Key Takeaways

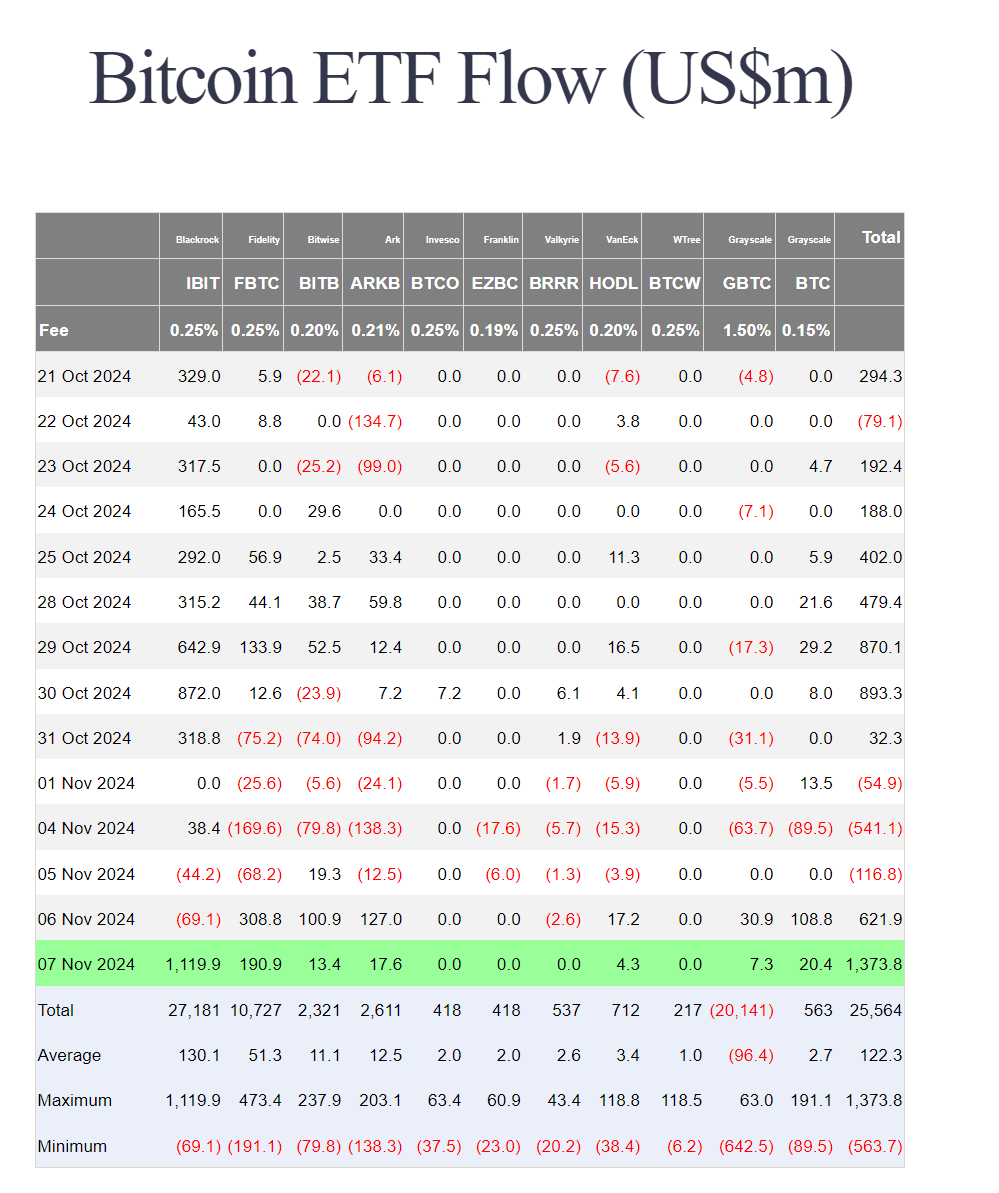

- BlackRock’s Bitcoin ETF noticed a document single-day influx of $1.1 billion.

- Complete inflows for US spot Bitcoin ETFs reached $1.37 billion throughout the session.

Share this text

BlackRock’s iShares Bitcoin Belief (IBIT) recorded $1.1 billion in inflows throughout a single buying and selling session, marking the most important one-day influx amongst US spot Bitcoin ETFs. The overall inflows throughout all Bitcoin ETFs reached $1.37 billion throughout the session.

BlackRock’s ETF dominated the day’s exercise with $1.12 billion in inflows, whereas Constancy’s Smart Origin Bitcoin Fund (FBTC) attracted $190.9 million throughout the identical interval.

The substantial ETF inflows coincided with Bitcoin’s value motion, which briefly reached $76,500 earlier than settling round $75,700. The reported flows might replicate exercise from the earlier buying and selling day as a result of T+1 reporting, explaining why BlackRock’s ETF confirmed damaging flows within the prior session whereas different funds noticed main inflows.

Since their launch in January 2024, US spot Bitcoin ETFs have gathered billions in belongings below administration, with BlackRock’s IBIT rising because the market chief.

Final month, US spot Bitcoin ETFs reached a document asset worth over $66.1 billion, because of a six-day influx streak and a Bitcoin value enhance.

Share this text

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)