- Algorand has a strongly bullish construction on the upper timeframes.

- The DeFi protocol’s Whole Worth Locked has elevated by greater than 50% in November, doubtless driving positive factors.

Algorand [ALGO] noticed huge worth positive factors in November. The legendary “Uptober”, a bullish October, noticed ALGO hover across the $0.117 assist zone. In November, ALGO has rallied by 97% to this point.

A bearish divergence between worth and momentum may lead to a pullback. Nonetheless, the heavy shopping for exercise in latest days confirmed that any retracements would doubtless be shallow and fast.

Lengthy-term downtrend nonetheless in play?

Primarily based on the downtrend from March to August, a set of Fibonacci retracement ranges had been plotted.

The confirmed that the 61.8% and 78.6% retracement ranges at $0.2397 and $0.2794 had been substantial resistance ranges for ALGO bulls to beat.

Within the short-term- that means this week — the Algorand worth prediction is leaning bearish. It is because the market is doubtlessly overextended, with the RSI forming a bearish divergence.

Since Bitcoin [BTC] continues to be above $90k, crypto market sentiment was bullish. A BTC drop under $89.5k may incite heightened short-term promoting.

A retest of the $0.16 stage could be a pretty shopping for alternative, however as issues stand such a deep drop won’t arrive. The $0.184 and $0.209 are the closest assist ranges to observe.

Algorand worth prediction — Bullish reversal forward?

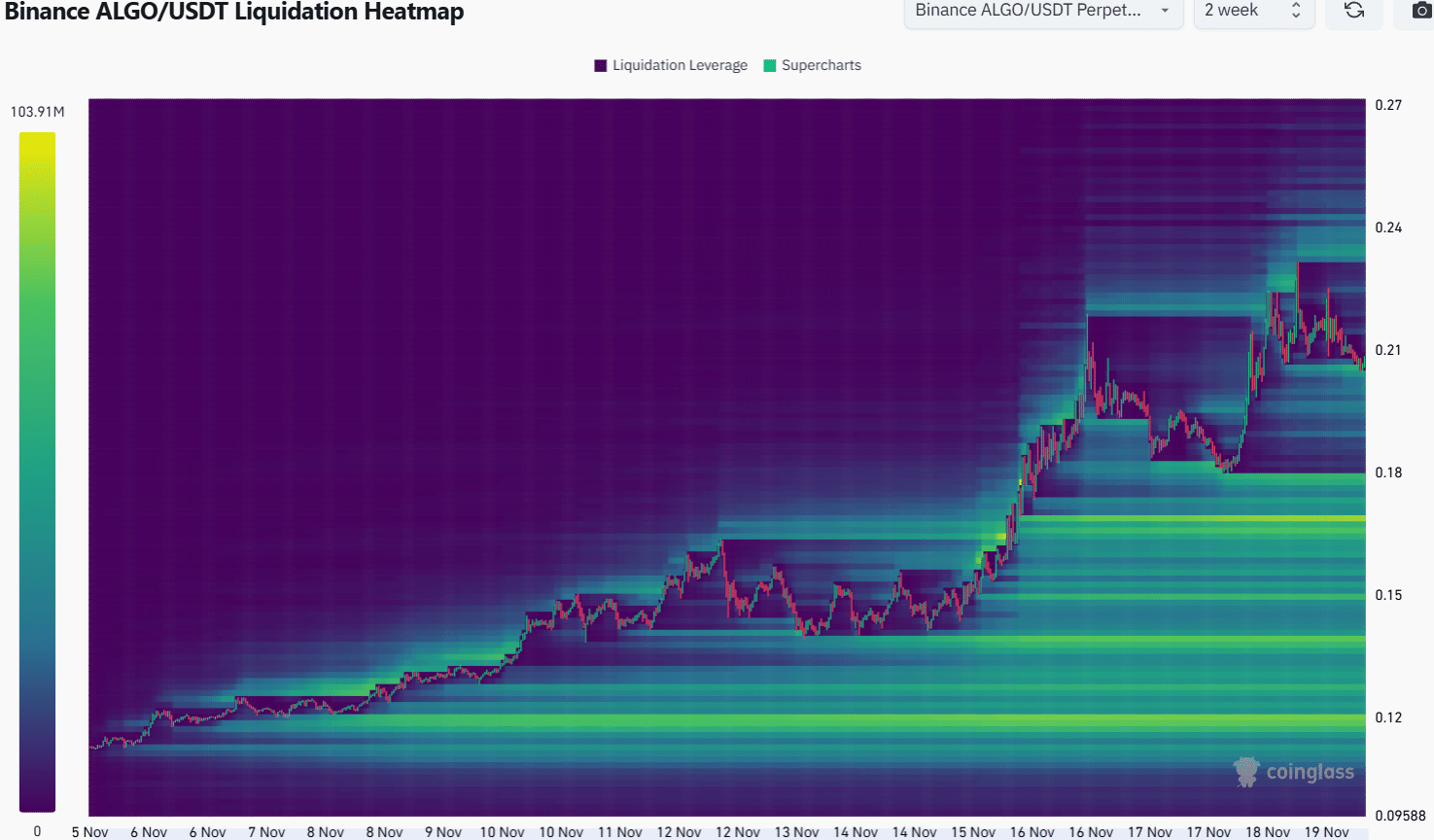

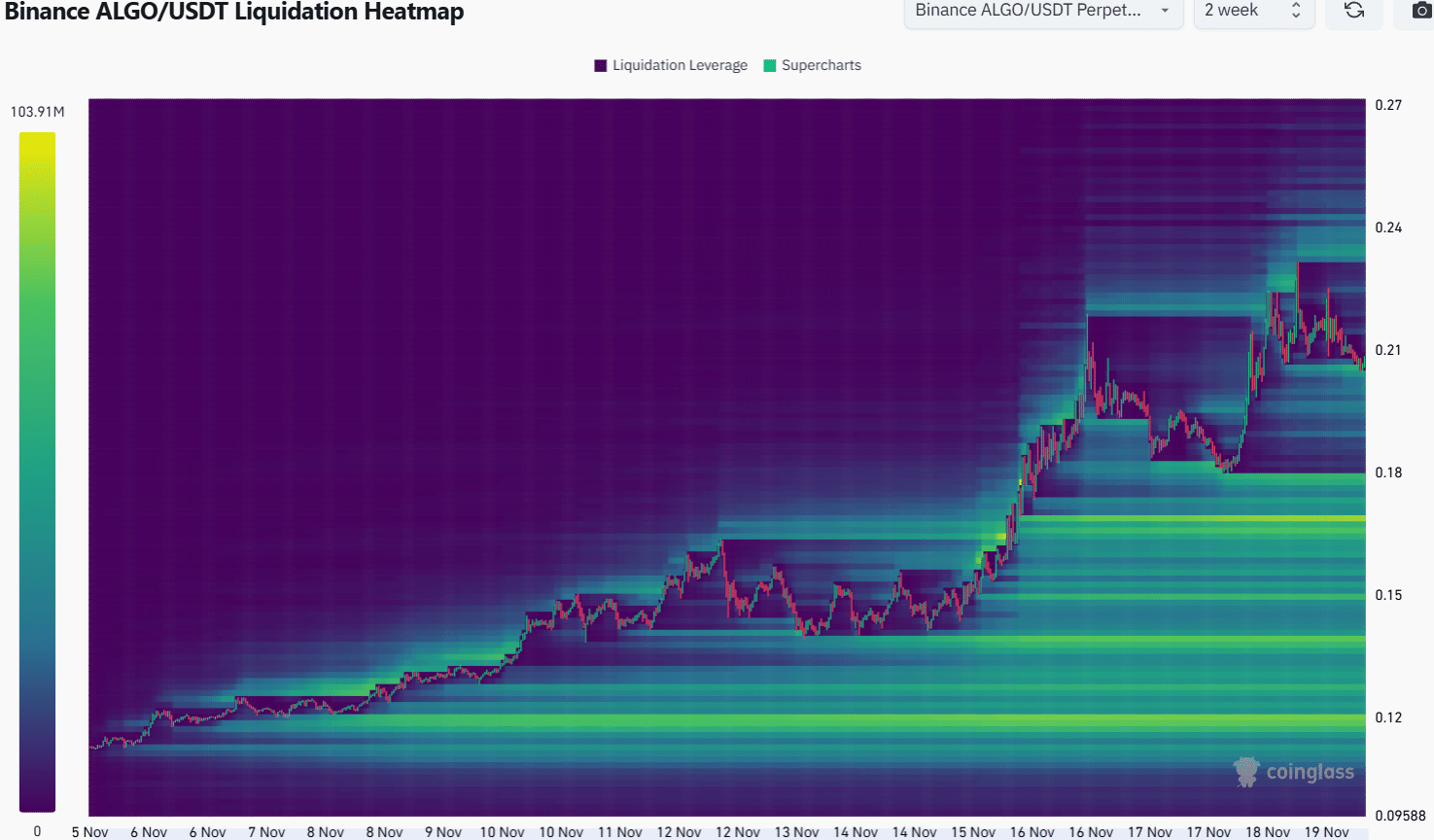

Supply: Coinglass

There have been a cluster of lengthy liquidations across the $0.205 area that Algorand costs visited just lately.

Sensible or not, right here’s ALGO’s market cap in BTC’s phrases

This sweep of the liquidity pool would doubtless yield a constructive response within the subsequent 2–3 days and will see ALGO rally towards the $0.235 area.

Beneath $0.205, the $0.178 and $0.167 had been additionally enticing magnetic zones that might see a bullish reversal within the coming weeks.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.