- BNB rallied nearer to $600 amid constructive funding price transition

- Important liquidation leverage and technical indicators backed market’s bullish momentum

Binance Coin (BNB) has been transferring decisively currently, with its most up-to-date positive aspects pushing the altcoin nearer to $600 at press time. This uptick in value got here on the again of market individuals seeing a exceptional change of pattern in market sentiment, with funding charges flipping constructive after an prolonged bearish interval.

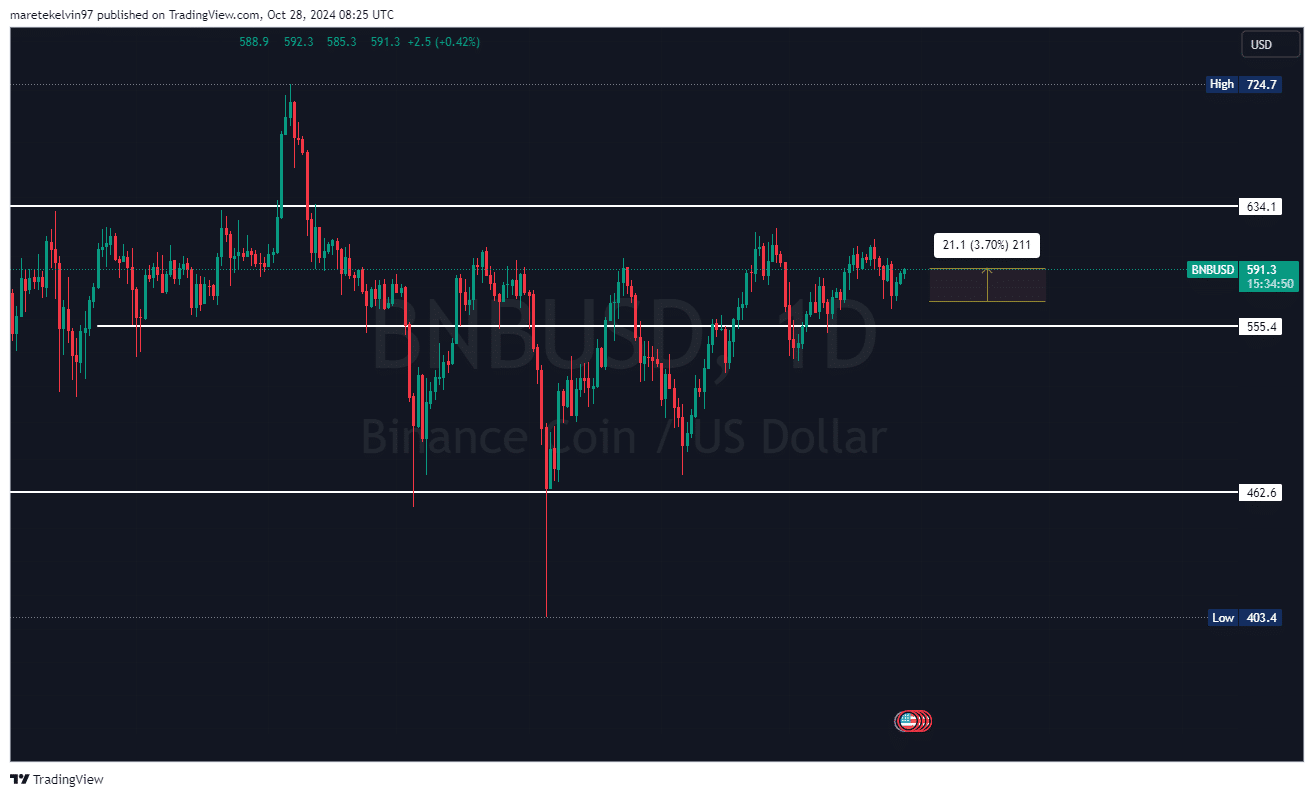

Additionally, the technical panorama underlined a strengthened market construction. BNB has established agency help at $555.4 whereas sustaining a strategic spot above its historic $462.6 ranges. Each value ranges are important and have confronted rejection a number of occasions just lately.

BNB’s metrics flash inexperienced

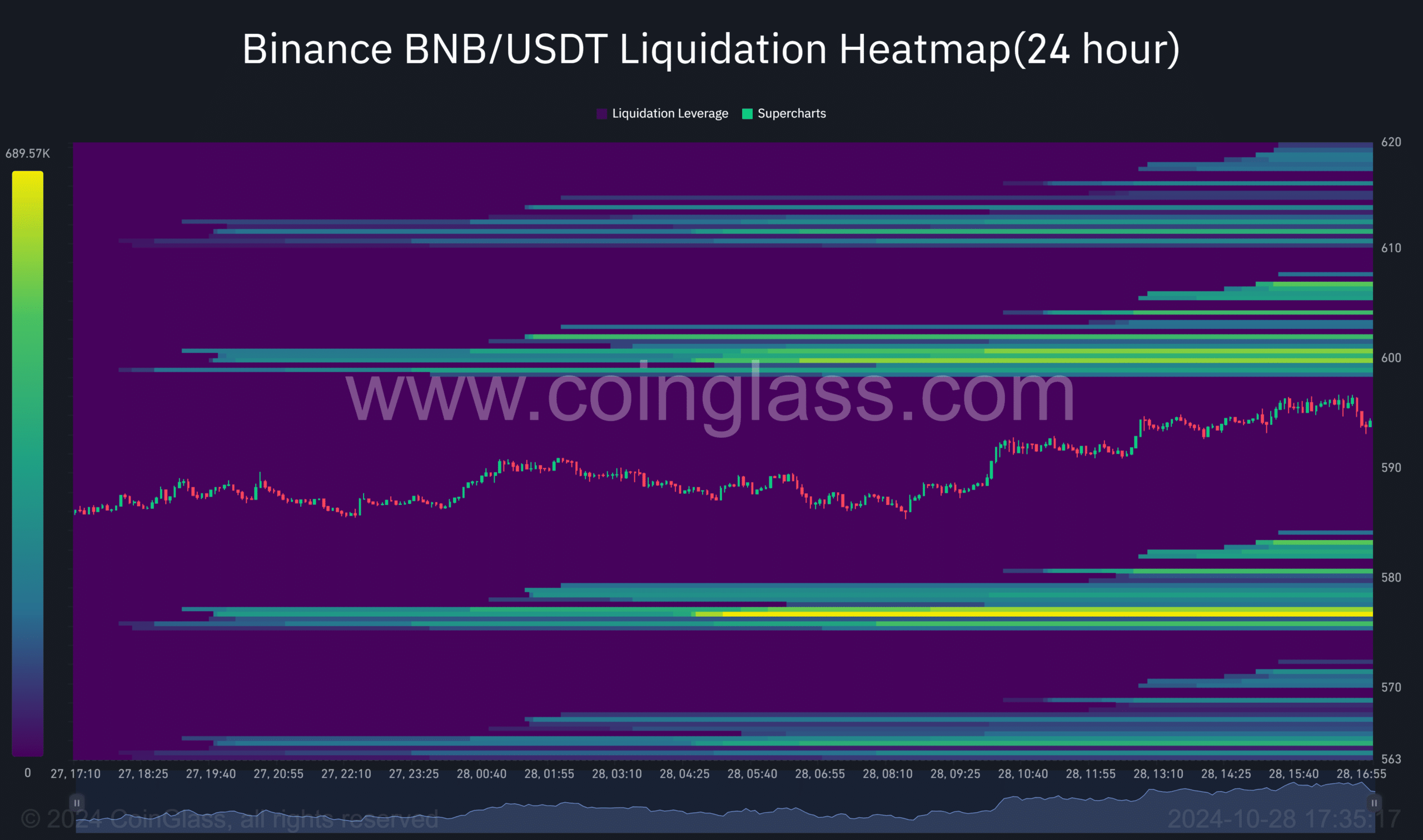

Apart from, the liquidation leverage additionally pressed larger to over 2M – An indication that confidence continues to be excessive among the many market’s individuals.

BNB’s market, therefore, appeared to have a bullish bias with a big liquidation pool at round $600. This might additional pull the altcoin’s value north. Right here, it’s additionally price mentioning that the current bullish momentum that has been accumulating is straight correlated to liquidity pull from the pool.

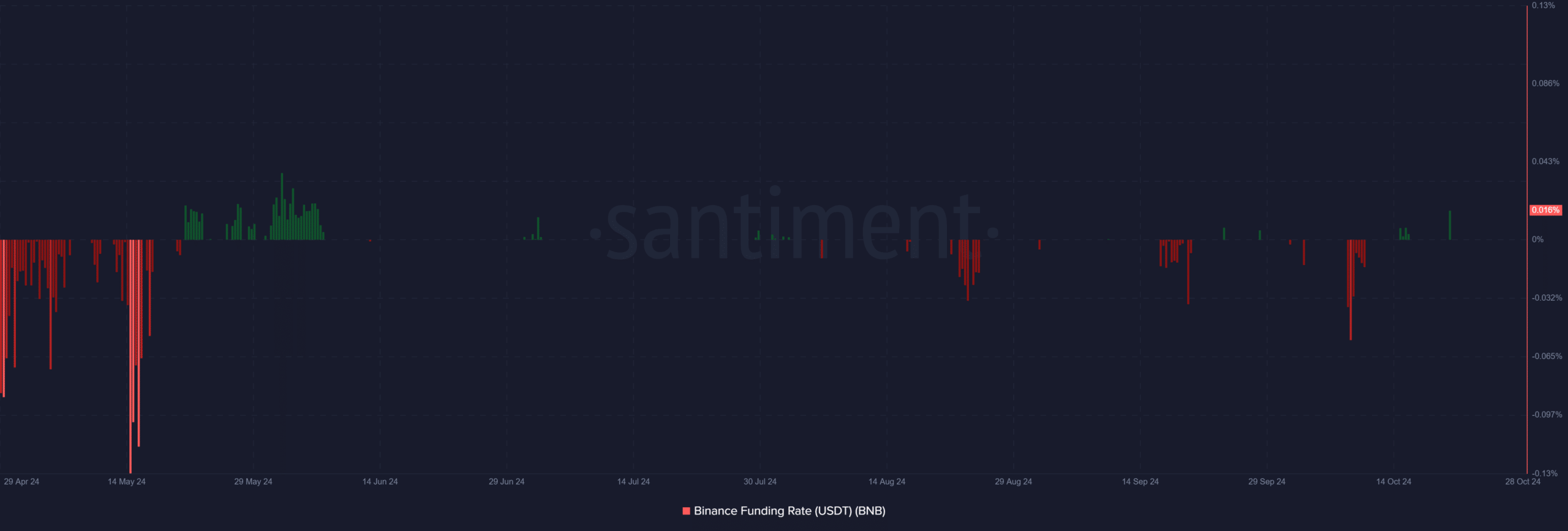

In the meantime, the shift in funding charges added important weight to the market’s bullish sentiment. BNB’s transition from adverse to constructive territory signalled a possible pattern reversal, notably important when mixed with the elevated liquidation metrics.

Such a confluence of indicators usually precedes main value actions.

Strategic value ranges form the buying and selling panorama

Consequently, all eyes are actually mounted on the essential $634.1 resistance degree, which traditionally has stood as the ultimate barrier to additional positive aspects. This degree has been traditionally important because it has seen a number of rejections previously.

Nonetheless, the robust help at $555.4 can present a transparent basis for any upcoming uptrend, making a well-defined buying and selling vary. With bullish momentum beginning to accumulate for BNB, the resistance degree at $634 is now clearly throughout the sights of the market’s bulls.

The constructive funding surroundings additional appeared to strengthen the potential for upward continuation.

A transparent path ahead emerges for BNB

BNB’s bullish market construction, backed by bettering funding charges and main liquidation leverage, painted a compelling image for sustained upside on the charts.

Whereas the $634.1 resistance stays a vital hurdle, the alignment of constructive indicators underlined rising momentum within the close to time period.

- BNB rallied nearer to $600 amid constructive funding price transition

- Important liquidation leverage and technical indicators backed market’s bullish momentum

Binance Coin (BNB) has been transferring decisively currently, with its most up-to-date positive aspects pushing the altcoin nearer to $600 at press time. This uptick in value got here on the again of market individuals seeing a exceptional change of pattern in market sentiment, with funding charges flipping constructive after an prolonged bearish interval.

Additionally, the technical panorama underlined a strengthened market construction. BNB has established agency help at $555.4 whereas sustaining a strategic spot above its historic $462.6 ranges. Each value ranges are important and have confronted rejection a number of occasions just lately.

BNB’s metrics flash inexperienced

Apart from, the liquidation leverage additionally pressed larger to over 2M – An indication that confidence continues to be excessive among the many market’s individuals.

BNB’s market, therefore, appeared to have a bullish bias with a big liquidation pool at round $600. This might additional pull the altcoin’s value north. Right here, it’s additionally price mentioning that the current bullish momentum that has been accumulating is straight correlated to liquidity pull from the pool.

In the meantime, the shift in funding charges added important weight to the market’s bullish sentiment. BNB’s transition from adverse to constructive territory signalled a possible pattern reversal, notably important when mixed with the elevated liquidation metrics.

Such a confluence of indicators usually precedes main value actions.

Strategic value ranges form the buying and selling panorama

Consequently, all eyes are actually mounted on the essential $634.1 resistance degree, which traditionally has stood as the ultimate barrier to additional positive aspects. This degree has been traditionally important because it has seen a number of rejections previously.

Nonetheless, the robust help at $555.4 can present a transparent basis for any upcoming uptrend, making a well-defined buying and selling vary. With bullish momentum beginning to accumulate for BNB, the resistance degree at $634 is now clearly throughout the sights of the market’s bulls.

The constructive funding surroundings additional appeared to strengthen the potential for upward continuation.

A transparent path ahead emerges for BNB

BNB’s bullish market construction, backed by bettering funding charges and main liquidation leverage, painted a compelling image for sustained upside on the charts.

Whereas the $634.1 resistance stays a vital hurdle, the alignment of constructive indicators underlined rising momentum within the close to time period.

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)