The RSI (Kernel Optimized) indicator integrates Kernel Density Estimation (KDE) with the Relative Energy Index (RSI), making a probability-based framework to find out how intently the present RSI stage aligns with traditionally important pivot factors. By using KDE, discrete historic pivot values are reworked right into a clean likelihood distribution, enabling extra refined pattern evaluation than conventional RSI alone.

Core Idea: Kernel Density Estimation (KDE)

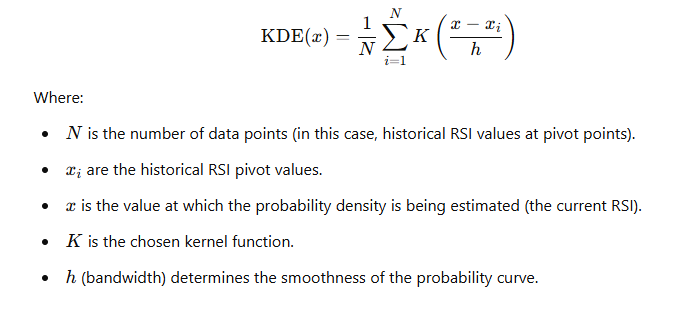

KDE is a non-parametric technique used to estimate the likelihood density perform of a dataset. As a substitute of counting on discrete bins as in histograms, KDE applies a steady kernel perform over every knowledge level to provide a clean curve that represents likelihood density at each stage of the variable being studied.

Basic KDE Components:

Step-by-Step Logic

-

Gathering RSI Pivot Knowledge: The method begins by figuring out historic highs and lows in RSI knowledge. These turning factors are recorded as separate units of RSI values: one set for pivot highs and one other for pivot lows.

-

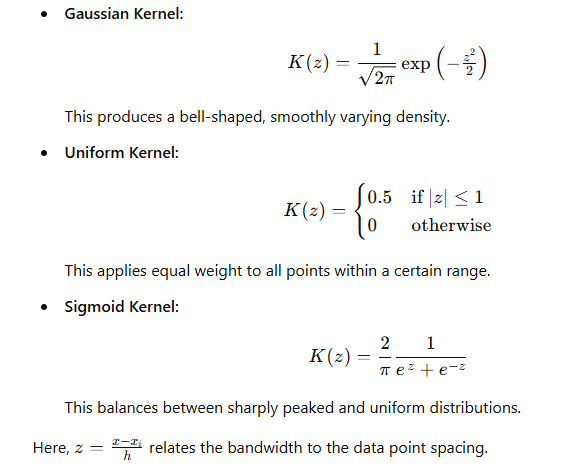

Choosing a Kernel Perform: A number of kernel choices could also be accessible, resembling Gaussian, Uniform, and Sigmoid. Every kernel defines how affect diminishes as the space from an information level will increase.

-

Adjusting the Bandwidth (h): The bandwidth controls how broad and clean the likelihood curve is:

- A smaller bandwidth highlights finer particulars and is extra delicate to particular person knowledge factors.

- A bigger bandwidth creates a smoother, extra generalized likelihood distribution.

-

Developing the Likelihood Distribution: After selecting the kernel and bandwidth, KDE is utilized to the units of pivot RSI values. The result’s a steady likelihood distribution, indicating how possible the present RSI is to be close to traditionally important pivot ranges.

-

Evaluating Chances: Two major strategies can be utilized:

- Nearest Mode: Focuses on the likelihood density on the level closest to the present RSI worth.

- Sum Mode: Integrates chances over a variety, offering a cumulative sense of how strongly the present RSI matches historic pivot patterns.

A user-defined threshold determines when the likelihood is taken into account excessive sufficient to counsel that the present RSI intently resembles earlier pivot circumstances.

-

Producing Market Indicators: By evaluating the present RSI’s likelihood distribution to historic pivot distributions:

- A excessive likelihood of similarity to historic low pivots might sign a bullish alternative.

- A excessive likelihood of similarity to historic excessive pivots might point out a bearish state of affairs.

The edge might be adjusted:

- The next threshold ends in fewer however extra dependable alerts.

- A decrease threshold produces extra alerts however might embrace extra noise.

Advantages of Kernel Optimization

-

Clean Knowledge Illustration: KDE transforms discrete pivot knowledge right into a steady, simply interpretable likelihood curve.

-

Likelihood-Based mostly Evaluation: Quantifying the probability of present circumstances matching historic pivot factors provides depth and robustness to RSI-based evaluation.

-

Flexibility and Adaptability: Customers can choose the kernel perform, alter bandwidth, and select likelihood analysis modes to tailor the indicator to numerous market circumstances.

-

Knowledgeable Determination-Making: Likelihood-driven insights assist merchants distinguish between random market fluctuations and real pivot-like conduct, enhancing confidence in entry and exit selections.

Conclusion

By integrating KDE with RSI, the kernel-optimized logic supplies a probability-based evaluation of the place the present RSI stands relative to historic pivot distributions. By kernel choice, bandwidth tuning, and threshold changes, merchants acquire a extra nuanced, statistically knowledgeable software for figuring out potential turning factors available in the market.

Obtain the RSI (Kernel Optimized) Indicator with Scanner utilizing the Kernel Optimized Logic above with built-in Scanner of foreign money pairs, time frames right here:

– for MT4: RSI Kernel Optimized with Scanner for MT4

– for MT5: RSI Kernel Optimized with Scanner for MT5