- ApeCoin’s current restoration chalked out a traditional rising broadening wedge on the every day chart.

- The derivates information confirmed a slight bullish edge, however a patterned breakdown might delay the restoration.

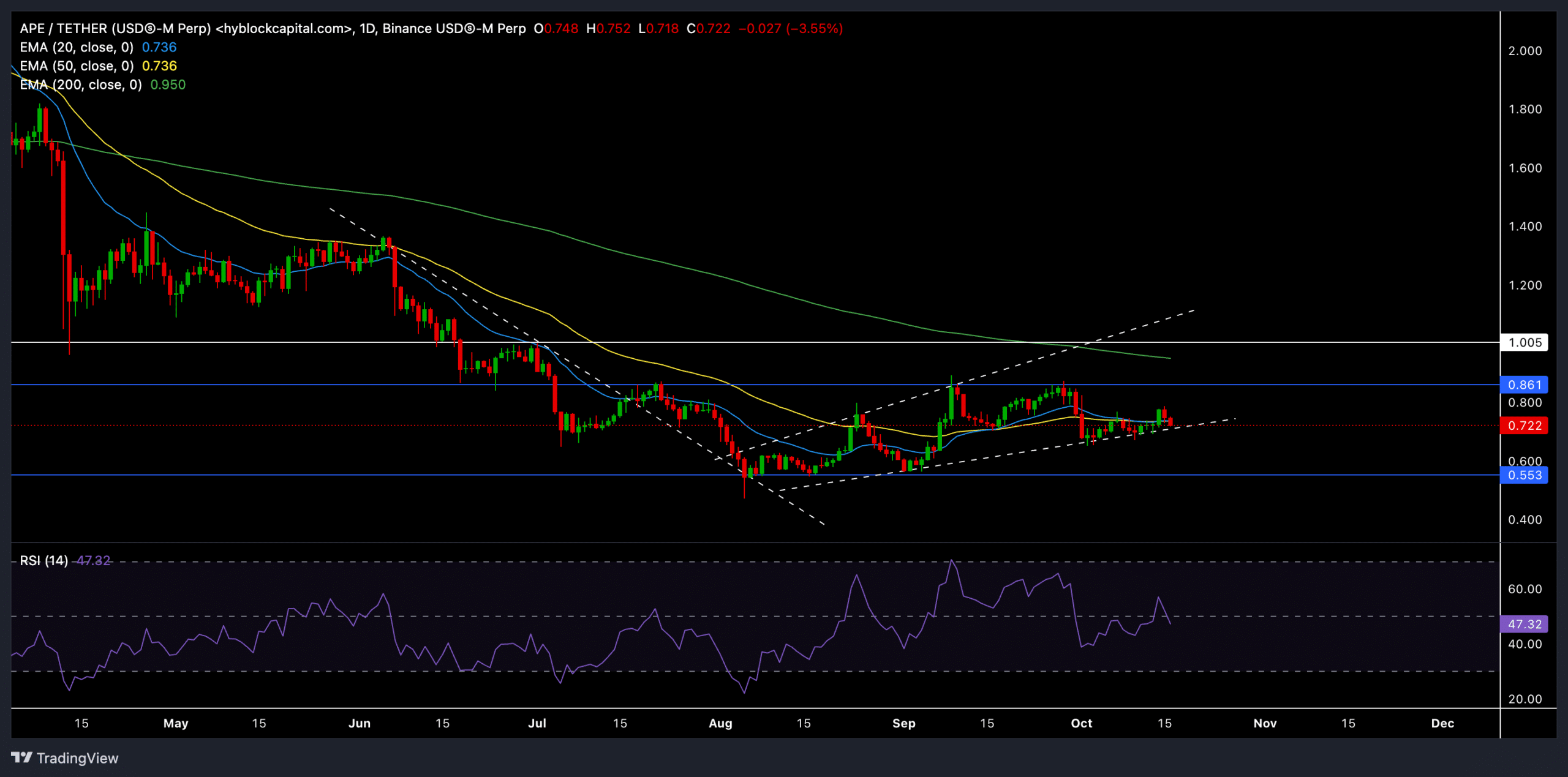

ApeCoin [APE] just lately bounced again from the $0.553 help, giving bulls renewed hope. APE was buying and selling at $0.722 at press time, going through quick resistance at $0.8. Nevertheless, the query stays: Can consumers maintain the momentum to interrupt key resistance ranges?

Consumers regained momentum

ApeCoin’s every day chart just lately noticed a rising broadening wedge, indicating a gradual improve in shopping for strain. This sample usually signifies extra volatility, with each upside and draw back potential.

The 20-day and 50-day EMAs (each at present round $0.736) continued to behave as main resistance factors, preserving ApeCoin’s worth from breaking right into a sustained uptrend.

A detailed above these ranges might gas a robust rally, doubtlessly focusing on the $0.86 resistance earlier than a check of the 200-day EMA at $0.95.

APE’s 20-day EMA and 50-day EMA are shifting downward however are near being examined, suggesting a fairly essential second for the coin. A breakout above these shifting averages might affirm a development reversal and provides the bulls the much-needed energy to problem the upper resistance zones.

In the meantime, the RSI hovered at 47, suggesting a comparatively impartial place on the time of writing. A right away transfer above the 50-mark might point out a shift in sentiment towards bullish momentum.

Alternatively, a dip towards the 30 degree would reaffirm the present bearish strain.

Key ranges to look at

The $0.553 degree remained essential as main help. If sellers handle to drive the value under this baseline, APE might face additional draw back dangers.

A breakdown from the rising broadening wedge construction might doubtlessly set off a drop again to the $0.553 mark and even decrease.

On the upside, the $0.8 resistance aligned with the higher line of the wedge sample, and a robust rebound from this level would seemingly trace at a patterned uptrend within the coming classes.

Derivatives information and market sentiment

In line with derivatives information, APE’s open curiosity has dropped by 3.04% to $29.94 million, indicating diminished dealer exercise. Nevertheless, the quantity elevated by 8.49% to $68.65 million, suggesting renewed curiosity in APE.

The lengthy/quick ratio on Binance (2.9017) and OKX (3.56) additionally indicated a predominantly bullish sentiment amongst merchants.

Learn ApeCoin’s [APE] Worth Prediction 2024–2025

Curiously, high merchants on Binance have a big lengthy bias, with a protracted/quick ratio of three.095 (accounts) and 1.3669 (positions). This implies that whereas general market sentiment could be cautious, main merchants had been optimistic about APE’s restoration.

Buyers ought to watch the rising broadening wedge construction, which can dictate the subsequent main transfer.

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)