Be a part of Our Telegram channel to remain updated on breaking information protection

AAVE (Aave) has lately skilled spectacular bullish momentum, pushed by growing demand inside the decentralized finance (DeFi) sector. Nevertheless, with the present downturn within the broader cryptocurrency market, many are questioning whether or not AAVE can preserve its upward trajectory and revisit its latest excessive of $396.

AAVE Key Statistics

- Present Value: $371

- Market Cap: $5.5 billion

- Buying and selling Quantity (24h): $1.32 billion

- Circulating Provide: 15 million AAVE

- Complete Provide: 16 MILLION AAVE

- CoinMarketCap Rating: #28

AAVE has dipped 2.76% from its latest highs during the last 30 and seven days, but it has showcased a rare rebound, hovering by 147.49% and 60.88% from its lowest ranges in the identical durations. This spectacular restoration highlights the coin’s rising energy and sustained bullish momentum regardless of a normal downtrend on the time of this evaluation.

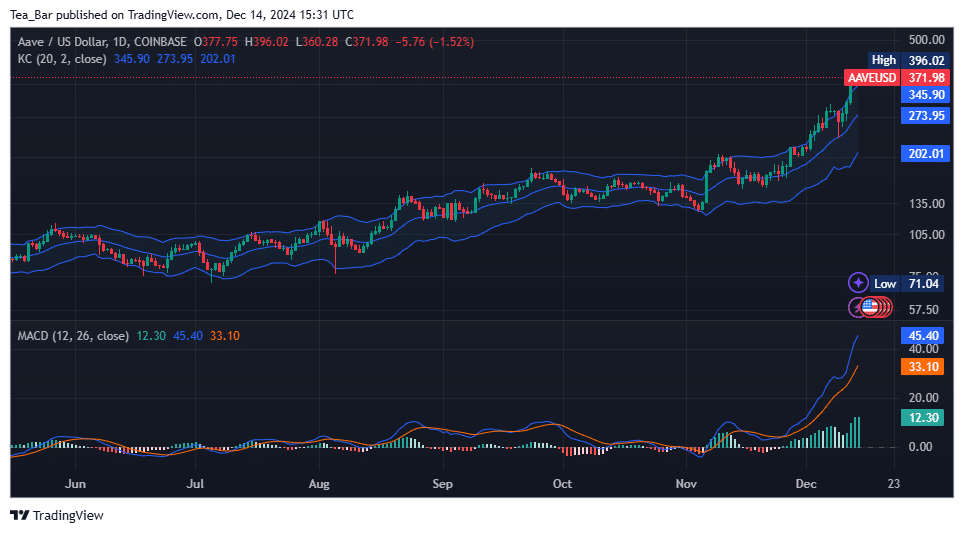

AAVE/USD Market

Key Ranges

- Resistance: $396, $410, $445

- Help: $345, $273, $202

The AAVE/USD each day chart highlights a formidable bullish run, with the worth consolidating round $371.98 after reaching a excessive of $396.02. The upward momentum has positioned AAVE close to important resistance ranges, with the closest at $396.02 (latest excessive). A break above this stage may open the trail towards the $410 mark, a psychological barrier, adopted by $445, which aligns with the following potential goal primarily based on historic value motion. Nevertheless, indicators of overextension within the MACD histogram recommend that the rally could encounter promoting stress within the close to time period.

On the draw back, speedy assist lies at $345.90, akin to the midline of the Keltner Channel, which has acted as a dependable dynamic assist throughout the uptrend. If bearish momentum intensifies, additional assist will be discovered at $273.95 (decrease Keltner Channel boundary). A deeper correction may push the worth to $202.01, a key stage that beforehand marked consolidation zones. Conditional on MACD traits and quantity stability, AAVE may both resume its upward climb or enter a corrective section, offering important resolution factors for merchants.

Can AAVE Overcome Market Downturn to Retest $396? Key Components to Watch

Given the present bearish sentiment within the broader market, the place most cryptocurrencies are experiencing declines, AAVE’s means to satisfy its latest excessive of $396 turns into tougher. In a “purple” market, the probability of sustained upward momentum for AAVE is diminished except it may possibly considerably outperform its friends. The general market downturn could exert downward stress on AAVE, significantly if there may be continued weak spot throughout main cryptocurrencies like Bitcoin and Ethereum. Because of this, AAVE may battle to interrupt via its resistance stage at $396 within the brief time period.

How Excessive Can Aave Go?

In such market situations, AAVE’s value would possibly face elevated volatility, doubtlessly revisiting decrease assist ranges like $345.90 or $273.95. Whereas the basics of Aave’s DeFi platform stay sturdy, exterior elements equivalent to international financial uncertainty, regulatory developments, and traders’ danger urge for food will play an important position. If the market sentiment shifts to extra favorable situations, AAVE may nonetheless make an try and retest $396, however warning is suggested within the face of widespread market weak spot.

AAVE/BTC Efficiency Perception

The AAVEBTC each day chart signifies a robust upward development as AAVE trades above the higher Keltner Channel (KC) band, signifying bullish momentum. The MACD histogram displays continued shopping for curiosity, with the MACD line sustaining a notable hole above the sign line. Regardless of a slight pullback (-1.85%), the worth stays considerably elevated from its latest low of 0.001157 BTC and continues to hover close to its peak of 0.003913 BTC. This implies that bulls preserve management, although a possible retracement towards the center KC band (0.002789 BTC) may present stronger assist earlier than resuming the uptrend.

In the meantime, market intelligence platform, Santiment famous that Aave (AAVE) has surpassed $300 in market worth for the primary time in over three years, supported by a broader altcoin rally. A big drop in AAVE’s “Imply Greenback Invested Age” signifies main stakeholders are reactivating dormant tokens, driving bullish momentum. In addition they highlighted sturdy common returns for 30-day (+33%) and 365-day (+109%) energetic merchants, reflecting AAVE’s spectacular efficiency. Whereas whale exercise continues to gas the rally, Santiment cautioned {that a} retracement is feasible if massive holders cut back circulation.

📈 As a number of altcoins develop at the moment, AAVE has erupted to a market worth of over $300 for the primary time in over 3 years. Take note of tasks which have large drops in “Imply Greenback Invested Age” like AAVE. This means main key stakeholders are shifting beforehand stagnant… pic.twitter.com/VmywKxRTzh

— Santiment (@santimentfeed) December 11, 2024

Alternate options to AAVE

Aave has firmly established itself as a pioneer in decentralized finance (DeFi), famend for its revolutionary flash mortgage characteristic that enables customers to borrow and repay funds inside a single transaction, all with out the necessity for collateral. Though Aave continues to dominate, newer tasks are quickly gaining traction, with Wall Avenue Pepe ($WEPE) rising as a standout. Regardless of the present market turbulence, $WEPE has efficiently raised a formidable $20.3 million throughout its presale, signaling sturdy curiosity from traders. At its present value of $0.000364, it presents an attractive alternative for these seeking to enter early.

Wall Avenue Pepe’s distinctive attraction lies in its intelligent twist on the enduring Pepe the Frog meme, seamlessly integrating it with a utility-focused ecosystem designed for on a regular basis crypto traders. On the coronary heart of this ecosystem is a personal insider neighborhood the place merchants can alternate insights and refine methods. That is enhanced by a collection of superior buying and selling instruments, real-time market indicators, and actionable recommendation that goals to assist smaller traders navigating the complexities of crypto buying and selling.

Elon Musk Loves Wall Avenue Pepe

The mission’s momentum is additional evident in its quickly rising on-line presence, significantly the increasing “WEPE Military” on Twitter. With greater than 4.7 billion $WEPE tokens staked at a formidable annual yield of 167%, Wall Avenue Pepe is positioning itself as a beautiful choice for retail traders desperate to discover its trader-centric ecosystem. As improvement continues, the mission has the potential to carve out a worthwhile area of interest within the cryptocurrency area.

Associated Information

Latest Meme Coin ICO – Wall Avenue Pepe

- Audited By Coinsult

- Early Entry Presale Spherical

- Non-public Buying and selling Alpha For $WEPE Military

- Staking Pool – Excessive Dynamic APY

Be a part of Our Telegram channel to remain updated on breaking information protection