- Any additional losses can affirm an up-channel breakout on the day by day chart.

- The derivatives knowledge indicated a cautious however barely bullish sentiment amongst prime merchants, which might stabilize the present uptrend.

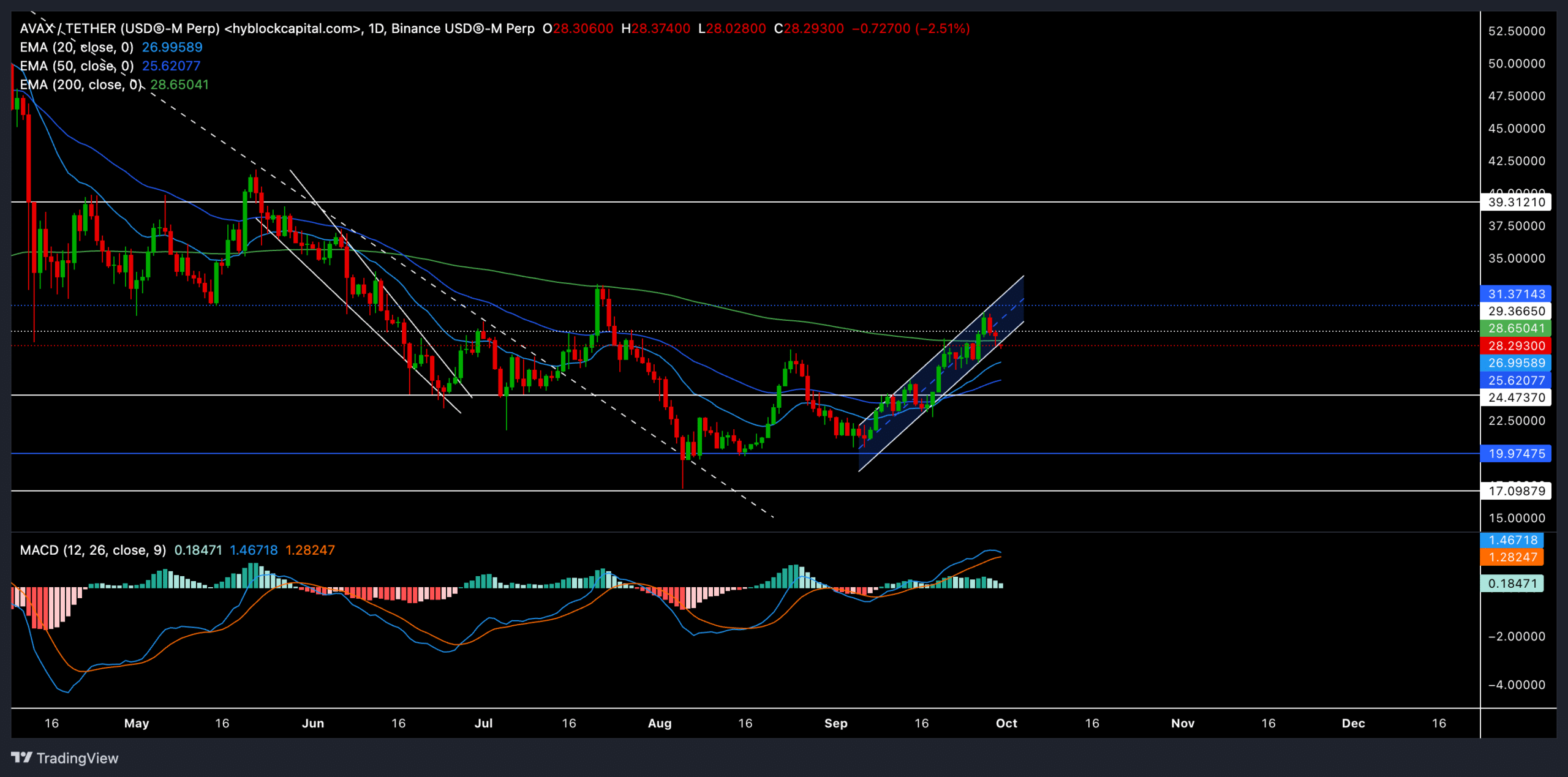

Avalanche [AVAX] continued its uptrend inside an ascending channel over the previous few weeks.

After breaking above the 50-day EMA, the bulls secured a gentle uptrend and propelled the value towards the 200-day EMA.

Nevertheless, the latest worth motion prompt the potential for a pullback because it approached key resistance ranges.

AVAX traded at $28.29 at press time, down by round 2.51% within the final 24 hours. Regardless of this dip, the bullish momentum remained intact as a result of a northbound 20-day EMA crossing above the 50-day EMA.

Can AVAX bulls provoke a long-term uptrend?

The 20-day EMA at $26.99 and the 50-day EMA at $25.62 confirmed an upward trajectory, suggesting a continued bullish development within the close to time period.

Nevertheless, the 200-day EMA at $28.65 was presently performing as a powerful resistance stage. If the value fails to interrupt above this stage, a short-term pullback could happen.

The MACD line affirmed a bullish edge as a result of it was above the sign line on the time of writing.

The histogram was additionally in optimistic territory, however the latest crimson candles on the day by day chart could result in a brief bearish crossover if the sellers proceed to exert stress.

If AVAX can shut above the $28.65 stage (200-day EMA), the bulls could try to push the value towards the $31.3 resistance. A breakout above this stage might set the stage for additional features towards $34-$36 within the coming days.

On the draw back, if AVAX fails to carry above the 200-day EMA, the value could revisit the $26.99 help stage, with the following main help at $25.62 (50-day EMA).

A sustained decline beneath this vary might open doorways to additional draw back towards $22-$20.

Derivatives knowledge revealed this

AVAX’s quantity surged by 36.82% over the previous day. This improve in quantity prompt growing curiosity amongst merchants, probably signaling a powerful upcoming transfer within the worth.

However Open Curiosity declined by 3.38%, indicating that some merchants have closed their positions. This divergence between quantity and open curiosity might suggest uncertainty available in the market course.

Learn Avalanche’s [AVAX] Value Prediction 2024–2025

The general lengthy/brief ratio stood at 0.9433 to barely favor the sellers. Nevertheless, the lengthy/brief ratio on Binance for prime merchants stood at 2.2206 to point that main market patrons had been betting on additional worth will increase.

It’s value noting that the broader market sentiment and Bitcoin’s motion may even play an important position in figuring out AVAX’s near-term trajectory.

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)