Singapore-based crypto service supplier Matrixport predicts that Bitcoin could attain as excessive as $160,000 by 2025. In a newly launched report, titled Matrix on Goal (Difficulty #2024-112), the agency outlines a state of affairs during which elevated institutional adoption, macroeconomic evolution, and broadening world liquidity might push the main cryptocurrency to unprecedented ranges.

Why Bitcoin Will Attain $160,000 In 2025

Matrixport’s analysis workforce notes that Bitcoin’s efficiency in 2024 exceeded a number of key value projections and validated their earlier analytical frameworks. In keeping with the report, this energy has been propelled by institutional buyers who embraced the Bitcoin ETF market. These buyers have “realized substantial features, incentivizing additional allocation as we transfer into 2025,” states Matrixport.

The report highlights Bitcoin’s emergence as a portfolio element, underscoring that “our evaluation recommends a 1.55% allocation to attain optimum diversification whereas sustaining portfolio stability.” This strategy displays Bitcoin’s gradual integration into conventional funding methods, in addition to its evolving standing as a macro-relevant asset.

Associated Studying

Wanting forward, Matrixport’s evaluation emphasizes the approaching “8% adoption threshold” that would sign a turning level for Bitcoin. Drawing parallels to different applied sciences that skilled exponential development as soon as this threshold was crossed.

“Traditionally, applied sciences that cross this mark, similar to smartphones and social media, expertise exponential development pushed by community results and broader accessibility. As Bitcoin features mainstream acceptance, it’s poised to transition from a distinct segment asset to a core element of world monetary markets,” the agency forecasts.

Matrixport additionally particulars a shift in market dynamics. Traditionally, Bitcoin’s cycles have been outlined by steep 80% retracements, however this sample could also be diminishing. The agency experiences “a rising base of dip patrons and institutional assist,” which it says reduces the chance of extreme corrective phases. Whereas short-term consolidations stay part of market construction, Matrixport anticipates these to be “much less pronounced, reflecting Bitcoin’s maturation as an asset class.”

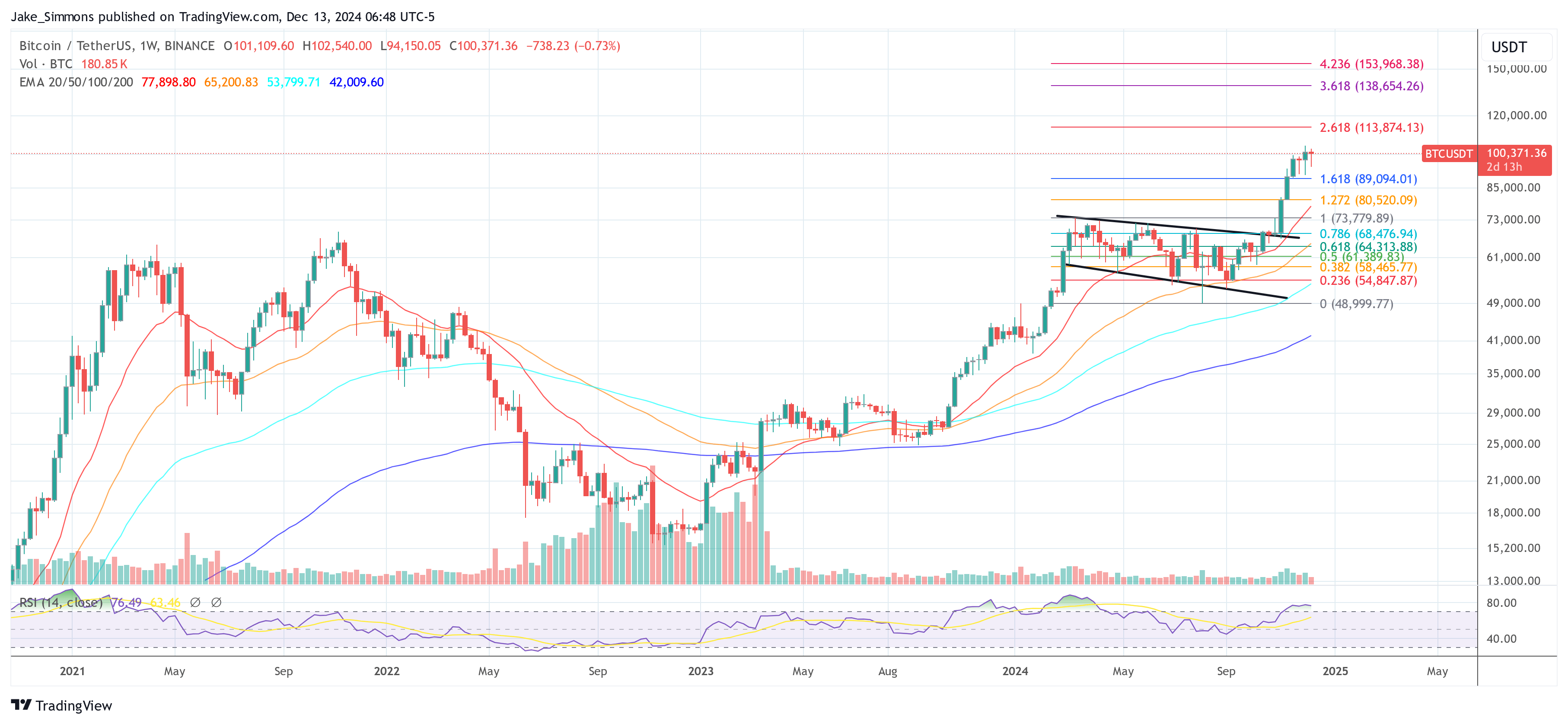

Concerning particular value forecasts, Matrixport outlines a “+60% upside” because the market progresses into 2025, culminating in a $160,000 value goal for Bitcoin. The report attributes this goal to “sustained demand for Bitcoin ETFs,” supportive macroeconomic situations, and an enlargement in world liquidity.

Associated Studying

Matrixport’s proprietary Greed & Concern Index—a barometer for market sentiment—signifies secure situations. The report claims that “the present consolidation section could also be shorter than earlier ones,” with stabilized funding charges and normalized market situations.

In flip, the analysts see “the stage … set for renewed upward momentum.” Matrixport additionally calls consideration to Bitcoin’s latest resilience, noting that “the swift restoration from latest overheated situations” helps the notion that BTC value is well-positioned for an additional development cycle.

The overarching view stays optimistic. Matrixport concludes that “the outlook for 2025 stays bullish,” with Bitcoin’s observe report as “an inflation hedge, and its integration into institutional portfolios recommend a transformative 12 months forward.” The agency concludes: “As adoption accelerates and the market matures, Bitcoin is positioned to attain new all-time highs, additional solidifying its function as a cornerstone of the worldwide monetary panorama.”

At press time, BTC traded at $100,371.

Featured picture created with DALL.E, chart from TradingView.com

Singapore-based crypto service supplier Matrixport predicts that Bitcoin could attain as excessive as $160,000 by 2025. In a newly launched report, titled Matrix on Goal (Difficulty #2024-112), the agency outlines a state of affairs during which elevated institutional adoption, macroeconomic evolution, and broadening world liquidity might push the main cryptocurrency to unprecedented ranges.

Why Bitcoin Will Attain $160,000 In 2025

Matrixport’s analysis workforce notes that Bitcoin’s efficiency in 2024 exceeded a number of key value projections and validated their earlier analytical frameworks. In keeping with the report, this energy has been propelled by institutional buyers who embraced the Bitcoin ETF market. These buyers have “realized substantial features, incentivizing additional allocation as we transfer into 2025,” states Matrixport.

The report highlights Bitcoin’s emergence as a portfolio element, underscoring that “our evaluation recommends a 1.55% allocation to attain optimum diversification whereas sustaining portfolio stability.” This strategy displays Bitcoin’s gradual integration into conventional funding methods, in addition to its evolving standing as a macro-relevant asset.

Associated Studying

Wanting forward, Matrixport’s evaluation emphasizes the approaching “8% adoption threshold” that would sign a turning level for Bitcoin. Drawing parallels to different applied sciences that skilled exponential development as soon as this threshold was crossed.

“Traditionally, applied sciences that cross this mark, similar to smartphones and social media, expertise exponential development pushed by community results and broader accessibility. As Bitcoin features mainstream acceptance, it’s poised to transition from a distinct segment asset to a core element of world monetary markets,” the agency forecasts.

Matrixport additionally particulars a shift in market dynamics. Traditionally, Bitcoin’s cycles have been outlined by steep 80% retracements, however this sample could also be diminishing. The agency experiences “a rising base of dip patrons and institutional assist,” which it says reduces the chance of extreme corrective phases. Whereas short-term consolidations stay part of market construction, Matrixport anticipates these to be “much less pronounced, reflecting Bitcoin’s maturation as an asset class.”

Concerning particular value forecasts, Matrixport outlines a “+60% upside” because the market progresses into 2025, culminating in a $160,000 value goal for Bitcoin. The report attributes this goal to “sustained demand for Bitcoin ETFs,” supportive macroeconomic situations, and an enlargement in world liquidity.

Associated Studying

Matrixport’s proprietary Greed & Concern Index—a barometer for market sentiment—signifies secure situations. The report claims that “the present consolidation section could also be shorter than earlier ones,” with stabilized funding charges and normalized market situations.

In flip, the analysts see “the stage … set for renewed upward momentum.” Matrixport additionally calls consideration to Bitcoin’s latest resilience, noting that “the swift restoration from latest overheated situations” helps the notion that BTC value is well-positioned for an additional development cycle.

The overarching view stays optimistic. Matrixport concludes that “the outlook for 2025 stays bullish,” with Bitcoin’s observe report as “an inflation hedge, and its integration into institutional portfolios recommend a transformative 12 months forward.” The agency concludes: “As adoption accelerates and the market matures, Bitcoin is positioned to attain new all-time highs, additional solidifying its function as a cornerstone of the worldwide monetary panorama.”

At press time, BTC traded at $100,371.

Featured picture created with DALL.E, chart from TradingView.com