Buying and selling Session Recap – December 6, 2024

Overview: As we speak’s buying and selling session revolved across the market’s response to the Non-Farm Payroll (NFP) report, which fueled important volatility and offered a number of buying and selling alternatives throughout key devices such because the E-mini S&P 500 (ES), Nasdaq futures (NQ), and crude oil. Merchants leveraged Polaris Buying and selling Group’s (PTG) methodologies to navigate the session efficiently, hitting a number of predefined goal zones.

Key Highlights:

- Market Sentiment and Expectations:

- Forward of the session, merchants famous an 85% probability of a Federal Reserve fee minimize this month, up from 67% pre-NFP.

- Early commentary set the stage for a bullish bias, with preliminary targets recognized for key indices.

- Non-Farm Payroll Influence:

- The NFP report’s launch triggered an instantaneous success of the 6090-6095 goal zone on ES and the 21525 stage on NQ.

- PTG’s “Line within the Sand” (LIS) for the session was established at 6080, offering a important benchmark for intraday positioning.

- Intraday Buying and selling Methods:

- Crude Oil: The Open Vary Lengthy setup achieved two targets proper after the opening bell, demonstrating the effectiveness of PTG’s methods.

- Nasdaq Futures (NQ):

- The Open Vary Lengthy set off was activated and efficiently hit all targets, with 21580 being a key milestone.

- Merchants have been suggested to keep up a protracted bias, avoiding quick trades amidst sturdy upward momentum.

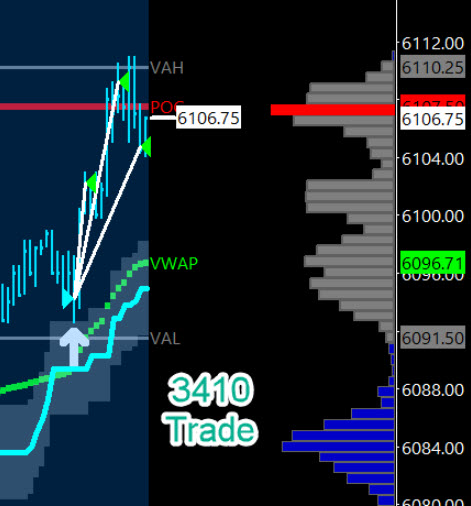

- E-mini S&P 500 (ES):

- The session noticed a three-day rally goal fulfilled, offering merchants with a considerable payoff.

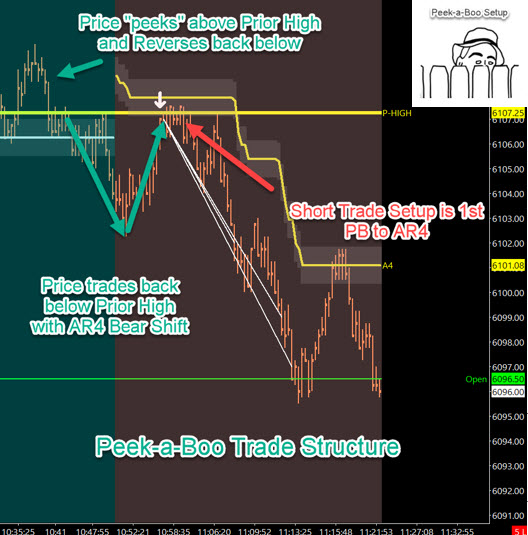

- Commerce Commentary:

- PTGDavid highlighted the precision of the Day by day Commerce Technique (DTS) in reaching its goal zones constantly.

- Key trades included a protracted place at 3410, which was accomplished with all targets met.

- “PKB (Peekaboo) Quick” setup offered extra alternatives because the market started to consolidate.

- Session Observations:

- By mid-morning, market exercise slowed, prompting PTGDavid to remain on the sidelines, citing diminished commerce edge.

- The commentary emphasised the significance of self-discipline and avoiding overtrading in low-probability situations.

- The session showcased the efficacy of PTG’s structured method, with a number of goal zones achieved throughout devices.

- Merchants have been reminded of the significance of adapting methods to market situations and sustaining self-discipline in quieter durations.

Abstract: The December 6 session exemplified strategic execution, with predefined targets hit throughout main markets and a give attention to disciplined buying and selling. PTG’s methodologies as soon as once more proved their robustness, enabling merchants to capitalize on the post-NFP volatility whereas navigating the session’s dynamics successfully.