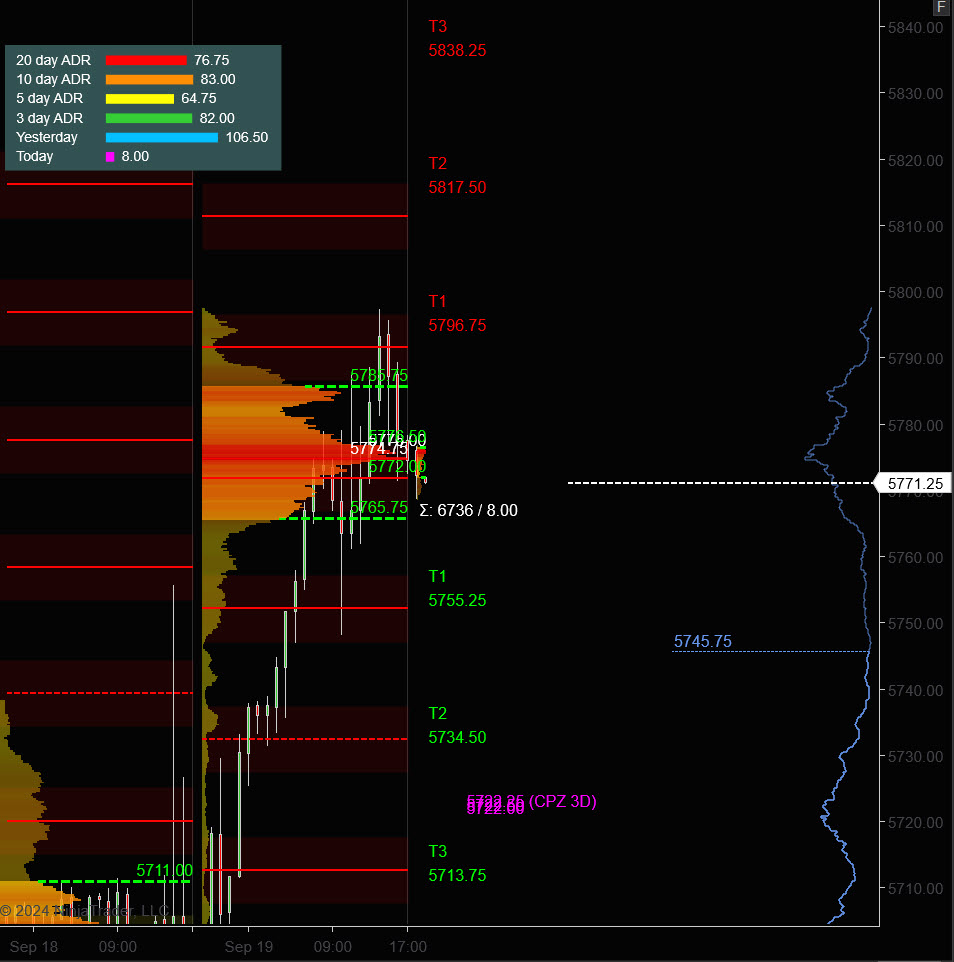

S&P 500

Vital Observe: We’ve begun publishing the PTG Buying and selling Room Each day RECAP which try to be receiving on the finish of every buying and selling day. This publication is a extra detailed evaluate of how the buying and selling unfolded all through the day from our viewpoint. It’s an “instructional” complimentary companion for use along with the Each day Commerce Technique. It continues to be “work-in-progress”, so please provide suggestions as to content material, model and relevance. We’re at all times striving to make PTG Merchandise and Providers the easiest in-class.

All Danger Disclosures discovered all through this web site applies equally to the every day recap publication.

Prior Session was Cycle Day 1: Worth rallied to satisfy the 5790 cycle goal on a True Hole increased which held all through the day, on the heels of a 50 bps charge minimize by Uncle Jay. Please evaluate Buying and selling Room RECAP 9.19.24. for extra particulars. Vary was 106 handles on 1.491M contracts exchanged.

…Transition from Cycle Day 1 to Cycle Day 2

This leads us into Cycle Day 2: Worth has fulfilled Cycle Goal (5790) throughout prior session. The BIG Occasion for immediately is Triple Choices Expiration (TOPEX) and as such we may see elevated volatility, given choices and futures contracts are expiring. Merchants and institutional traders regulate or shut positions to keep away from settlement obligations. This will create massive swings available in the market, particularly within the closing hours of the buying and selling day, which is named the “witching hour.” It’s estimated that $5.1 Trillion in choices will probably be expiring. That’s plenty of shekels!

Regular for Cycle Day 2 (CD2) could be for MATD rhythmic consolidation of prior session’s bullish true hole. Provided that cycle goal has been fulfilled with TOPEX being the dominant theme of the day, we’ll proceed to conduct our every day buying and selling as regular, specializing in core structural patterns with favorable reward-to-risk alternatives.

Our self-discipline of sustaining positioning that’s aligned with market forces continues to serve us properly, so keep the course.

As such, situations to contemplate for immediately’s buying and selling.

Bull Situation: Worth sustains a bid above 5775, initially targets 5785 – 5790 zone.

Bear Situation: Worth sustains a suggestion beneath 5775, initially targets 5760 – 5755 zone.

PVA Excessive Edge = 5785 PVA Low Edge = 5765 Prior POC = 5775

ES Chart (Profile)

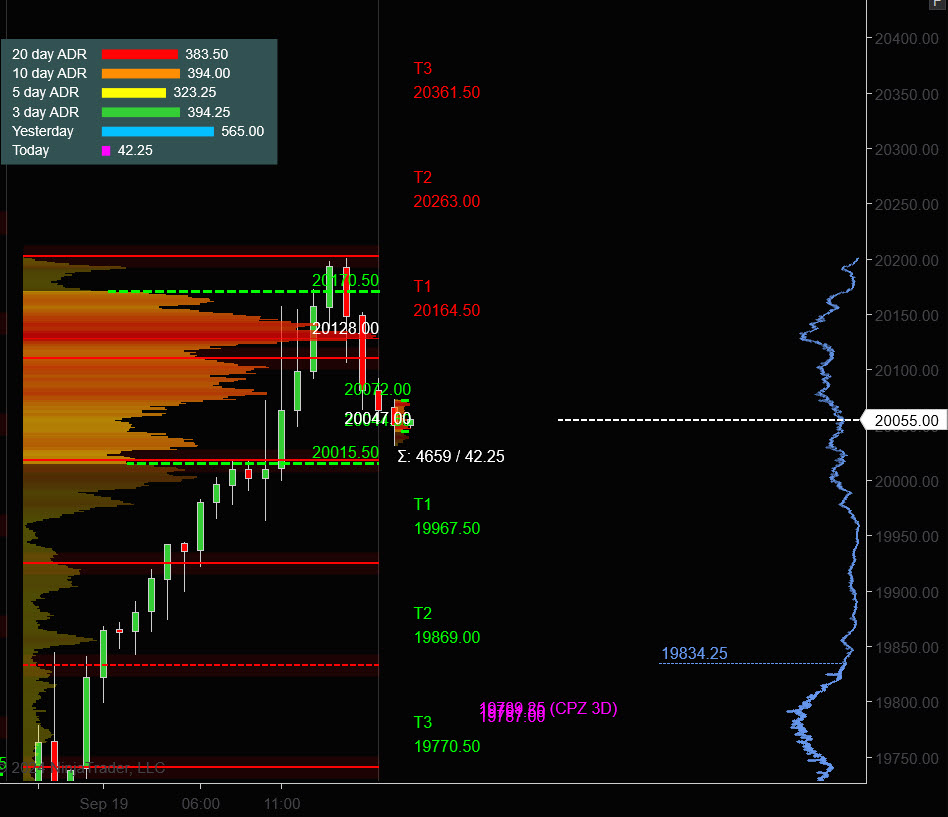

Nasdaq 100 (NQ)

Prior Session was Cycle Day 1: Worth rallied to satisfy the 20095 cycle goal on a True Hole increased which held all through the day, on the heels of a 50 bps charge minimize by Uncle Jay. Please evaluate Buying and selling Room RECAP 9.19.24. for extra particulars. Vary was 565 handles on 562k contracts exchanged.

…Transition from Cycle Day 1 to Cycle Day 2

This leads us into Cycle Day 2: Worth has fulfilled Cycle Goal (20095) throughout prior session. The BIG Occasion for immediately is Triple Choices Expiration (TOPEX) and as such we may see elevated volatility, given choices and futures contracts are expiring. Merchants and institutional traders regulate or shut positions to keep away from settlement obligations. This will create massive swings available in the market, particularly within the closing hours of the buying and selling day, which is named the “witching hour.” It’s estimated that $5.1 Trillion in choices will probably be expiring. That’s plenty of shekels!

Regular for Cycle Day 2 (CD2) could be for MATD rhythmic consolidation of prior session’s bullish true hole. Provided that cycle goal has been fulfilled with TOPEX being the dominant theme of the day, we’ll proceed to conduct our every day buying and selling as regular, specializing in core structural patterns with favorable reward-to-risk alternatives.

Our self-discipline of sustaining positioning that’s aligned with market forces continues to serve us properly, so keep the course.

As such, situations to contemplate for immediately’s buying and selling.

Bull Situation: Worth sustains a bid above 20015, initially targets 20130 – 20190 zone.

Bear Situation: Worth sustains a suggestion beneath 20015, initially targets 19985 – 19959 zone.

PVA Excessive Edge = 20170 PVA Low Edge = 20015 Prior POC = 20128

NQ Chart (Goal Grasp)

Financial Calendar

Commerce Technique: Our tactical commerce technique will merely stay unaltered…We’ll be versatile to commerce each lengthy and quick aspect from Choice Pivot Ranges. Proceed to deal with Bull/Bear Stackers and Premium/Reductions. As at all times, remaining in alignment with dominant intra-day pressure will increase chances of manufacturing successful trades.

Keep Targeted…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Buying and selling…David

“Figuring out is just not sufficient, We should APPLY. Prepared is just not sufficient, We should DO.” –BR

*****This commerce technique report is disseminated for “schooling solely” and shouldn’t be considered in any method as a suggestion to purchase or promote futures merchandise.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No illustration is being made that the usage of this technique or any system or buying and selling methodology will generate earnings. Previous efficiency is just not essentially indicative of future outcomes. There may be substantial danger of loss related to buying and selling securities and choices on equities. Solely danger capital ought to be used to commerce. Buying and selling securities is just not appropriate for everybody.

Disclaimer: Futures, Choices, and Foreign money buying and selling all have massive potential rewards, however in addition they have massive potential danger. You should pay attention to the dangers and be keen to just accept them with the intention to spend money on these markets. Don’t commerce with cash you possibly can’t afford to lose.

This web site is neither a solicitation nor a suggestion to Purchase/Promote futures, choices, or currencies. No illustration is being made that any account will or is prone to obtain earnings or losses much like these mentioned on this website online. The previous efficiency of any buying and selling system or methodology is just not essentially indicative of future outcomes.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)