It’s election season so naturally guarantees, critiques, and coverage proposals are being slung backwards and forwards by all sides. One of many objects each side of the aisle are highlighting is a re-visit of the Little one Tax Credit score. An exquisite rebate from Uncle Sam to folks who drain their financial institution accounts every month on daycare, sports activities registration charges, and uneaten kids’s menu objects at Applebee’s.

Since 2017, a credit score of $2000 per youngster may be utilized to your tax invoice for any household making below $400,000. In different phrases, in case you have 3 youngsters, you possibly can knock $6000 off your revenue tax obligation! Even higher, it’s nonetheless refundable should you don’t owe any taxes making for a pleasant pocketing of money each Spring.

Now, the coverage is ready to run out in 2025 reverting again to solely a $1,000 credit score with none price of residing changes built-in regardless of a tough interval of inflation. What would possibly occur when its clawed again and the way can we enhance it for going ahead.

The unique youngster tax credit score and subsequent expansions are extensively considered an efficient and value environment friendly software to scale back youngster poverty and meals insecurity for tens of millions of low-income households.

COVID period coverage in 2021 even proved increasing the coverage expands its advantages. Throughout this era, individuals may get as a lot as $3,600 per yr per youngster cut up into month-to-month funds. It’s possible you’ll bear in mind getting just a few hundred bucks a month kicked again into your checking account should you had youngsters throughout COVID.

Since households didn’t have to earn a certain quantity to qualify, 19 million youngsters in low-income households grew to become eligible and began receiving month-to-month advantages.

Why would we let this expire?

The reply appears to be politics. Democrats proposed expansions throughout Republican administrations just for it to be blocked on technicality grounds. Republicans proposed comparable concepts throughout Democratic administrations however had been blocked for a similar causes. Appears a coverage that

-

Reduces youngster poverty

-

Helps with the backbreaking prices of children at present

-

Has an ideal bang on your buck on future society returns

-

Incentives households to have youngsters throughout a nationwide declining fertility price

makes an excessive amount of sense to maintain on the books.

In concept that is no brainer. The appropriate loves decrease taxes. The Left loves a social program. The Joint Committee on Taxation (JCT) estimates that the entire price of constructing the 2021 growth everlasting is $105.1 billion per yr.

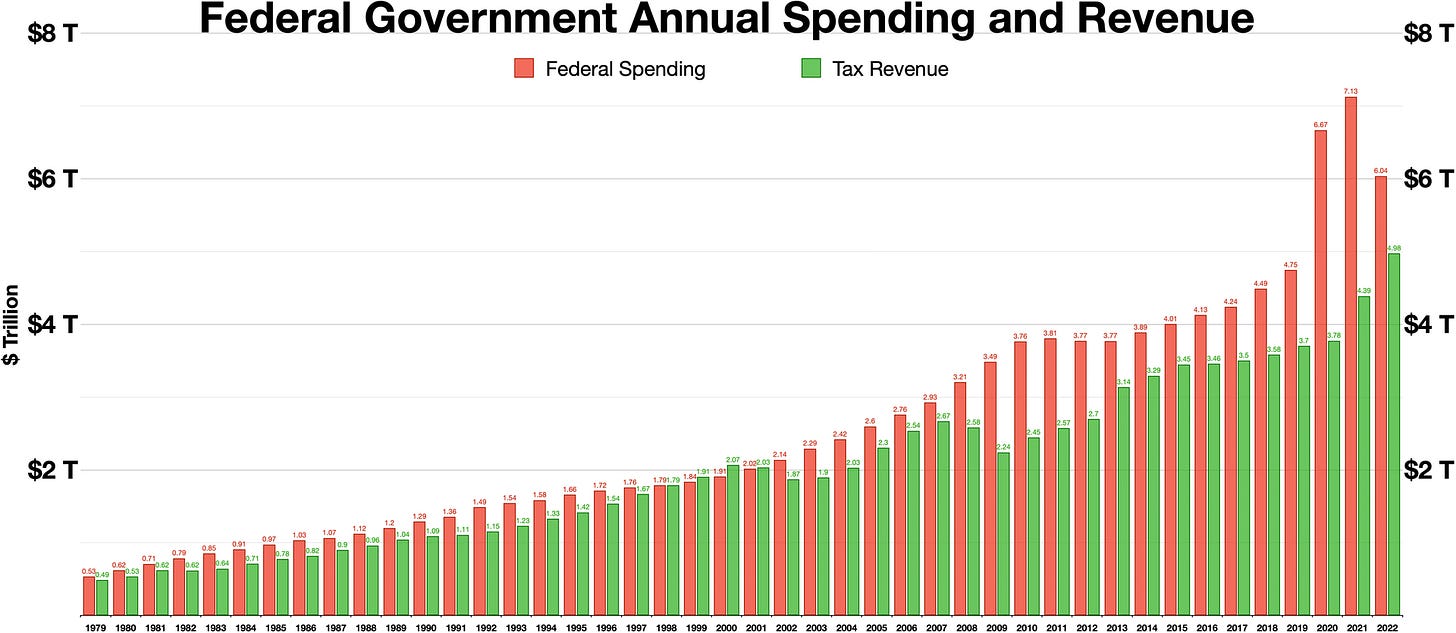

For some factors of references on what $105.1 Billion is to the U.S. Govt’s price range,

-

The federal government spent $6 trillion in 2022 making this only a 1.75% enhance in whole spending per yr

-

It spent $1.6 trillion or 26.6% of its price range on social safety in 2022 (type of the other of supporting kids)

-

We’ve accepted $170 billion for Ukraine to struggle Russia since 2022

-

With the cash being despatched on to households, different applications like SNAP (meals stamps) and subsided college lunches would seemingly see some financial savings

So who ever will get into workplace subsequent yr, let’s get it performed!

Dads – use the identical persuasion you apply to your spouse on Saturday nights. She, like Congress, most likely isn’t within the temper however that by no means stopped you earlier than. Quickly you may not have the ability to write off the mistak—-I imply, loves of your life.

Taken with being on the Dealer Dads Podcast in 2024? Shoot me an e mail! I’d like to have subscribers on to sit down for a dialogue

Ideas? Questions? Feedback?

Attain out! Perhaps I’ll do a full publish on the subject or as a Q&A

traderdads@substack.com

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)