- A second potential issuer filed for the U.S. spot XRP ETF.

- Nevertheless, the altcoin remained muted post-SEC attraction towards Ripple Labs

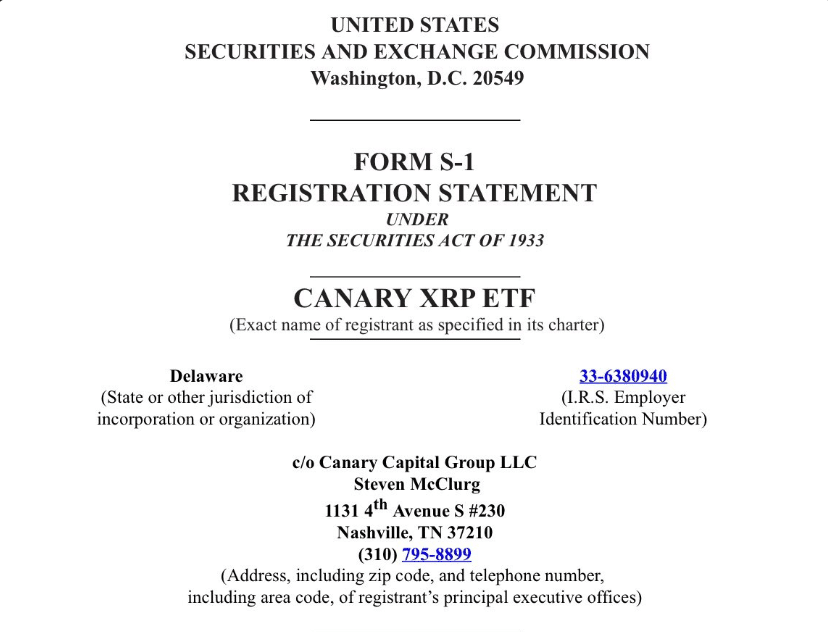

Canary Capital is the most recent participant to hitch the U.S. spot Ripple [XRP] ETF race. On the eighth of October, the agency filed an S-1 kind, an preliminary safety registration, with the SEC.

The submitting comes every week after Bitwise made an identical utility with the regulator.

Canary Capital is a brand new funding agency launched by Steven McClurg, a co-founder of Valkyrie Fund.

The agency’s spokesperson cited a ‘progressive regulatory’ area as the explanation for the transfer.

“We’re seeing encouraging indicators of a extra progressive regulatory setting coupled with rising demand from buyers for classy entry to cryptocurrencies past Bitcoin and Ethereum – particularly buyers in search of entry to enterprise-grade blockchain options and their native tokens equivalent to XRP.”

The newest XRP ETF submitting has renewed market optimism concerning the altcoin.

Reactions to the submitting

Reacting to the submitting, Nate Geraci of ETF Retailer acknowledged that an XRP ETF approval was a ‘matter of when, NOT if.’ However he added that the end result might depend upon the U.S. elections.

“One other XRP ETF submitting…Approval a matter of when, not if, IMO. However that “when” might be *a lot* additional out sooner or later until there’s a change in administration.”

This was the stance of most market observers after Bitwise filed for the same utility final week.

Market pundits felt the transfer was hinged on the upcoming U.S. elections, as the present administration nonetheless had no regulatory readability, particularly for different tokens like XRP and Solana [SOL].

Ripple Labs-SEC lawsuit

The continued Ripple Labs-SEC lawsuit supported the problem for an XRP ETF from a regulatory standpoint.

On the 2nd of October, the regulator appealed towards a ruling that categorized the sale of XRP to institutional buyers as ‘safety’ however to not the general public.

Ripple termed the attraction ‘irrational and misguided.’ Nevertheless, this meant that the regulator nonetheless thought-about XRP safety and may very well be a stumbling block to the approval.

Ergo, market observers consider {that a} change within the SEC or US administration might assist make clear the standing of the remainder of crypto tokens.

Influence on XRP

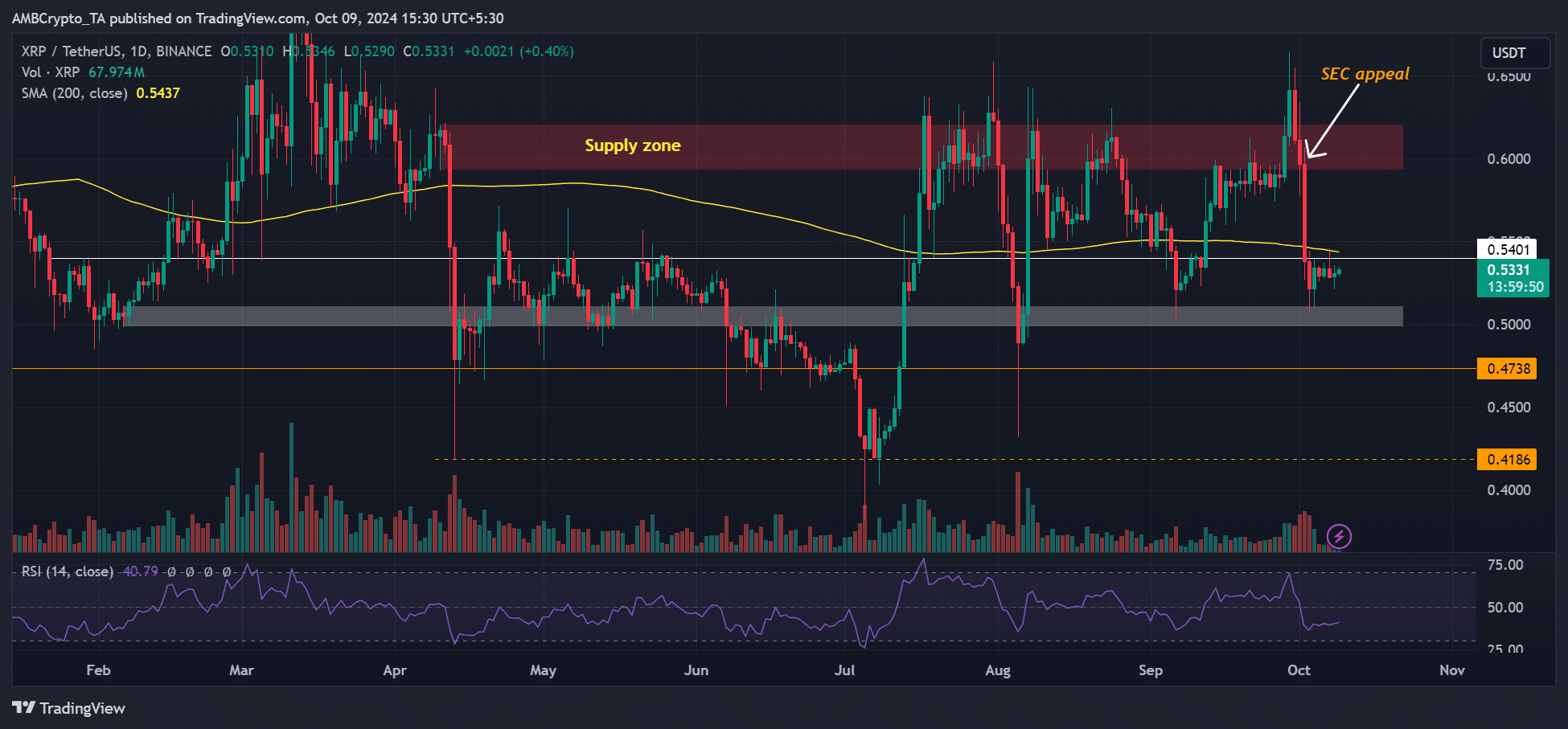

Because the SEC’s attraction on the 2nd of October, XRP has dropped from $0.6, flipping its market construction to bearish after dropping under the 200-day Shifting Common (MA).

The newest XRP ETF replace didn’t change a lot on the time of writing. The value was seen consolidating under $0.54 for the previous few days.

- A second potential issuer filed for the U.S. spot XRP ETF.

- Nevertheless, the altcoin remained muted post-SEC attraction towards Ripple Labs

Canary Capital is the most recent participant to hitch the U.S. spot Ripple [XRP] ETF race. On the eighth of October, the agency filed an S-1 kind, an preliminary safety registration, with the SEC.

The submitting comes every week after Bitwise made an identical utility with the regulator.

Canary Capital is a brand new funding agency launched by Steven McClurg, a co-founder of Valkyrie Fund.

The agency’s spokesperson cited a ‘progressive regulatory’ area as the explanation for the transfer.

“We’re seeing encouraging indicators of a extra progressive regulatory setting coupled with rising demand from buyers for classy entry to cryptocurrencies past Bitcoin and Ethereum – particularly buyers in search of entry to enterprise-grade blockchain options and their native tokens equivalent to XRP.”

The newest XRP ETF submitting has renewed market optimism concerning the altcoin.

Reactions to the submitting

Reacting to the submitting, Nate Geraci of ETF Retailer acknowledged that an XRP ETF approval was a ‘matter of when, NOT if.’ However he added that the end result might depend upon the U.S. elections.

“One other XRP ETF submitting…Approval a matter of when, not if, IMO. However that “when” might be *a lot* additional out sooner or later until there’s a change in administration.”

This was the stance of most market observers after Bitwise filed for the same utility final week.

Market pundits felt the transfer was hinged on the upcoming U.S. elections, as the present administration nonetheless had no regulatory readability, particularly for different tokens like XRP and Solana [SOL].

Ripple Labs-SEC lawsuit

The continued Ripple Labs-SEC lawsuit supported the problem for an XRP ETF from a regulatory standpoint.

On the 2nd of October, the regulator appealed towards a ruling that categorized the sale of XRP to institutional buyers as ‘safety’ however to not the general public.

Ripple termed the attraction ‘irrational and misguided.’ Nevertheless, this meant that the regulator nonetheless thought-about XRP safety and may very well be a stumbling block to the approval.

Ergo, market observers consider {that a} change within the SEC or US administration might assist make clear the standing of the remainder of crypto tokens.

Influence on XRP

Because the SEC’s attraction on the 2nd of October, XRP has dropped from $0.6, flipping its market construction to bearish after dropping under the 200-day Shifting Common (MA).

The newest XRP ETF replace didn’t change a lot on the time of writing. The value was seen consolidating under $0.54 for the previous few days.

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)