- Celestia’s $1.06 billion TIA unlock is imminent, setting an important check for key help ranges.

- Bearish sentiment prevails with low social engagement and adverse funding charges regardless of upcoming liquidity.

Celestia [TIA] token is on the point of a significant shift because it gears as much as unlock $1.06 billion price of tokens, practically 80% of its provide. With TIA buying and selling at $5.37, up 0.87% at press time, this inflow of liquidity might considerably influence the token’s market path.

Many traders now surprise if the unlocked tokens will spark new demand or result in elevated promoting strain, thereby shifting TIA’s present development.

TIA worth motion evaluation: Consolidation or breakout?

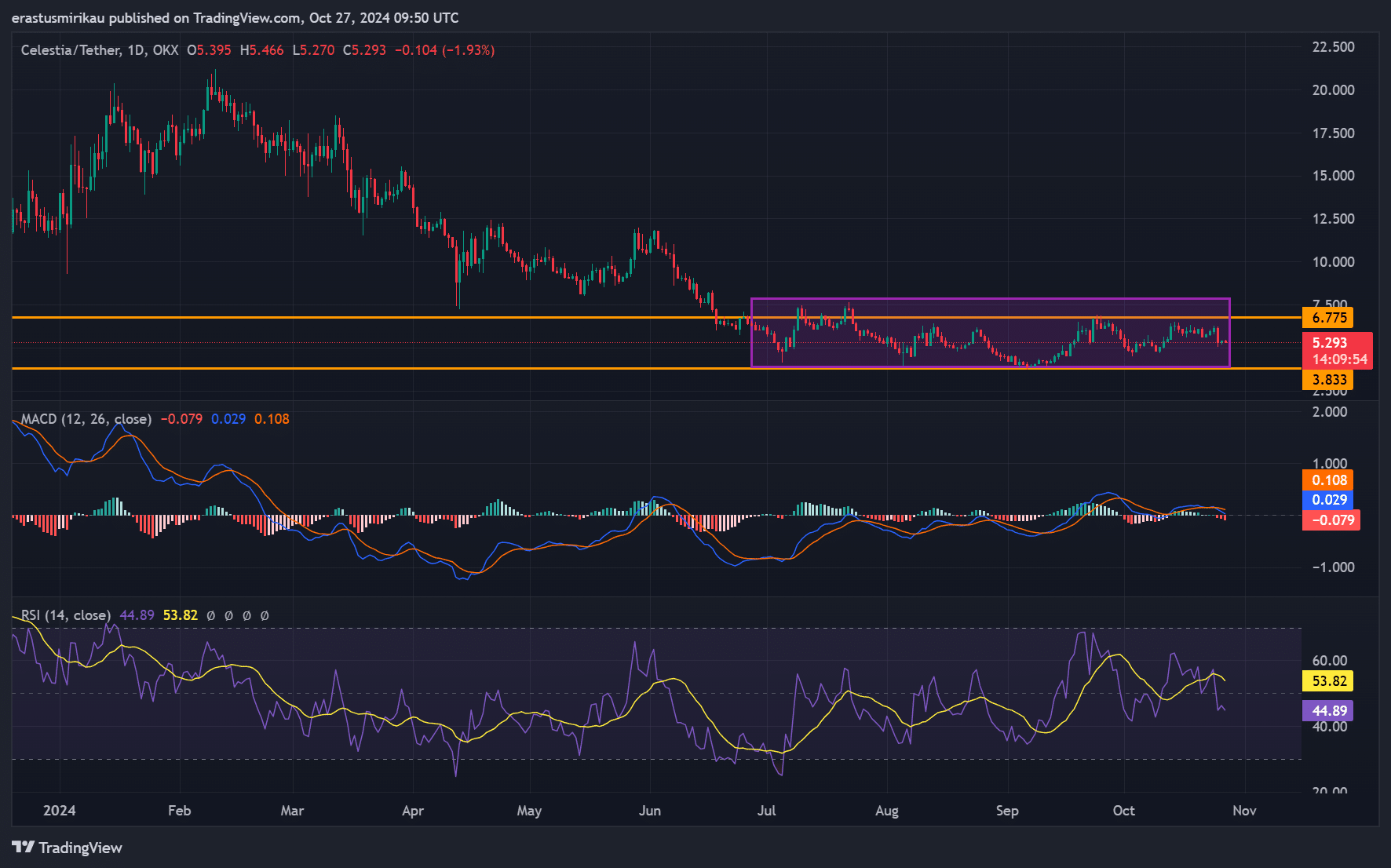

The every day Celestia chart reveals a buying and selling vary between $3.83 and $6.77, the place the token has been consolidating for months. Presently, TIA hovers round $5.29, with indicators of slight bearish momentum.

The MACD indicator suggests weakening bullish momentum, with the sign line close to zero. Moreover, the RSI, sitting beneath 50, signifies restricted bullish power.

Nevertheless, with the unlock occasion approaching, Celestia could also be at a turning level. Ought to consumers step in, the value might break the $6.77 resistance, sparking upward momentum.

Conversely, if the market reacts unfavorably, TIA might slide towards its $3.83 help stage, which could sign a possible breakdown.

Is TIA attracting sufficient social curiosity?

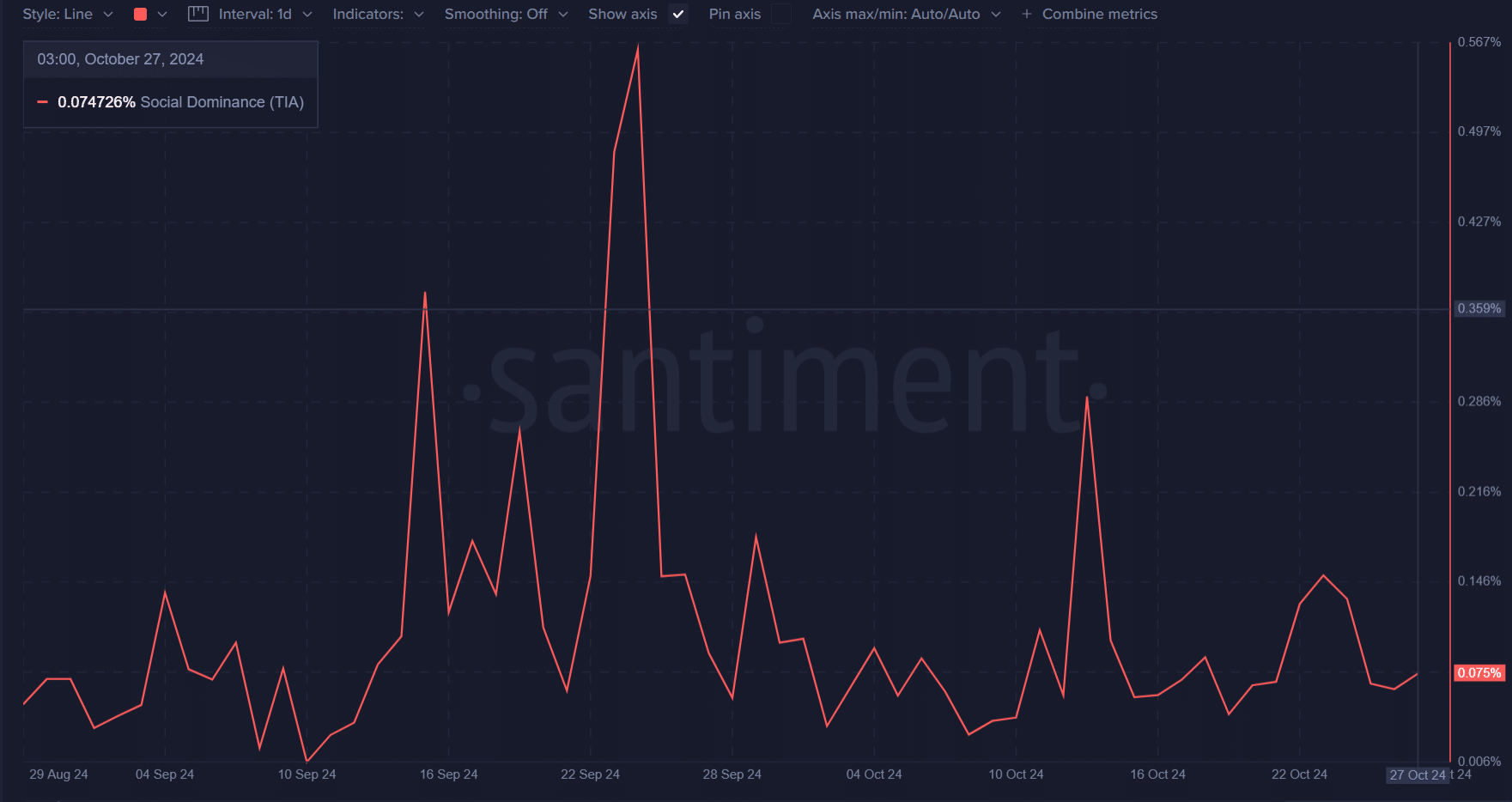

The Social Dominance chart reveals sporadic spikes in Celestia discussions, notably round mid-September and early October. Nevertheless, current knowledge reveals subdued social exercise, at the moment hovering round 0.075%. This restricted engagement means that TIA could not but be capturing the broader market’s consideration.

The dearth of social traction might point out minimal retail pleasure main as much as the unlock. A lift in social dominance might drive new curiosity, probably aiding a breakout.

Nevertheless, if TIA continues to lack social momentum, it might battle to achieve traction regardless of the numerous liquidity inflow.

Funding charge hints at bearish sentiment

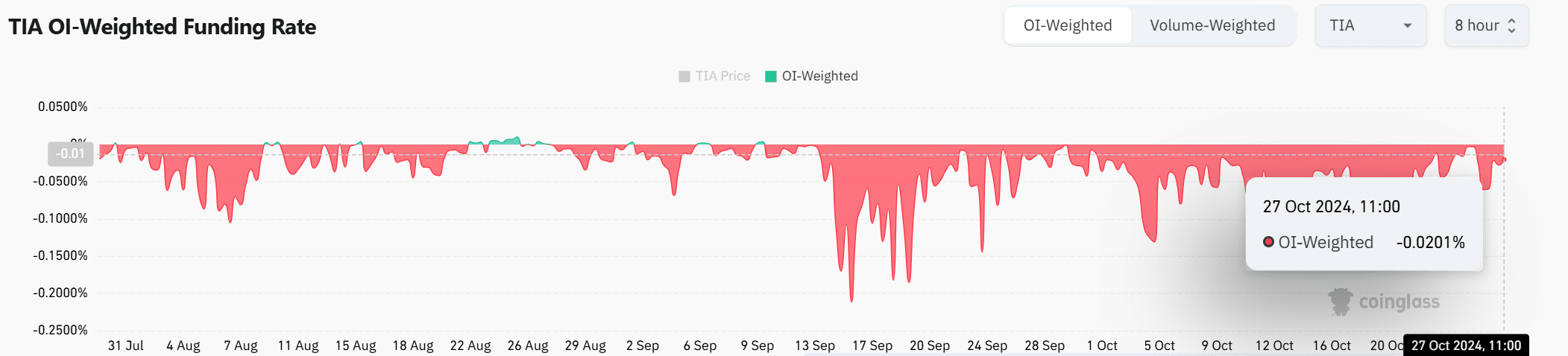

TIA’s OI-weighted funding charge stays in adverse territory, most lately at -0.0201%, signaling that brief positions dominate the futures market. This development highlights a cautious sentiment, as many merchants seem like betting on a worth decline.

Nevertheless, if the unlock occasion triggers renewed shopping for curiosity, a shift towards a impartial or constructive funding charge might point out a sentiment reversal, supporting a possible rally.

Due to this fact, monitoring funding charge tendencies can present perception into broader market expectations round Celestia’s worth path.

Is your portfolio inexperienced? Take a look at the TIA Revenue Calculator

Conclusively, Celestia’s large $1.06 billion unlock locations TIA at a essential juncture. Whereas the token’s worth at the moment sits at $5.37 inside a steady vary, a number of indicators mirror bearish sentiment, together with low social dominance and a adverse funding charge.

Consequently, Celestia’s subsequent transfer largely is determined by how the market absorbs the inflow of unlocked tokens. A surge in curiosity or a constructive funding shift might propel TIA upward; in any other case, the token could battle to keep up its worth, making this occasion pivotal for Celestia’s future.

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)