An analyst has defined how the worst could possibly be behind for Bitcoin, and This autumn might carry again bullish momentum if historical past is something to go by.

Q3 Has Traditionally Been The Worst Time For Bitcoin Traders

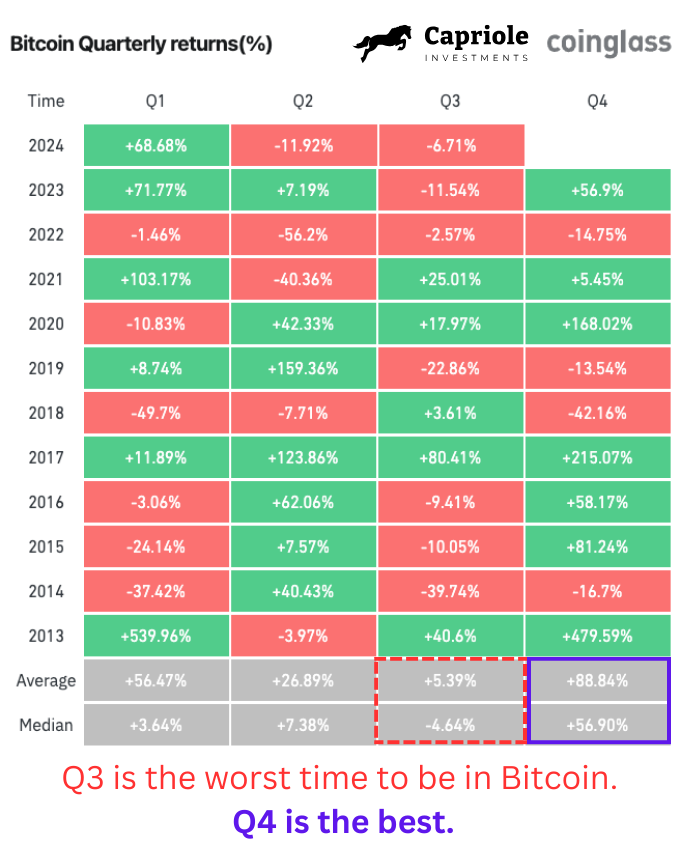

In a brand new submit on X, Capriole Investments founder Charles Edwards talked about how buyers are going by the worst time for Bitcoin. Beneath is the desk cited by the analyst, which breaks down the quarterly returns the cryptocurrency has seen all through its historical past.

As is seen, the third quarter of the yr has typically been the worst time for Bitcoin all through historical past, with common returns for the month standing at +5% and median ones at -4%

For perspective, the second-worst performing quarter tends to be Q2, however its common and median returns of +27% and +7%, respectively, are nonetheless considerably higher than Q3’s.

On the opposite facet of the spectrum is This autumn, the following quarter of the present yr. Bitcoin has had its greatest intervals this quarter, with common and median returns at +89% and +57%, respectively.

“In case you are nonetheless right here, congratulations. You made it by the worst time to be in Bitcoin,” says Edwards within the submit about BTC merchants. “The most effective lies forward.”

Final yr, the cryptocurrency loved an uplift of just about 57% on this interval. With Q3 quick approaching an in depth, it stays to be seen how the BTC value finally ends up performing in This autumn this time round.

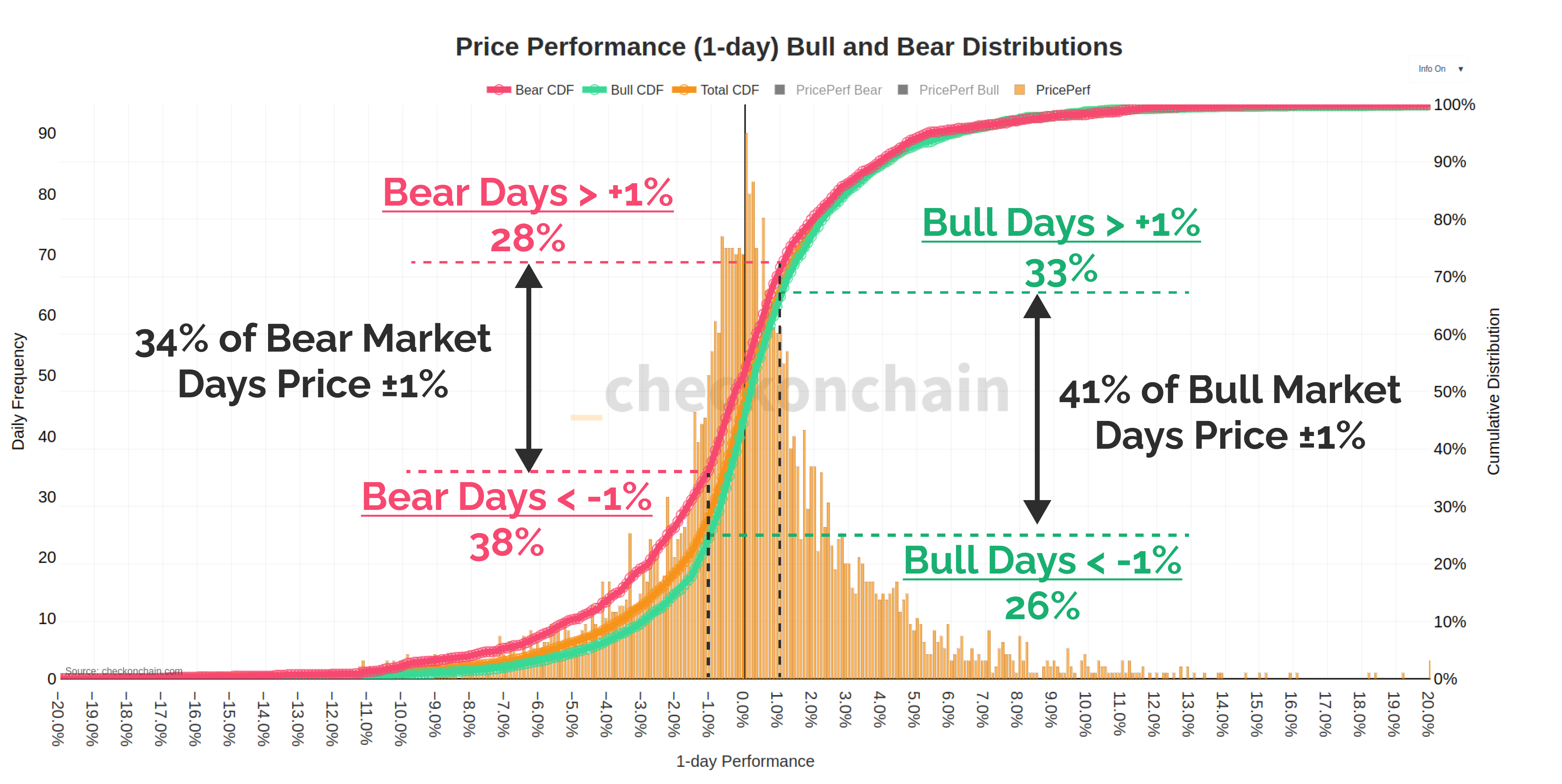

Talking of historic patterns, on-chain analyst Checkmate mentioned how the day by day value efficiency distribution has seemed throughout bear and bull markets in an X submit.

Right here is the chart shared by the analyst:

As displayed within the above graph, round 28% of bear market days have seen the asset pattern greater than +1%, whereas about 38% have seen it decline by greater than -1%. The remaining 34% of the times have seen the cryptocurrency stay inside +1% to -1% of the day past.

Throughout bullish intervals, Bitcoin has spent 33% of the times witnessing an increase of greater than +1%, whereas 26% registering a drop of over -1%. The asset has consolidated for the remaining 41%.

The symmetry between the three sorts of days is fascinating, however what stands out is how the distributions are virtually the identical between bear and bull markets.

“Day merchants try to beat a three-sided coin, with a 3rd of all days rallying, a 3rd selling-off, and a 3rd doing nothing,” notes Checkmate.

BTC Value

Bitcoin has proven a sudden burst of bullish momentum over the past 24 hours as its value has jumped greater than 5%, reaching the $60,900 stage.

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)