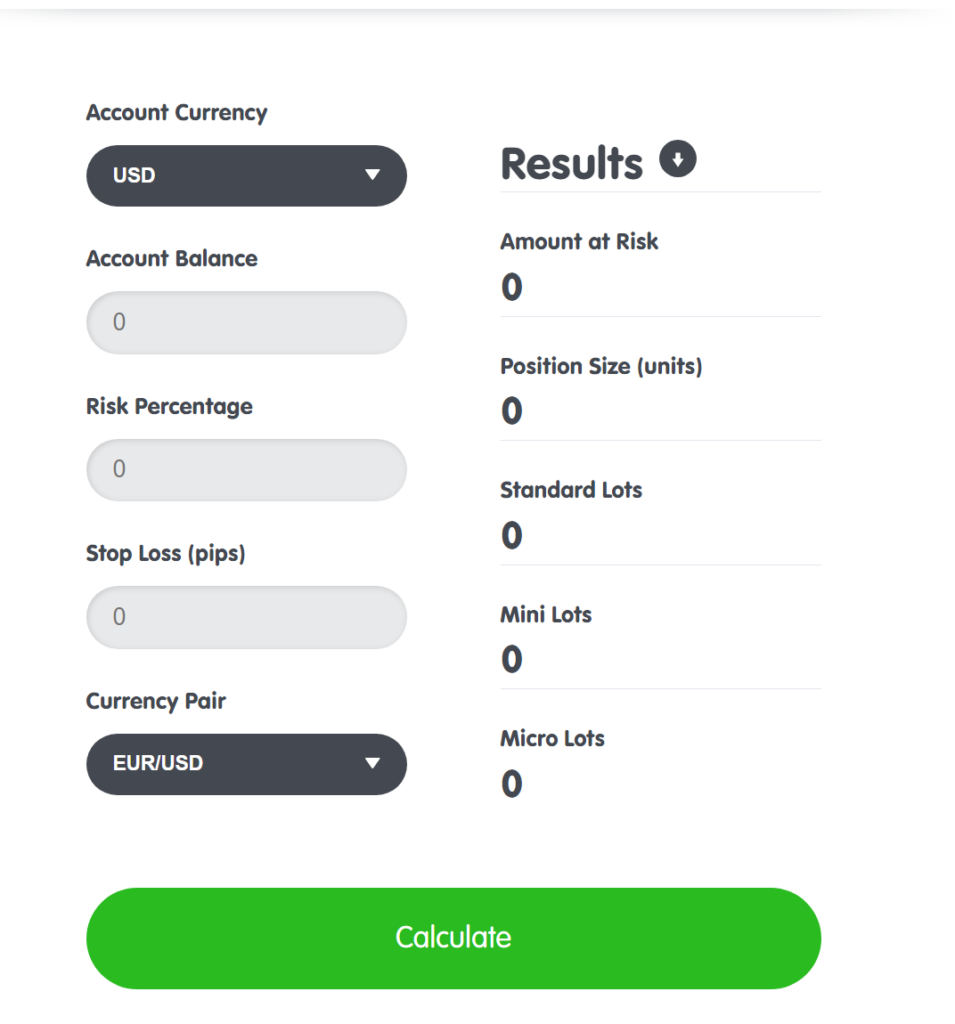

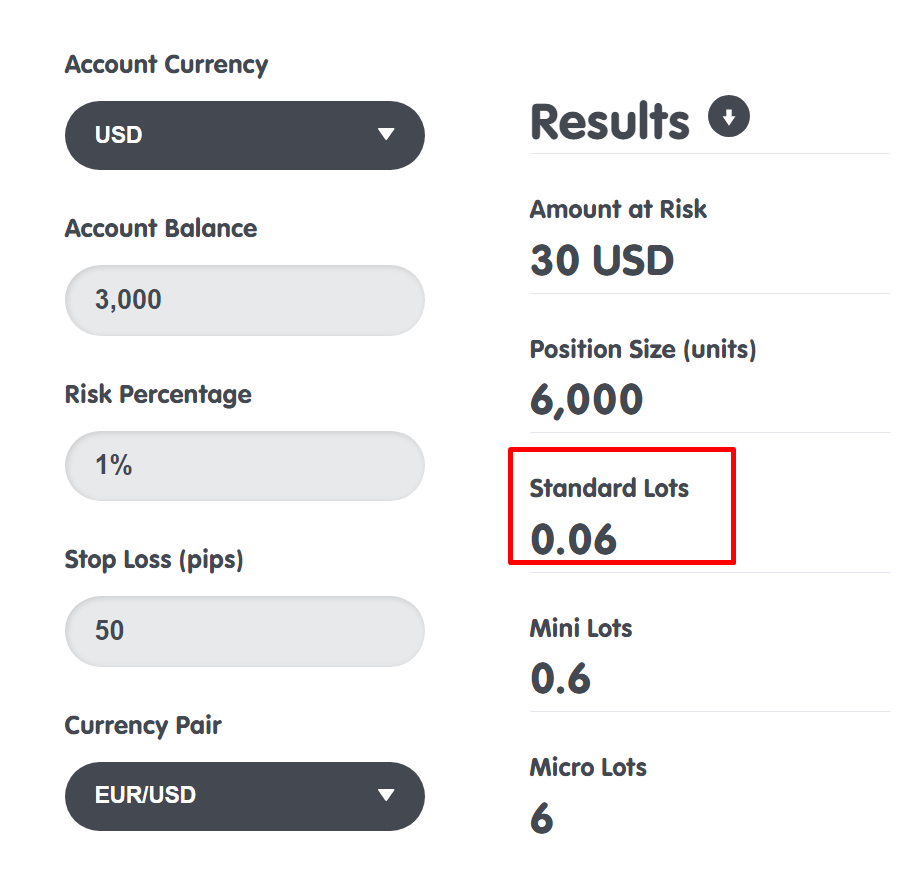

Babypips’ Place Dimension Calculator

Even earlier than you utilize it you’ll be able to already inform that this is so simple as it will get!

As a result of for those who recall the method I shared with you, this calculator already does all of it for you.

So, let’s say that you simply, once more, have a $3,000 account and that you simply solely wish to danger 1% per commerce.

And at last, you may have a 50 pip cease loss.

Wanting on the calculation, you would want to enter trades with 0.06 heaps or 6,000 models!

After all, there’s a draw back to this calculator.

Which is that it assumes that you’re getting into the commerce proper now as a market order.

However, what in order for you extra flexibility?

What if you wish to place orders prematurely and apply correct danger administration?

On this case, you’d want a pip worth calculator…

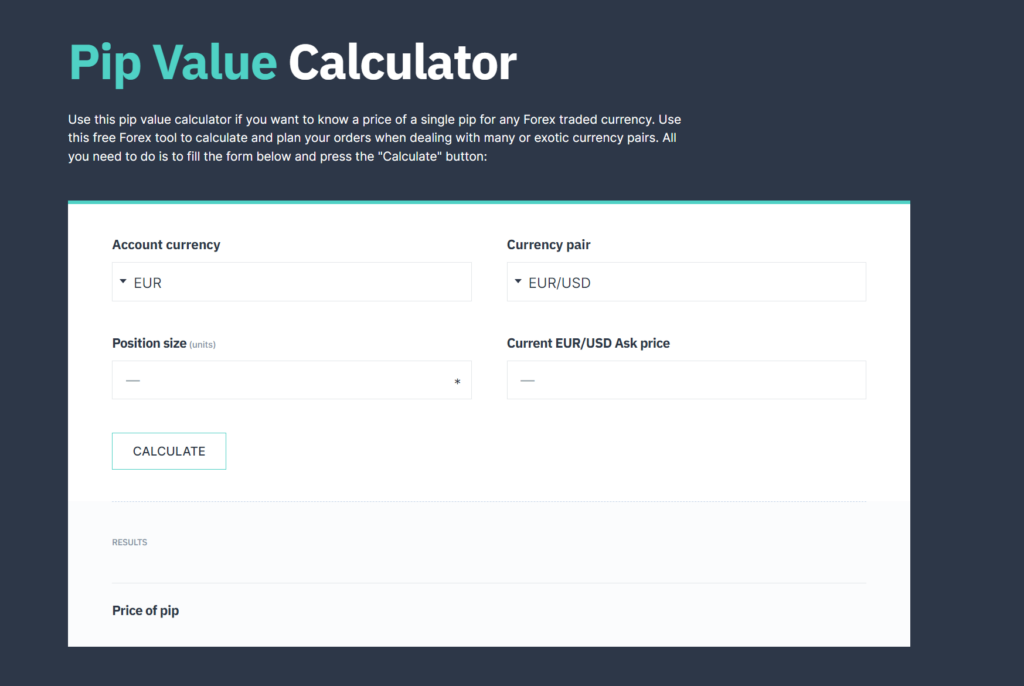

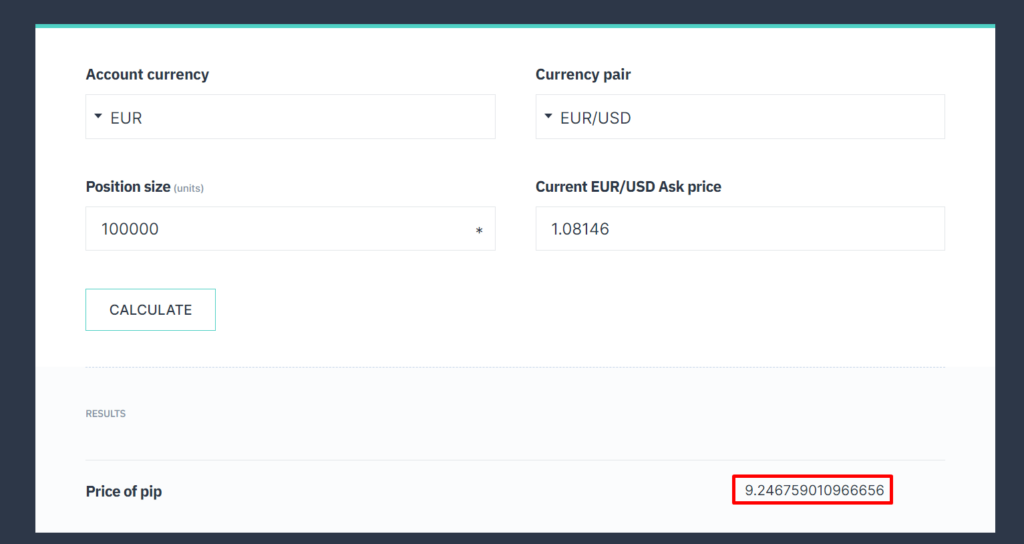

EarnForex’s Pip Worth Calculator

Keep in mind the prolonged calculation I shared with you?

Items to purchase = Threat quantity / (cease loss in pips – worth per pip)

Worth per pip = (1 pip / present value) x 1 customary lot

Rather a lot, proper?

However on this case, we don’t want the worth per pip calculation as we have already got a platform doing it for us!

So, identical factor!

Let’s say you may have a $3,000 account and also you’re risking 1% which is $30 and your cease loss is round 50 pips.

And that you’re inserting a restrict order on EURUSD on the value of 1.08146.

Wanting on the calculator, our pip worth is $9.25 per one customary lot (sure, on this case at all times put 100k)

If we plug within the numbers…

Items to purchase = $30 danger / (50 pips – $9.25 pip worth)

Items to purchase = $30 danger / 40.75

Items to purchase = 0.74 models

And sure, you’ll be able to create your spreadsheet to automate the remainder of the formulation.

However that’s just about it!

P.S. The variety of models to purchase on this instance is a special quantity from the earlier instance as a result of I positioned a special ask value

Now…

I’m certain there are much more calculators on the market that totally automate issues.

There are buying and selling platforms that have already got an built-in danger administration calculator in them.

There are even indicators to put in in your MetaTrader 4 to use danger administration!

However on this case…

I did my finest to share with you essentially the most accessible calculators on the market as I don’t wish to spend half of this information instructing you learn how to register with sure brokers are set up indicators on our platform.

With that each one stated and performed, we’re not performed but.

As a result of within the subsequent part, I wish to do one thing very particular for you.

Extra of a “bonus” on what you’ll be taught on this information.

As a result of for those who observed…

I at all times ask you to danger 1% of your account per commerce or allocate 10% of your account per commerce.

However when can you modify these numbers?

When must you danger 0.5% per commerce?

How about allocation, what do you allocate 20% of your capital per commerce on a single inventory?

How do you go about it?

Let me let you know within the subsequent part…

Learn how to apply danger administration in shares and foreign exchange: The key to altering the parameters

The underside line is that this…

The way you modify your danger relies upon available on the market situation and what time of buying and selling model you may have.

Because of this on this last part I’ll share with you learn how to apply danger administration for intraday buying and selling in foreign exchange.

However principally, the decrease the timeframe you go, the extra exact it is advisable to be.

Particularly in your danger administration.

Because of this for decrease timeframe buying and selling you’d wish to undertake the percentage-based danger administration for Foreign exchange.

Keep in mind the method I shared with you?

Items to purchase = Threat quantity / (cease loss in pips – worth per pip)

Sure, I do know that I shared with you instruments on learn how to automate them as a lot as you’ll be able to.

However I pulled them out simply to refresh your reminiscence!

Within the earlier examples, I shared with you that you need to danger 1% danger per commerce in case your cease loss is hit, proper?

However this time…

When you’re buying and selling beneath the 1-hour timeframe it’s extremely beneficial that you simply solely danger 0.5% danger per commerce (no matter whether or not it’s a bull or bear market).

Why is that?

The reason being frequency.

The upper the frequency of your trades, the sooner the suggestions you’ll get in your outcomes

And sooner the suggestions implies that the larger the chance your feelings shall be concerned (i.e. greed and worry).

So, to scale back your attachment to single wins and losses, you’d wish to danger 0.5% danger per commerce in order that your thoughts is extra centered on the numbers than the returns.

Received it?

And that’s all the things for right this moment!

The world of danger administration is thrilling, and what I’ve shared with you right this moment is simply the tip of the iceberg.

Nevertheless, I made certain to share with you adequate to get you began buying and selling within the foreign exchange market as quickly as doable.

So with that stated, let’s do a fast abstract of what you’ve discovered right this moment…

Conclusion

Right here’s the reality:

Understanding learn how to apply danger administration in foreign exchange should come first and never final.

This ensures that you simply don’t blow your hard-earned cash irrespective of what number of occasions you mess up!

Worse case?

Your portfolio bleeds.

Providing you with sufficient time to cease the bleeding and be taught from errors (as a substitute of nuking your portfolio with one buying and selling mistake)

So, right here’s a fast recap of what you’ve discovered right this moment…

- Having a risk-based share place sizing is a little more sophisticated to use, however this provides you each the pliability of inserting your cease loss anyplace whereas additionally sustaining danger.

- There are free and accessible place sizing calculators prepared so that you can entry, similar to calculators from BabyPips, and EarnForex.

- When you plan to commerce the decrease timeframes, danger 0.5% per commerce and even decrease similar to 0.25%

And that’s just about it!

A whole information from newbie to superior on how one can surgically management the chance parameters of your portfolio!

However this time I wish to hear what you assume.

What are another danger administration strategies you realize of?

And for those who commerce crypto, how do you apply danger administration there?

Let me know within the feedback beneath!

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)