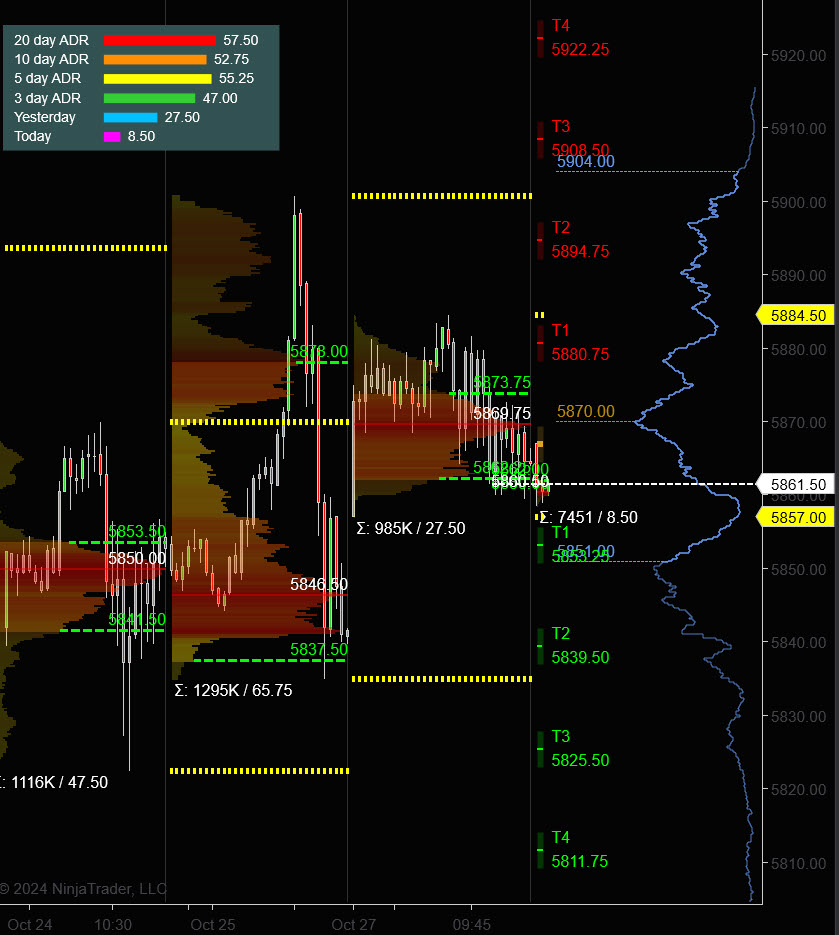

S&P 500

Prior Session was Cycle Day 1: Value established a brand new cycle low @ 5857 in a really quiet slim vary buying and selling session with anemic quantity.

For a extra detailed recap of the buying and selling session, click on on this hyperlink: Trading Room RECAP 10.28.24

Try the hyperlink to study extra concerning the Taylor Cycle and safe your FREE TRIAL.

…Transition from Cycle Day 1 to Cycle Day 2

Transition into Cycle Day 2: Value continues to be “range-mode” with lagging volumes and low volatility, which is starting to frustrate intra-day and swing merchants.

As all of us are keenly conscious, markets rotate from contractionary durations (vary) to expansionary durations (development). We additionally know that markets spend nearly all of the time in contraction (vary) consolidations as it’s regularly absorbing incoming info from a plethora of sources. Increase power for the subsequent expansionary (development) interval.

Our job is to defer to the present rhythms and train persistence, maybe by reviewing our commerce plans and making ready for the varied eventualities that might unfold and the way we’re going to reply. Make helpful of the quiet contraction interval, in order to be ready for the inevitable enlargement interval.

This week is fulfilled with Tech Earnings Stories which is anticipated to be the primary driver of market exercise. We’ll proceed to stay our self-discipline of sustaining positioning that’s aligned with market forces continues to serve us properly, so keep the course.

As such, eventualities to contemplate for immediately’s buying and selling.

Bull State of affairs: Value sustains a bid above 5860, initially targets 5880 – 5885 zone.

Bear State of affairs: Value sustains a suggestion beneath 5860, initially targets 5845 – 5840 zone.

PVA Excessive Edge = 5874 PVA Low Edge = 5862 Prior POC = 5870

ES (Profile)

Nasdaq 100 (NQ)

Prior Session was Cycle Day 1: Value established a brand new cycle low @ 20486 in a really quiet slim vary buying and selling session with anemic quantity.

For a extra detailed recap of the buying and selling session, click on on this hyperlink: Trading Room RECAP 10.28.24

…Transition from Cycle Day 1 to Cycle Day 2

Transition into Cycle Day 2: Value continues to be “range-mode” with lagging volumes and low volatility, which is starting to frustrate intra-day and swing merchants.

As all of us are keenly conscious, markets rotate from contractionary durations (vary) to expansionary durations (development). We additionally know that markets spend nearly all of the time in contraction (vary) consolidations as it’s regularly absorbing incoming info from a plethora of sources. Increase power for the subsequent expansionary (development) interval.

Our job is to defer to the present rhythms and train persistence, maybe by reviewing our commerce plans and making ready for the varied eventualities that might unfold and the way we’re going to reply. Make helpful of the quiet contraction interval, in order to be ready for the inevitable enlargement interval.

This week is fulfilled with Tech Earnings Stories which is anticipated to be the primary driver of market exercise. We’ll proceed to stay our self-discipline of sustaining positioning that’s aligned with market forces continues to serve us properly, so keep the course.

As such, eventualities to contemplate for immediately’s buying and selling.

Bull State of affairs: Value sustains a bid above 20485, initially targets 20655– 20705 zone.

Bear State of affairs: Value sustains a suggestion beneath 20485, initially targets 20430 – 20365 zone.

PVA Excessive Edge = 20602 PVA Low Edge = 20514 Prior POC = 20537

NQ Chart (Profile)

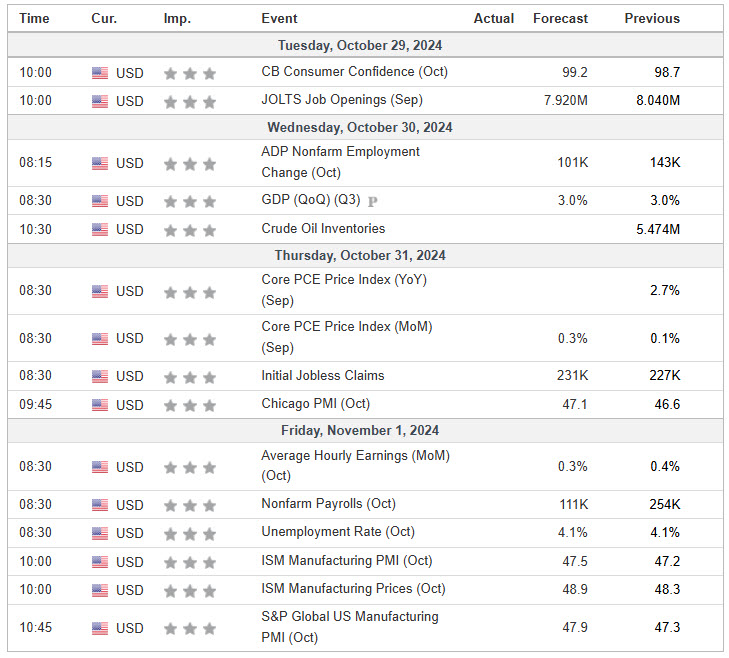

Financial Calendar

Commerce Technique: Our tactical commerce technique will merely stay unaltered…We’ll be versatile to commerce each lengthy and quick facet from Resolution Pivot Ranges. Proceed to deal with Bull/Bear Stackers and Premium/Reductions. As at all times, remaining in alignment with dominant intra-day drive will increase possibilities of manufacturing profitable trades.

Keep Centered…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Buying and selling…David

“Understanding will not be sufficient, We should APPLY. Prepared will not be sufficient, We should DO.” –BR

*****This commerce technique report is disseminated for “training solely” and shouldn’t be seen in any approach as a suggestion to purchase or promote futures merchandise.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No illustration is being made that using this technique or any system or buying and selling methodology will generate earnings. Previous efficiency will not be essentially indicative of future outcomes. There’s substantial threat of loss related to buying and selling securities and choices on equities. Solely threat capital must be used to commerce. Buying and selling securities will not be appropriate for everybody.

Disclaimer: Futures, Choices, and Forex buying and selling all have massive potential rewards, however additionally they have massive potential threat. You could pay attention to the dangers and be keen to just accept them with a purpose to put money into these markets. Don’t commerce with cash you possibly can’t afford to lose.

This web site is neither a solicitation nor a suggestion to Purchase/Promote futures, choices, or currencies. No illustration is being made that any account will or is more likely to obtain earnings or losses much like these mentioned on this site. The previous efficiency of any buying and selling system or methodology will not be essentially indicative of future outcomes.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)