- Toncoin confirmed indicators of being overvalued on the charts

- Medium-term holders have been promoting the token after the failed breakout previous $6

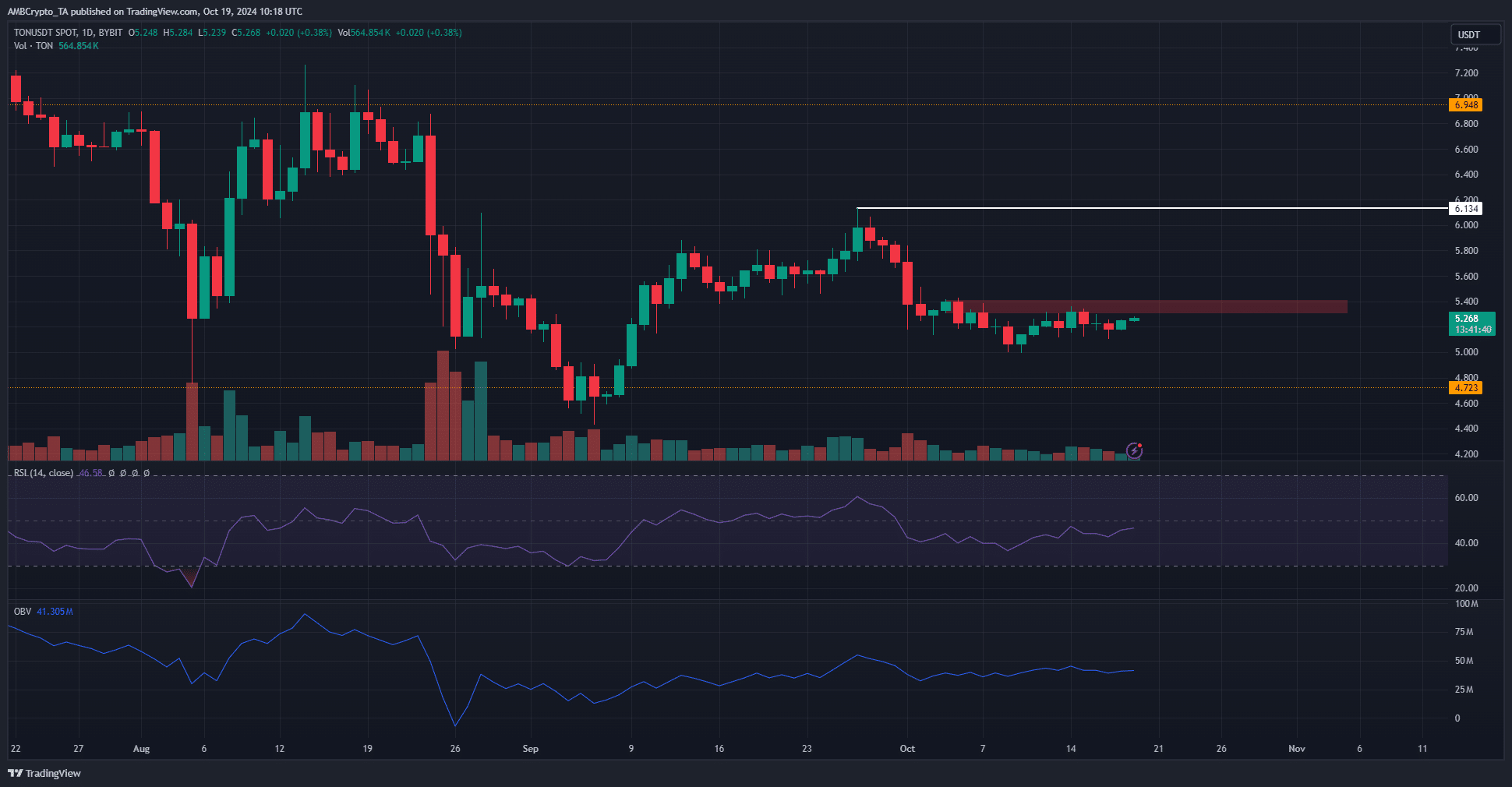

Toncoin [TON], at press time, was down by near 14% from the excessive it made in late September – $6.13. That’s not all although because the market construction of the Tenth-ranked crypto asset by market cap was bearish on the each day timeframe too.

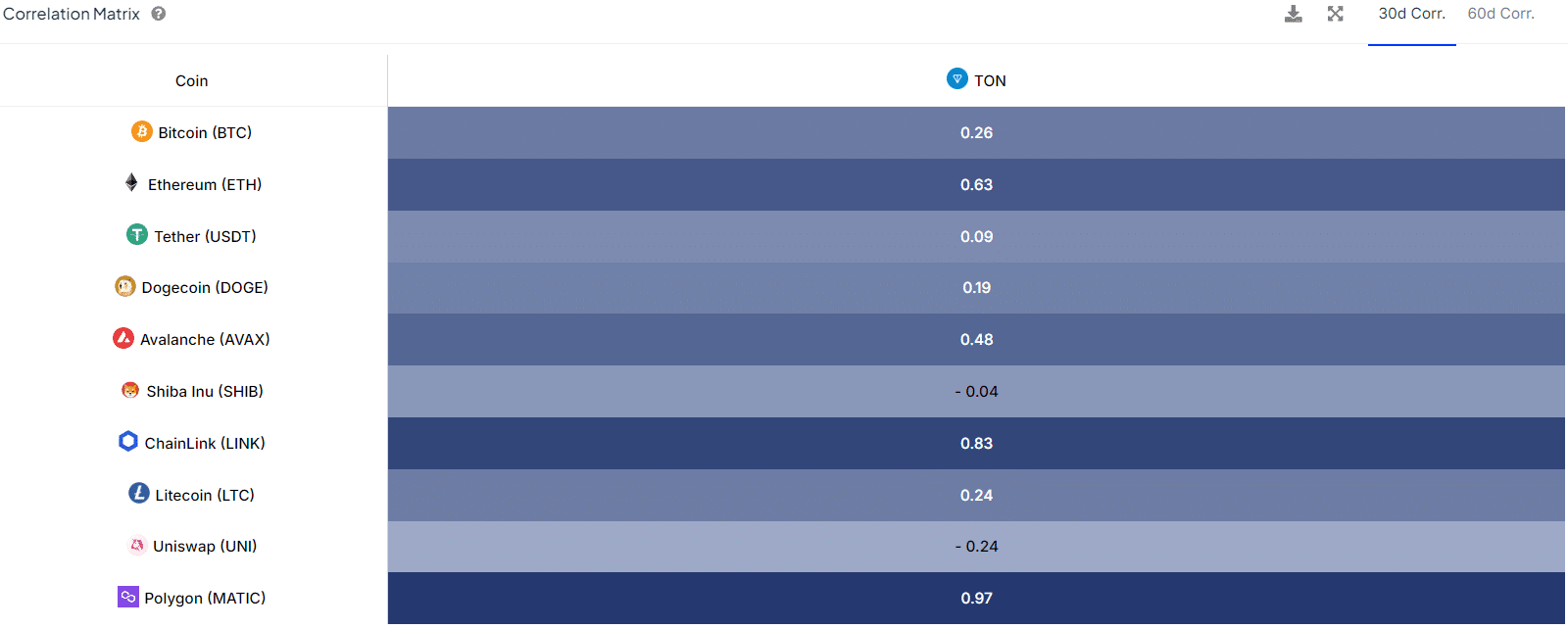

The correlation matrix additionally highlighted the latest underperformance of Toncoin. For example – Over the previous month, it has had a +0.26 correlation with Bitcoin [BTC], with the latter rallying by 10.5% over the identical interval.

To evaluate this additional, AMBCrypto investigated different metrics to grasp TON’s possibilities of taking part in catch-up.

Proof for accumulation in latest weeks

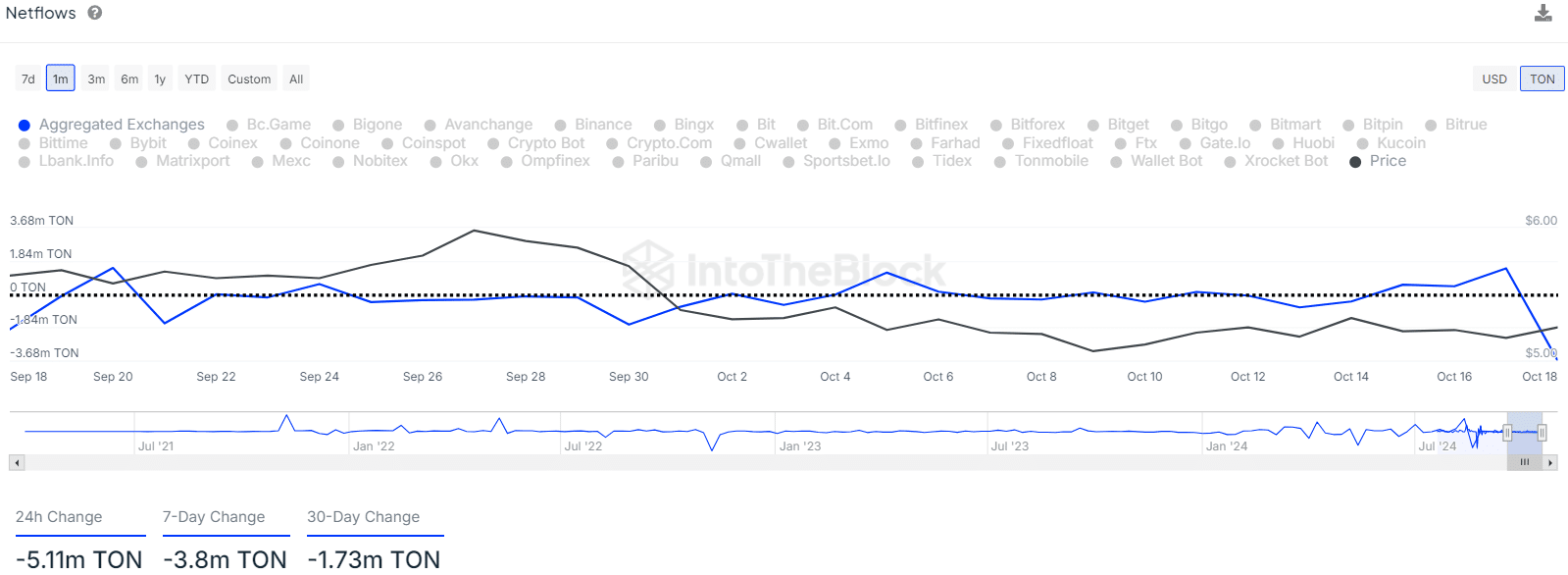

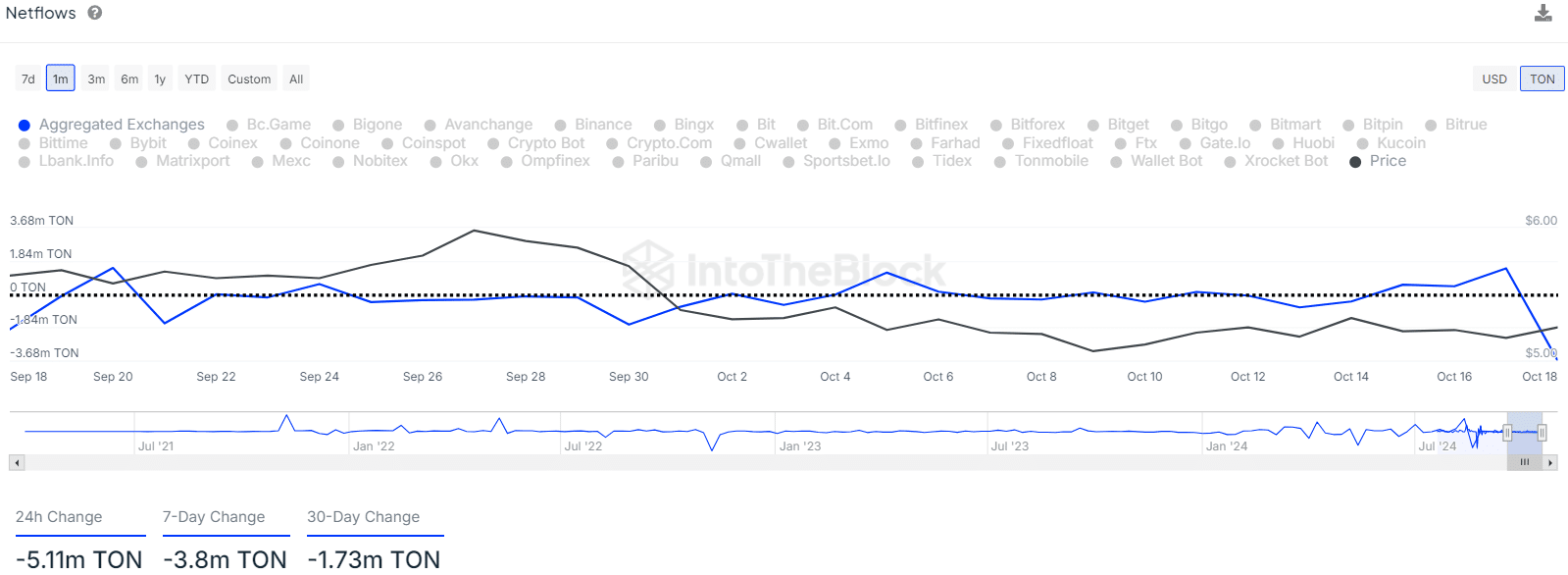

Supply: IntoTheBlock

The netflows from exchanges confirmed that 5.11 million TON had been transferred out of exchanges within the final 24 hours. This was a bullish signal because it advised accumulation. Prior to now 30 days, the netflows had a determine of -1.73 million TON.

Merely put, the previous 24 hours’ development hasn’t been the identical because the development seen over the month. Some promoting stress and token inflows had been noticed earlier this week too.

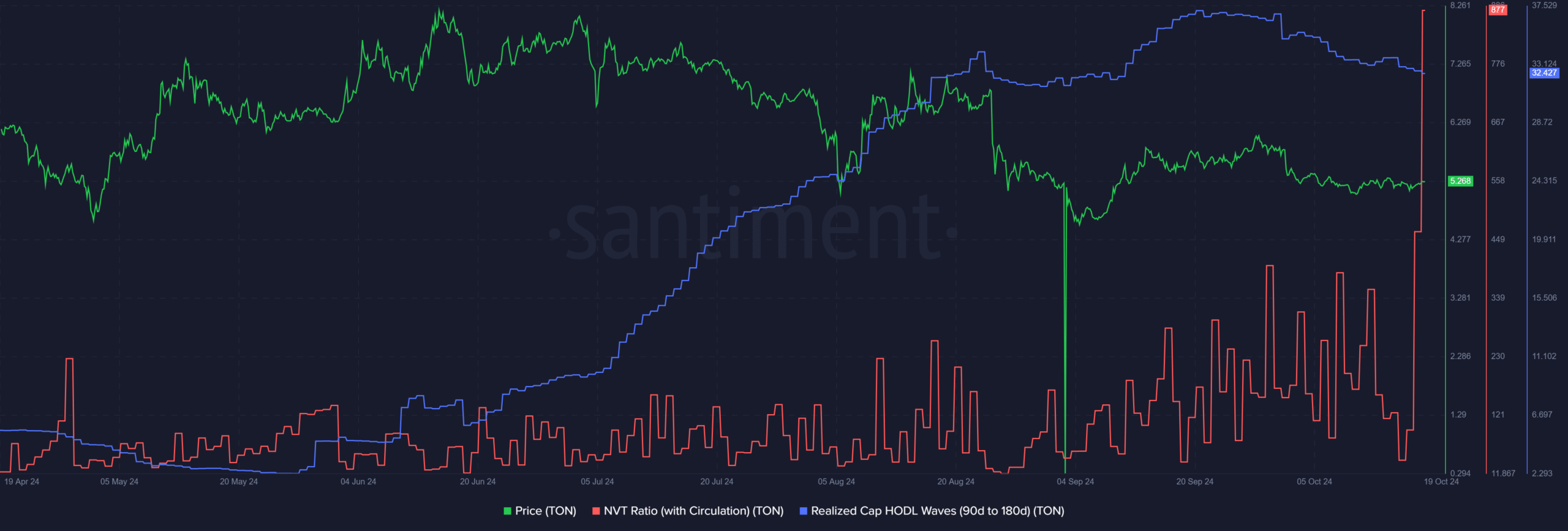

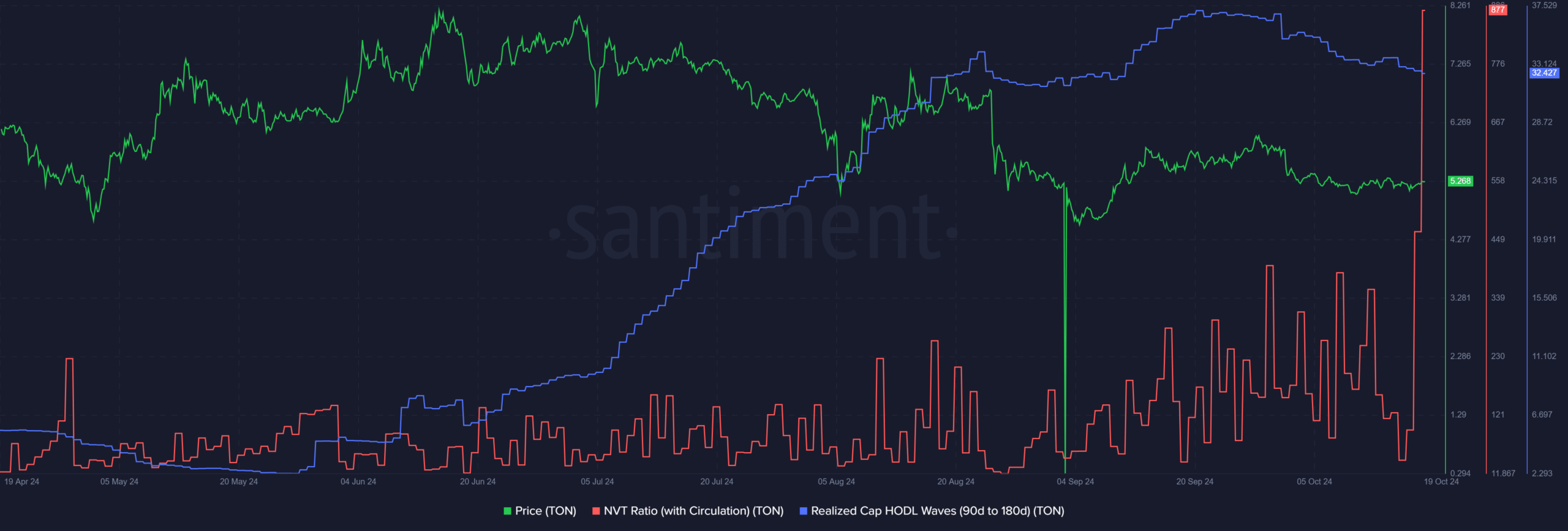

Supply: Santiment

The Community Worth to Transaction (NVT) Ratio, calculated utilizing the each day circulation, has trended increased since September too. The excessive NVT meant that the market cap of the asset was excessive in comparison with the tokens transacted – An indication that the asset could also be seemingly overvalued.

The realized cap HODL waves (90-180 days) started to fall over the past three weeks too. This implied that cash held for 90-180 days had been spent or moved – A sign of distribution. This might have an effect on the possibilities of a rally on the charts.

Value motion clues for merchants and buyers

Each the HODL waves knowledge and rising NVT had bearish on-chain findings. The each day value chart additionally had a bearish outlook. The newest vital excessive was at $6.13, which TON must surpass to determine a brand new uptrend.

Learn Toncoin’s [TON] Value Prediction 2024-25

The OBV and the RSI indicated lackluster demand and impartial momentum, respectively.

With a resistance zone overhead at $5.4 from the bearish order block, TON bulls must band collectively and assault or danger being left behind whereas BTC rallies.

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)