It is a new sequence known as Portait of a Dealer. The primary one among this sequence is about my good good friend at MBC Securities, Clockwork, who began with me within the coaching class of summer season 2011. It is going to reference a variety of what occurred in Prop Dealer Collection, which I counsel studying first, though I do attempt reference something related. Extra writer’s notes within the footnote:

Portrait of a Dealer as a Younger Man

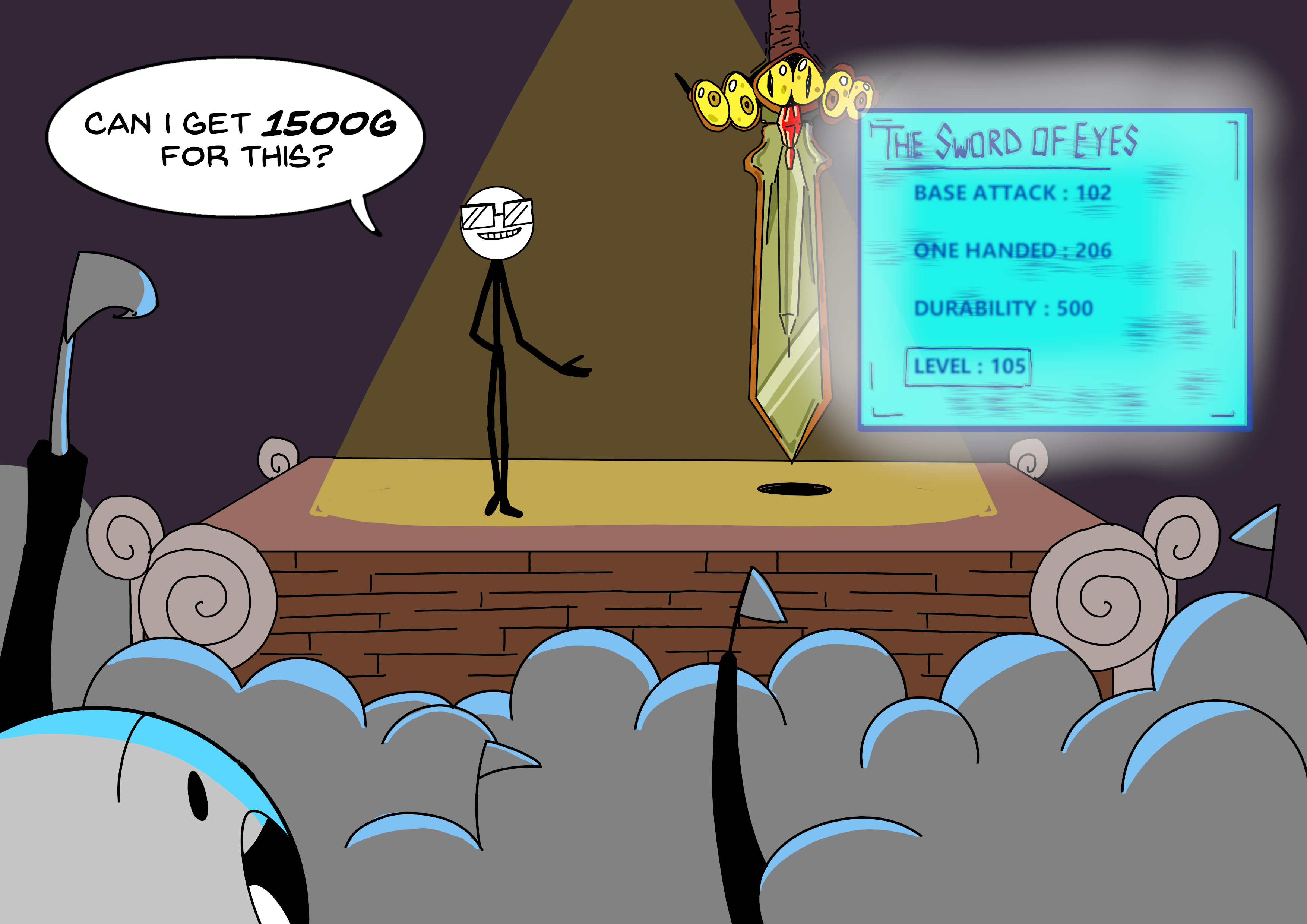

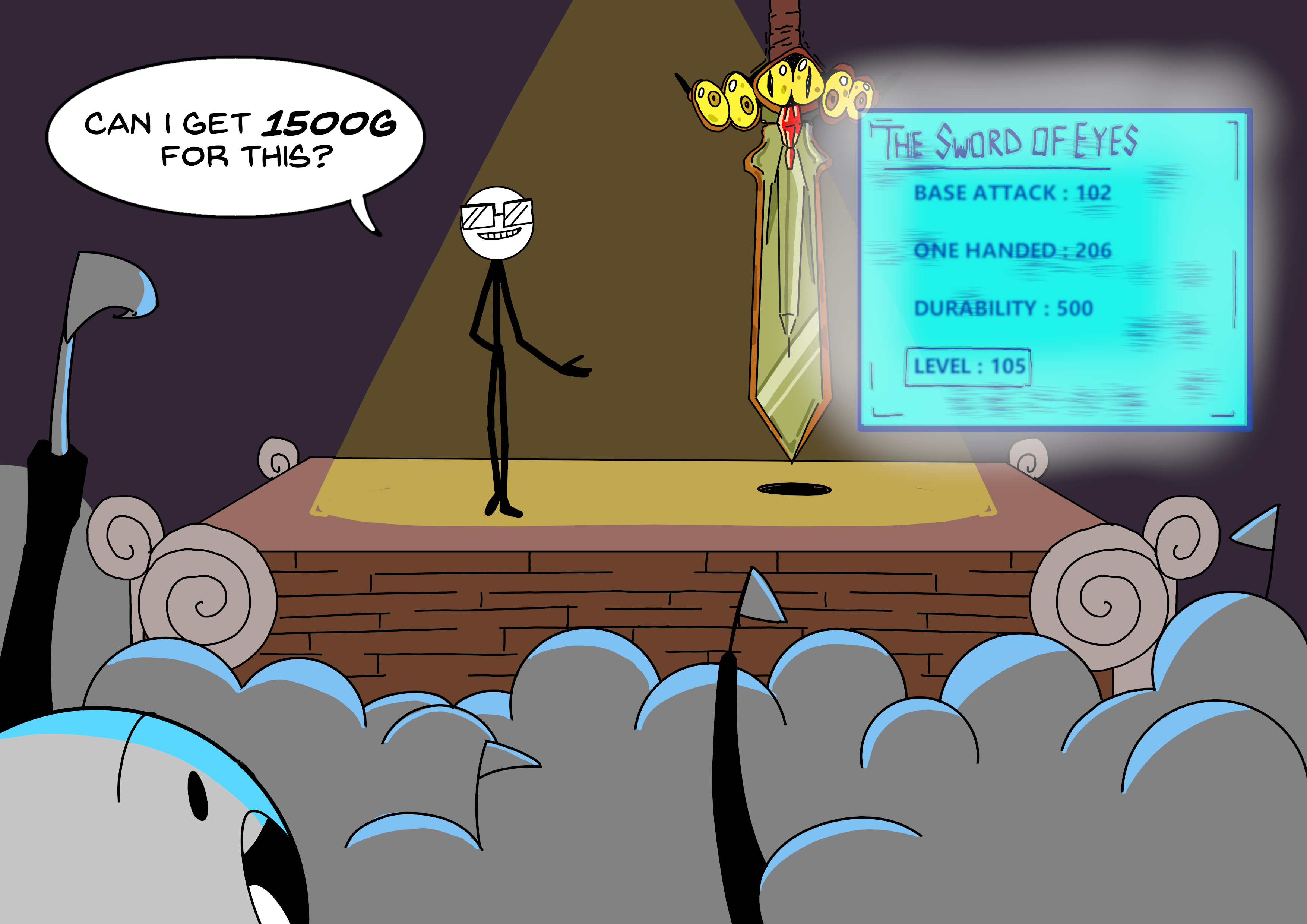

Rising up, Stephen appreciated to play multiplayer on-line position taking part in video games (MMORPGs). He loved immersing himself in a digital ecosystem the place he may work together with different gamers all world wide. Stephen had advanced previous the purpose of feeling satisfaction from the “regular approach” to get pleasure from video games, which was to defeat bosses and full quests. He as a substitute discovered himself hooked on the financial subset of the sport–that’s to say, he appreciated to farm gadgets after which commerce them on the net market or on Ebay.

So Stephen would grind away for gadgets all evening lengthy and this took a variety of time away from learning for college. His dad and mom had been your typical straight-laced Asian dad and mom who emigrated from Taiwan in 2006. They needed Stephen to go to highschool, work onerous, and turn into a pharmacist. So naturally, they instructed him to cease gaming a lot and get again to the books. So now he can’t discover as a lot time for gaming however he nonetheless needed to make some coin. So he determined… let’s simply skip the hours of laborious in-game farming and simply dive straight to {the marketplace} itself. He shifted his method: simply scoop up gadgets already farmed by another person at low cost costs when there was an excessive amount of stock. Hold hand-written notes on merchandise gross sales to look at traits. Then flip the merchandise for larger costs when provide dries up. He ended up tripling his small checking account on the time by simply rapidly flipping gadgets as a intermediary. Early on we are able to see Stephen didn’t wish to pursue conventional professions, he needed to be available in the market–shopping for low and promoting excessive.

In a while Stephen would attend UC Berkeley as an economics main. With newfound independence residing in faculty dorms, he once more discovered himself spending approach an excessive amount of gaming. This time, he was into Dota–the favored Warcraft III customized mod that might later ignite a decade-long frenzy into MOBA video games. There was no financial facet to Dota, he moreso loved the competitors of sooner, extra direct team-vs-team gameplay. His grades had been mediocre and he didn’t actually assume a lot about life after commencement. He had a obscure concept that he would simply comply with what different econ or enterprise majors pursued–possibly get into banking or attempt to get an MBA. It wasn’t actually motivating till he found the inventory market. In his third 12 months, Stephen met a household good friend who had doubled his account by buying and selling choices on triple-levered monetary ETF’s FAZ and FAS, which prompted Stephen to open up his personal retail buying and selling account. After only a quick interval dabbling in choices methods, he knew: that’s what I wish to do after I graduate. He figured that the most effective path to really learn to commerce can be by means of mentorship at knowledgeable buying and selling agency–whichever one would take him. He utilized to all the highest buying and selling corporations, names like Susquehanna, Optiver, Trillium, Jane Road, and First New York. None of them gave him a response.

As a substitute, he solely received accepted by a small equities agency with a middling repute–a agency known as MBC Securities. Not solely would this third-rate agency not pay him any wage, they had been really going to *cost him* cash for taking the place. They known as it a tuition price for educating him the best way to commerce and for Stephen, mentioned tuition price can be $6,000. He omitted this truth to his dad and mom and tried to legitimize it by calling it a “Wall Road dealer” job. Although this place appeared suspect, his selection was both MBC or a number of the conventional finance jobs he utilized to as a backup. He had one supply from Charles Schwab to do commerical banking in Jackson, Mississippi for a $40,000 annual wage. Eh.

There aren’t any Asians in Mississippi. I’m not going there. New York is my dream. I’m simply going to go for it.

Portrait of a Dealer as a Rookie

Within the spring of 2011, I crossed paths with Stephen on-line whereas taking part in Dota purely by likelihood. Initially, it wasn’t me however my cousin who teamed up with him in a randomly generated match. They saved profitable and saved taking part in collectively, in order that they added one another as chat buddies. As they bonded over Dota, being each fourth-year faculty college students, additionally they mentioned their post-graduation futures. Stephen talked about his intention to begin buying and selling at MBC Securities—the identical agency I used to be headed to, a truth my cousin knew. Subsequently, my cousin launched me to Stephen, making him the primary individual from our coaching class that I met. The moniker I bestowed upon him within the Prop Dealer Collection is a nod to this encounter—Clockwork, impressed by a playable hero in Dota. The nickname additionally aptly describes his outstanding buying and selling consistency–which you’ll quickly examine.

Three months later, Clockwork has transitioned right into a CBOE-registered MBC/Y5 dealer on a bustling New York Metropolis buying and selling ground. The primary month is all in regards to the coaching program and the demo. It’s about ingratiating oneself into MBC’s agency tradition–work onerous, learn to commerce responsibly, do your job and get into good trades. Victor, MBC’s managing associate, units the expectation that we needs to be worthwhile merchants inside 3 years. However Clockwork has payments to pay and restricted help and a uncooked starvation to win straight away. He desires to be worthwhile as quickly doable. He makes a behavior to ask inquiries to everybody he perceives to be extra knowledgable about markets. Our head dealer Tuco. Our ground supervisor, CJ. After which me as a result of I sat subsequent to him.

One of many first belongings you discover about Clockwork is his response velocity, honed from years of gaming. Within the coaching program, we might be taught a easy scalp known as the “Mush” commerce. The commerce is fairly easy, there’s a giant order at a complete quantity degree on a inventory–say $5.00. As the massive order at 5.00 will get eaten up and quantity will increase, the dealer makes an attempt to snipe the previous couple of remaining shares earlier than the order is gone and the inventory ticks by means of the extent. The algo will probably elevate the bid a number of cents larger over the entire and you’ll promote into the power. It’s an especially low threat commerce. Timing is essential–too early and also you’re caught with a place earlier than any momentum happens and should need to hit out, too late and also you’re consuming the slippage and getting a worth above the entire. By 2011, this commerce was much less about earning money and extra about understanding the mechanics of studying order stream after which reacting to it. Clockwork rapidly developed glorious timing and beloved to mush shares. He took satisfaction in making 5 cents in 5 seconds. It was frequent apply for him to kind by means of 100 inventory symbols on the extent II in the course of a day to seek out Mush commerce alternatives.

Everybody available in the market has a facet of the market that that feels innately related to them. Some folks like to research information. Some like elementary analysis. Some folks wish to chart. They draw their trendlines and overlay all their transferring averages and indicators into the charting interface. Scoot Brownler, the umbrella buying and selling agency’s chief technical officer, would get up at 6:30am every single day and begin ripping by means of charts. You may inform that he loves that facet of being a dealer. Clockwork? He beloved to commerce–that means, he likes to push buttons to get out and in. He would normally commerce all day from open to shut, outpacing the whole coaching class in complete shares traded and most inventory symbols traded. If he was down $100, he’d chip away with $20-30 features to get again to even, after which get to gross optimistic. For him, being crimson on the day was simply a possibility to seek out extra trades to get inexperienced.

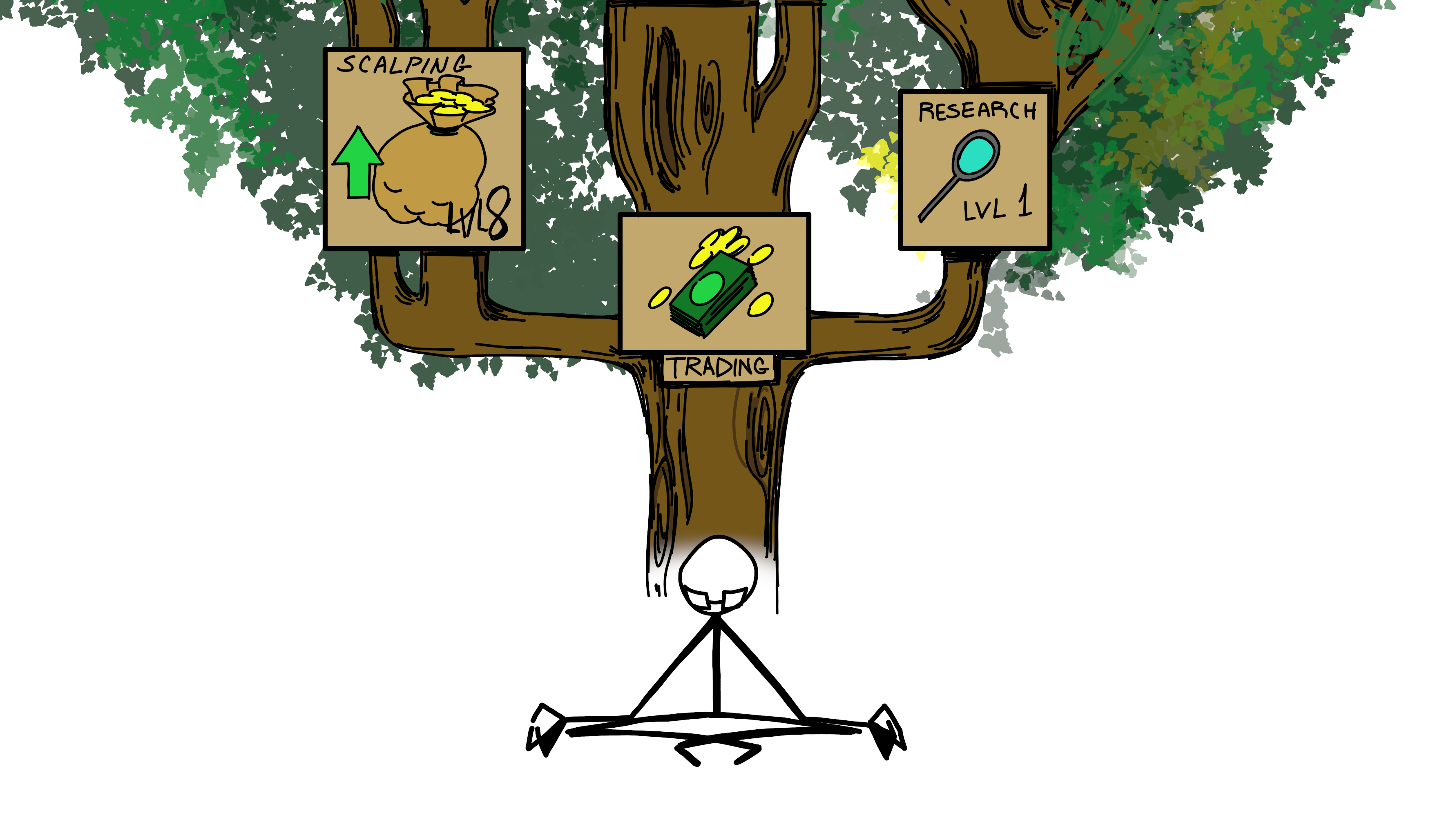

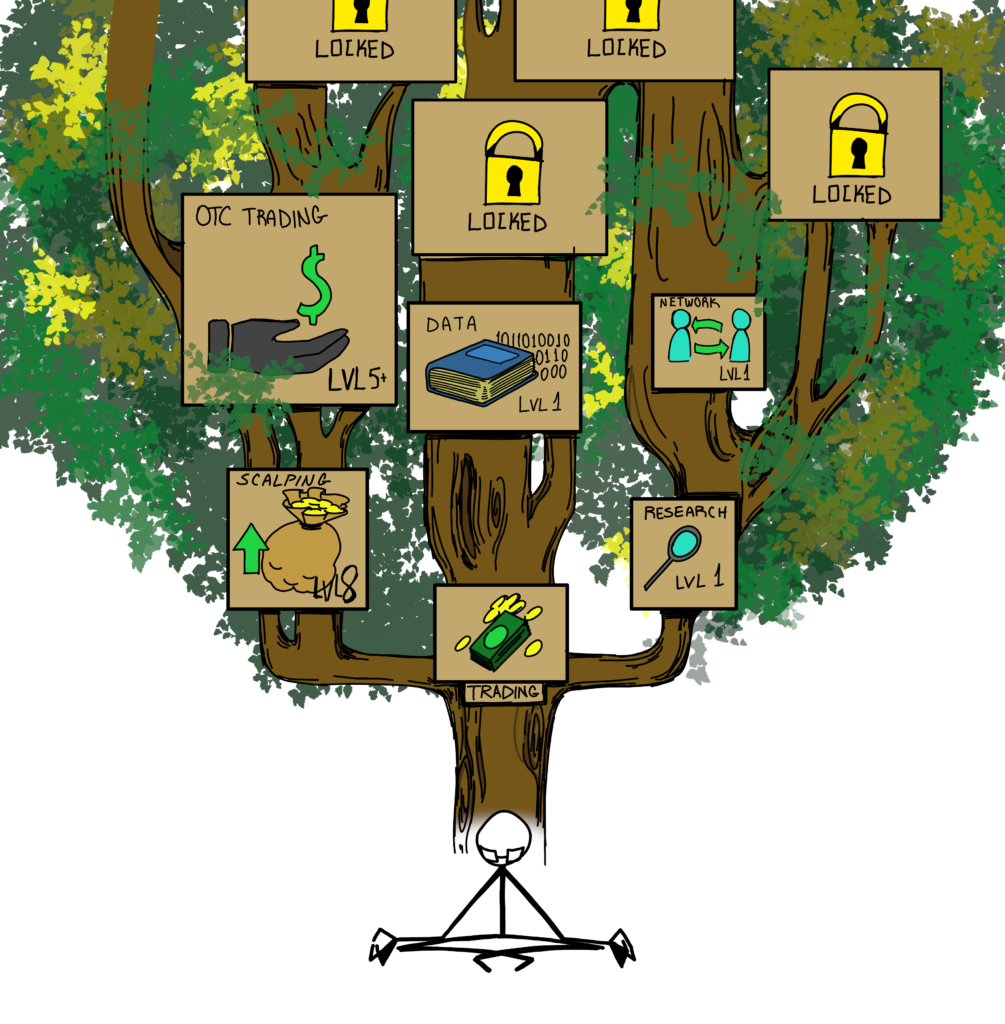

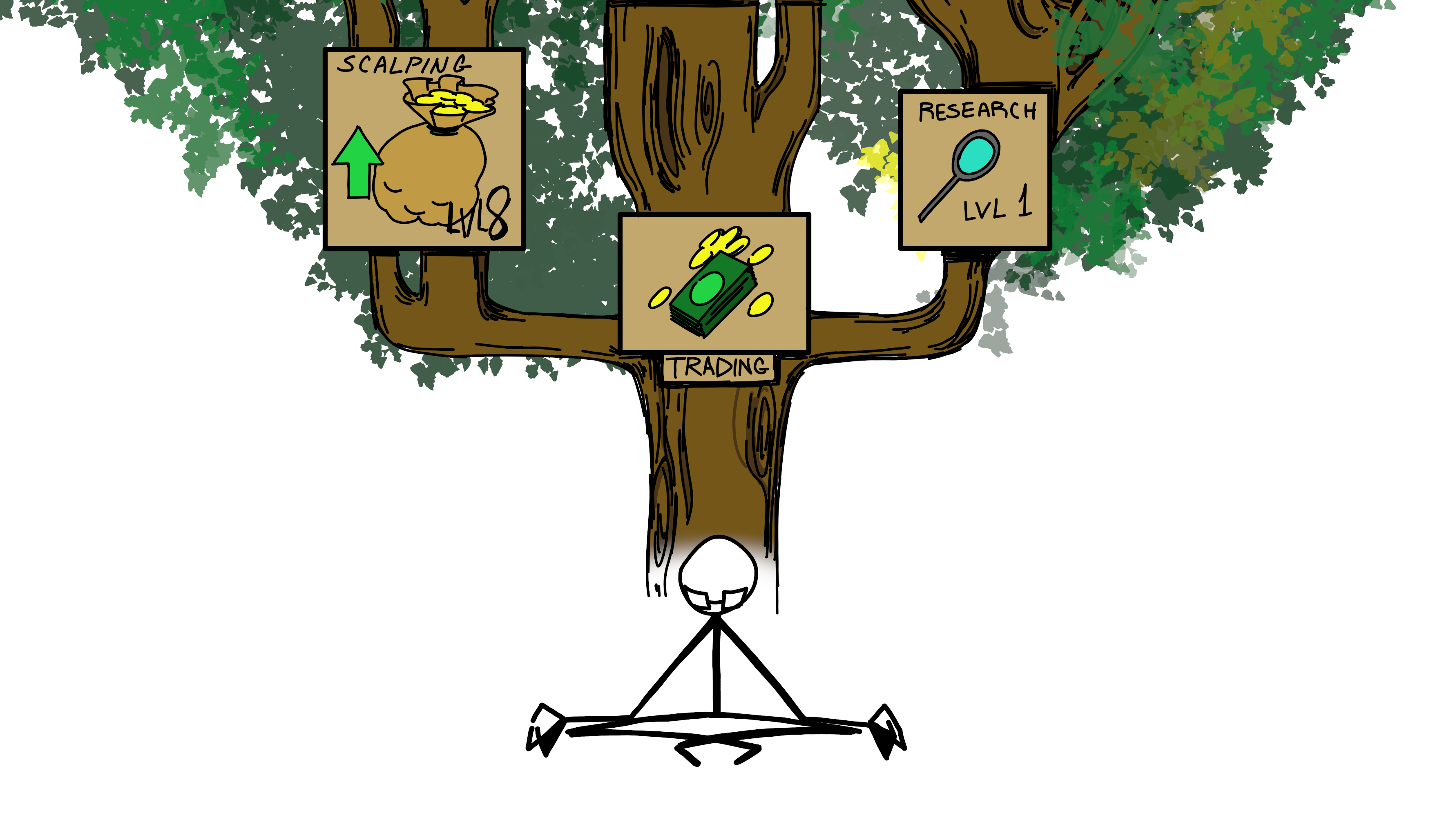

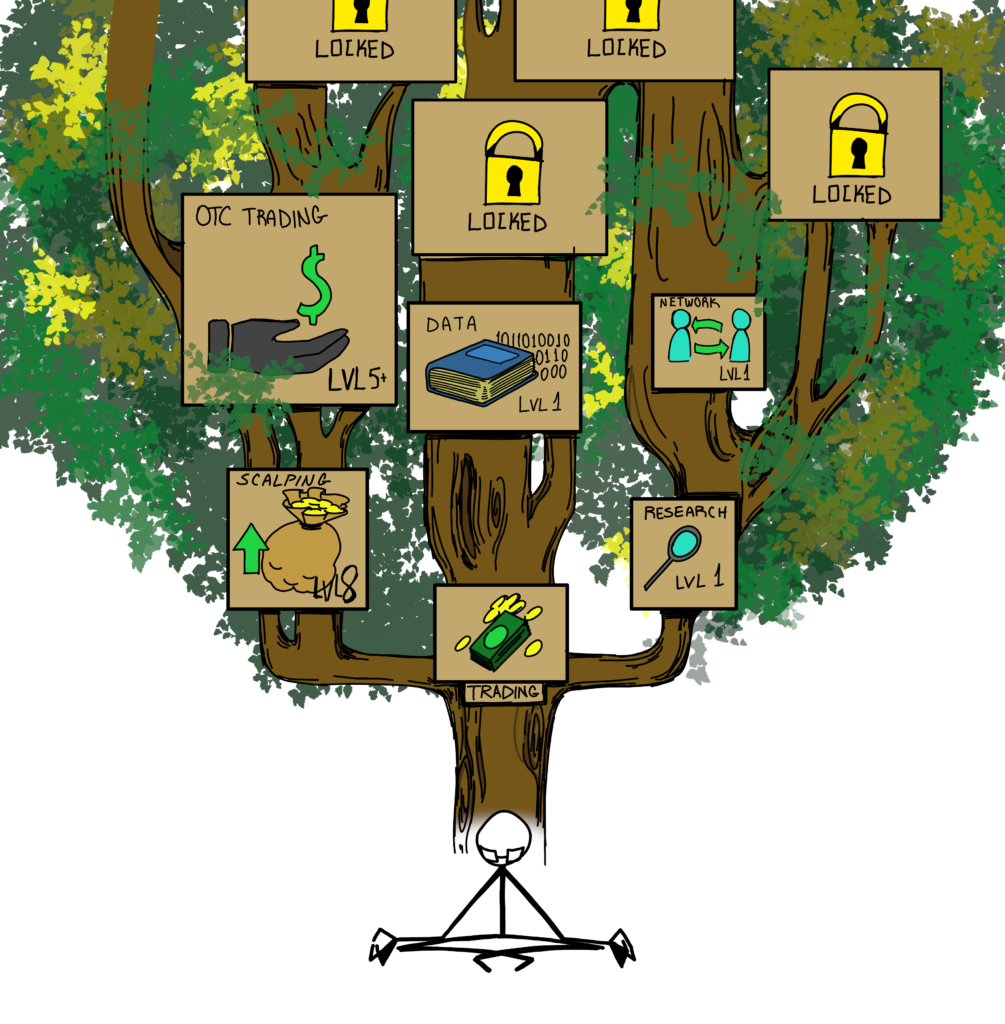

To make an all-too-fitting analogy, honing oneself as a dealer kind of resembles the early levels of character constructing in an MMORPG. You’ve got a finite quantity of ability factors and all these completely different attributes to place all of your factors into. Pushed by a ardour for lively buying and selling, Clockwork invested virtually all his ability factors into scalping.

Portrait of a Dealer as a Marginal Dealer

Frequent state of affairs: a inventory breaks over a key degree or vary and we’re buying and selling it. We all know our entry and we all know our stops, however the fuzzy half is the expectation of the place the inventory will go and whether or not we are able to maintain it to that time.

Clockwork: This inventory could make a brand new excessive as we speak. I simply purchased extra.

He then “mushes” 2000 shares by means of the important thing breakout degree. A couple of minutes later, the inventory retraces again to entry level.

Clockwork: I offered most of it into that push.

Pete: You’re already out?! what occurred to the inventory making a brand new excessive?

Clockwork: 10-cent market, need to promote rapidly. I can rebuy it right here at identical worth now.

Pete: However it’s a worse commerce now. It simply confirmed you that it may’t break from its vary.

Clockwork: Yeah however not earlier than I make one other 10 cents.

That dialog, one which we will need to have had a thousand instances, describes the place we had been at in 2012. We are able to scalp to gather small margins however it may’t scale all that a lot. By 2011, the lively day buying and selling group predominantly centered on this one large query: May day merchants nonetheless make cash scalping towards HFT? Contemplate the timeline of great market construction modifications ranging from 1996, when the SOES bandits made their presence recognized and began the golden age of day buying and selling. In 2001, the NYSE transitions to decimal pricing, then in 2002, the NASDAQ implements SuperMontage, adopted by NYSE hybridization in 2006. Many of those modifications, one after the other, would part worthwhile scalpers out of the market. By 2011, the rise of HFT had rendered the market remarkably environment friendly on the micro timeframe, diminishing many of the previous dependable performs from the scalper’s bag. Maxing out all of 1’s ability factors into scalping within the 12 months 2012 could not have been the optimum growth plan.

To reply to these modifications, the brand new “meta”at MBC grew to become one thing administration had labeled “Trades2Hold”. As a substitute of scalping 5-10 cents, you’ll goal to trip the whole intraday pattern for a number of factors. However the Trades2Hold fashion was thought-about place buying and selling and Clockwork already put all his ability factors into scalping. Consequently, a problematic behavior had emerged–get used to creating 5-10 cents on a regular basis and that’s all you attempt to make. The breakaway strikes on momentum shares that may make your whole month that you just had been supposed to carry till the shut–he saved lacking out. They’re too unstable. Too spready. Too excessive priced, nominally. Require wider stops. Miss the most effective entry. After which when he was lucky sufficient to get into shares that had breakaway strikes, what occurred then? He offered too early into preliminary power, as a result of that’s what scalpers do. As an observer, I discover it didn’t trouble him an excessive amount of–at the very least on the surface. If I offered what would’ve been a monster achieve approach too early, I’d get mad.

Clockwork–properly, he accepted who he was. Whereas many on the desk struggled to attempt to adapt to the brand new Trades2Hold meta, he would principally keep on with his weapons and proceed scalping. He earned a repute on the desk as a cautious dealer (learn: piker), dabbling solely in low margin trades. To the uninitiated, ‘piker’ may sound like a disparaging label meant to mock merchants reluctant to take vital dangers. Nonetheless, Clockwork’s technique was underpinned by a steadfast resolve to complete every buying and selling day in revenue, irrespective of how modest. This disciplined method bore fruit when he celebrated a outstanding streak of 30 out of 30 days within the inexperienced from April to Could 2012. At 4 pm, because the closing bell chimed, he would reliably finish the day with a inexperienced PnL, like clockwork. After accounting for cut up and buying and selling charges (usually much more for top frequency scalpers), the cumulative income amounted to only a few thousand {dollars}, however his means to by no means lose was a testomony to his consistency and willpower.

He had buying and selling expertise. He had prudent threat administration. He had consistency. Victor had been touting him as one of many agency’s finest younger merchants, even dedicating a chapter to him in his newest guide, “The Gameplan”. He was then promoted to Junior Dealer with a better revenue cut up. Regardless of his finest efforts, his general earnings energy was nonetheless removed from having the ability to match even the meager $40,000 wage he may have effortlessly collected as a standard banker in Jackson, Mississippi. He’s simply lacking that one last item… one last item earlier than making the essential leap from subsistence-level marginal dealer to a persistently worthwhile dealer with life-changing earnings potential.

Portrait of a Dealer as a Creating CPT

It’s March of 2013, days earlier than the merger between MBC Securities and Western Buying and selling Group (WTG). Issues weren’t nice. Neither of us had even netted $10,000 within the prior 12 months regardless of buying and selling thousands and thousands of shares every month and spending 8 hours within the workplace every day grinding tape. NYC hire funds begin to eat away at our meager financial savings and disillusionment begins to kick in. The preliminary glamour and promise of being a ‘Wall Road Dealer’ was carrying off rapidly.

We had a dialog about the place we had been at. We had been caught.

Pete: We barely make something by scalping every single day. Have a look at how a lot of our revenue will get eaten up by cut up, fee, desk and information charges, and bullshit like that. We’re going to expire of cash. Can’t hold occurring like this.

Clockwork: We’d be making extra working at McDonald’s then we do buying and selling proper now. That may be very, very unhappy.

Everybody else in our coaching class had now left. On their approach out, a lot of our colleagues harbored a adverse sentiment about their expertise at MBC Securities–it doesn’t appear doable to make actual cash there. Clicking buttons for 5-10 cents at a time…half of it eaten by charges and cut up… it’s not a sustainable enterprise mannequin. The Trades2Hold meta couldn’t discover any footing as no one had developed a dependable technique to seize bigger features. There weren’t any merchants at MBC demonstrating constant profitability past subsistence wage ranges and even the managing companions struggled to make cash. Possibly we received tricked into coming right here by this buying and selling agency that promotes themselves by way of social media and solely makes cash off their schooling income. Clockwork discovered himself at a crossroads. If you’re confronted with the ever looming risk of failure, how do you select to deal with it?

Pete: Let’s simply step up our measurement and both make some huge cash or we blow up. Then we may transfer on. I’ll transfer again to California, I’ll get an actual job or go to regulation faculty.

Clockwork: Haha that’s proper, we both make some huge cash or we go dwelling. No extra of this tough work all day to barely make any cash. I at all times have my supply to be a banker in Jackson, Mississippi.

Generally we deal with humor. We put the fact out within the open–blow up your account and get fired. The “Wall Road Dealer” dream you’ve romanticized since graduating? POOF. It’s gone. You gotta go dwelling. Stay along with your dad and mom. Return to highschool or get an actual job. If Clockwork had a string of unhealthy trades, he’d inform me one thing alongside the strains of…

So we’d giggle it off and hold buying and selling somewhat than dwell on the robust questions. However Clockwork had much more resolve behind all of the goofing round. He despatched an e mail to Victor, after a troublesome day the place he round-tripped what would’ve been his private finest PnL. For an extremely constant scalper, a big spherical journey in PnL is anathema. Don’t let winners flip into losers–that’s the scalper’s creed. On this e-mail, Clockwork selected to replicate on his bigger objectives somewhat than dwell on the day’s PnL.

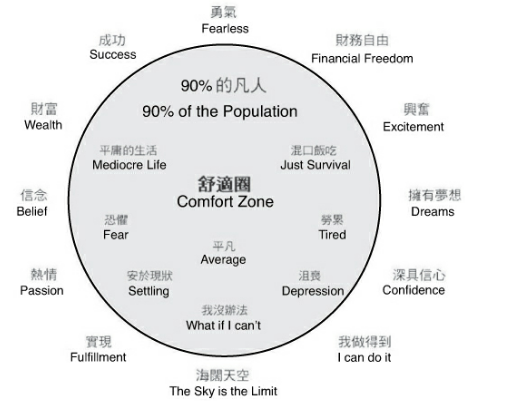

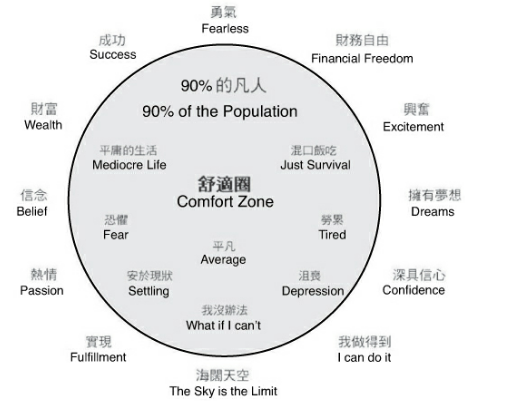

I got here throughout this image whereas shopping on the Web, which I believed was value sharing. As proven on the pie chart, 90 p.c of the inhabitants lives within the Consolation Zone. They're common, residing a mediocre life. They're settling only for survival. They're depressed, drained, fearful, and sometimes ask, “What if I can’t?” These descriptions are spot on. I’m going to be very sincere, I determine myself with a pair descriptions talked about above. Generally I’m fearful. Generally I doubt whether or not I can do it. However in the long run, I managed to remain within the recreation and fought to overcome the most important enemy, myself. So, what do I have to do to get out of the 90 p.c, and turn into the highest 10 p.c? What traits do they possess? They're fearless. They've goals. They're assured, at all times pondering “I can do it.” The sky is their restrict. They've perception and fervour. They search wealth, success, monetary freedom, success, and pleasure. What makes these 10 p.c so particular is that they’re not mentally confined. They give the impression of being to get higher every day. They know they will get a lot better. I’m nonetheless very younger. My precedence needs to be seeking to be taught as a lot as I can, not how a lot I could make within the subsequent week or two. I wouldn’t say I’m presently the ten p.c exterior the 90 p.c now. However I might say that I've improved lots. Evaluating myself with after I began, I've grown to be a greater threat taker. I've strived to step exterior of my consolation zone. I’m not settling like earlier than. I’m extra fearless than earlier than. And I've larger goals than earlier than. But, I nonetheless have lots to enhance and attain. Day by day is a studying day for me. [Clockwork breaks down a trade he made in ADSK for a few paragraphs] I used to be somewhat bit depressed that I gave again my private finest. However truthfully, what's that $250 going to imply to me in my buying and selling profession? I feel I made the suitable selection for not settling. Now I do know I’m able to a brand new private finest. Sooner or later I’m certain that that new private finest will come.

He nonetheless held an optimism that he would make it. Possibly he simply humored me after I felt down.

After the agency’s transition to WTG, Clockwork centered on his major goal: rising his threat tolerance. He approached this purpose with warning, avoiding the temptation to indiscriminately make ‘YOLO bets’ on each single play. As a substitute, he adopted a methodical method, anchored in two elementary practices:

1. Meticulously journaling and reviewing every commerce, aiming to outline the core components of his finest trades

2. Evaluating his trades primarily based on the insights gleaned from these critiques, and adjusting his measurement accordingly—allocating extra to the highest-rated (A) trades, whereas being extra conservative with B and C graded trades

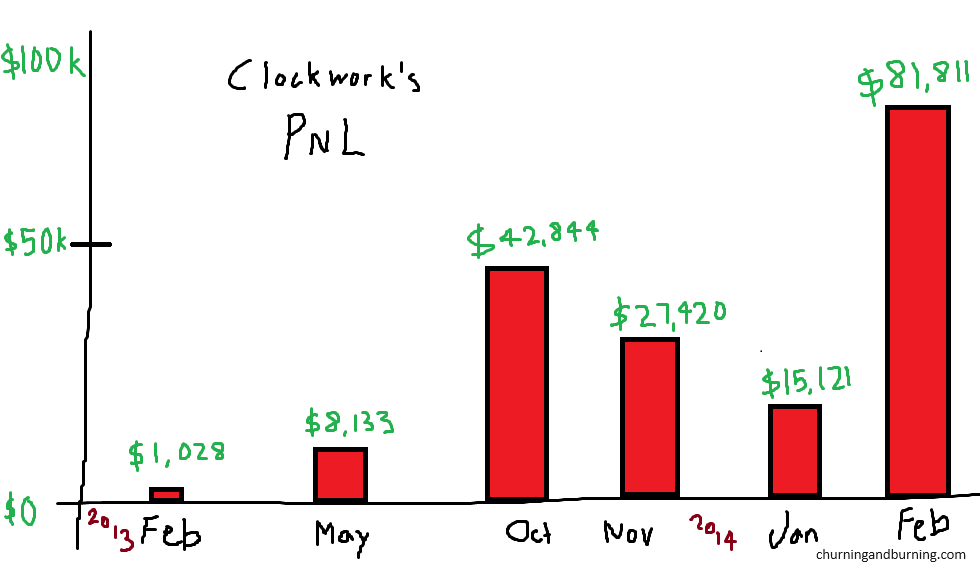

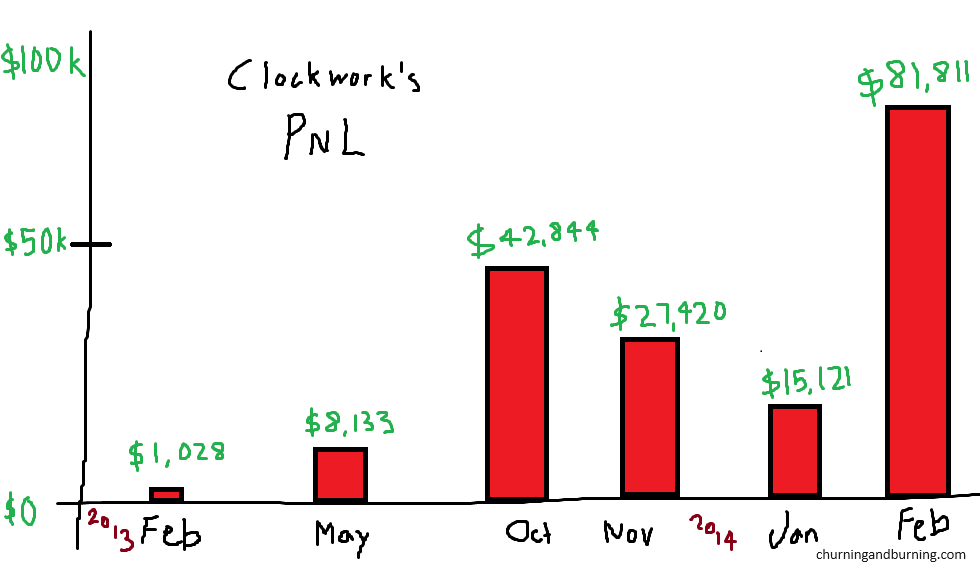

Clockwork’s playbook was principally centered on scalping for vary breaks the place he may commerce within the route of the preliminary momentum and use tight stops. Nonetheless, he step by step refined his inventory choice standards, figuring out the shared traits of the most effective vary break performs. Eradicate illiquid crap. Discover shares that transfer. Attempt to add to winners after which maintain onto them somewhat longer than he was comfy with. His easy method bore fruit in Could 2013 when Clockwork achieved the best month-to-month PnL amongst all MBC Junior Merchants, incomes $8,133. This enchancment bolstered his conviction that reaching six-figure features was not a matter of if, however when.

His secondary purpose was to increase his playbook with completely different methods. His answer was to easily emulate different worthwhile merchants by figuring out their finest methods by way of the WTG linked blotter system. This trait—eschewing the have to be the solitary genius in favor of embracing and appreciating efficient methods from others—is invaluable for any dealer. Our mutual good friend Tommy would usually stroll by Clockwork’s station to take a look at all his positions, after which comment “you’re like a spider with a finger in each pie.” It was quite common to placed on a brand new place after which seconds later you’d see Clockwork mirroring the commerce.

Jimmy discovered a spread break play? He’s in. Eagle’s shorting AAPL? He’s in. Riggs is buying and selling the Russell rebalance? He’s in. Mr. West doubles down on a plummeting inventory, taking a ton of ache? Effectively, he could not dive in headfirst, however he retains a eager eye on the inventory, ready for a possible setup to purchase it safely.

The dealer he copied essentially the most? Clearly it might be the dealer sitting immediately subsequent to him.

I made the Fannie Mae commerce and that modified every part. MBC Securities was going to present merchants entry to commerce OTCBB shares for the primary time. Clockwork noticed how a lot cash I made in a day and he knew… he’s gotta get into that shit straight away. That’s the factor that may make him a bonafide CPT.

If PTO could make that sort of cash, I do know I could make it too.

Clockwork will get entry to the OTC platform beginning in August. OTC buying and selling is a good match for him as a result of there aren’t any HFTs. He doesn’t have to remodel his mindset and go towards his pure tendencies. He will get to be himself–click on buttons, scalp speedy strikes in each instructions, and rack up instantaneous income as if it’s all only a online game. Better of all, he has the right mentor for this technique. So Clockwork empties all his remaining ability factors into OTC buying and selling after which he prays that there are nonetheless sufficient alternatives within the 12 months for him to take benefit.

From August ahead, every single day between us includes speaking store in regards to the mechanics of buying and selling these OTC penny shares. On one inventory, we are going to discover quantity has elevated and there’s order stream coming in and we all know it’s time to commerce extra continuously. Generally we discover it’s uneven and there’s a looser unfold so higher to attend. We discuss our fills on ECNs vs. market maker routes. We discuss what hits the scanner and what sectors are scorching. On the massive days the place we play essentially the most unstable strikes, we discuss by means of how the tape slows down so we all know when to promote and lock in features. Retail merchants commerce these OTC names and so they have ideas about the place their shares will go of their most optimistic eventualities–FNMA may go to $25 if the Treasury lets them earn! Blah blah blah–they’ll spam it throughout social media. If you commerce actively for a residing, you may’t depend on that dreamland final result to hit. It’s day-to-day and the main target is on all of the little issues. Clockwork’s now centered on tape-reading performs on unstable OTC names which might be up/down 40-100% intraday, the place he can scalp enormous strikes with good timing and execution.

After a pair tune-up months, Clockwork finds his footing buying and selling liquid OTC names like FNMA and AAMRQ in October. He ends the month with a private file PnL of $42,844–sufficient to crack the WTG top-10 for the primary time in his profession. He closes the 12 months robust with further 5-figure months in November and December, ending the 2013 calendar 12 months with $118,415. That’s ok for second place amongst all MBC merchants.

He’s excited. That is what he’s been ready for–an precise worthwhile scalping technique in the suitable market, the place one accumulate 5-6 determine months without having to take ache. It was only the start.

Portrait of a Dealer as a Breakthrough CPT

In 2014, the Pot Shares grew to become en vogue and the OTC craze reached a peak on the MBC Securities desk. Penny shares would commerce from a number of cents to a couple {dollars} and supply superb alternatives for expert merchants. Quantity surged and spreads tightened, an important recipe for OTC scalpers. Clockwork would commerce out and in of those shares all day, racking up thousands and thousands of shares for the month. At one level, his speedy scalping grew to become so efficient that the market makers threatened to deactivate OTC routing for the whole agency. They known as it ‘poisonous order stream’ and there was a complete ordeal about agreeing to sure stipulations on canceling orders. They’re simply mad he’s taking their cash. He completed the February 2014 with one other private file, tallying $81,811 in a month.

From making a $1000 in a month to creating $81,811 in a month over the course of a 12 months. Bonanza! He’s an authorized CPT now. The very best is but to return.

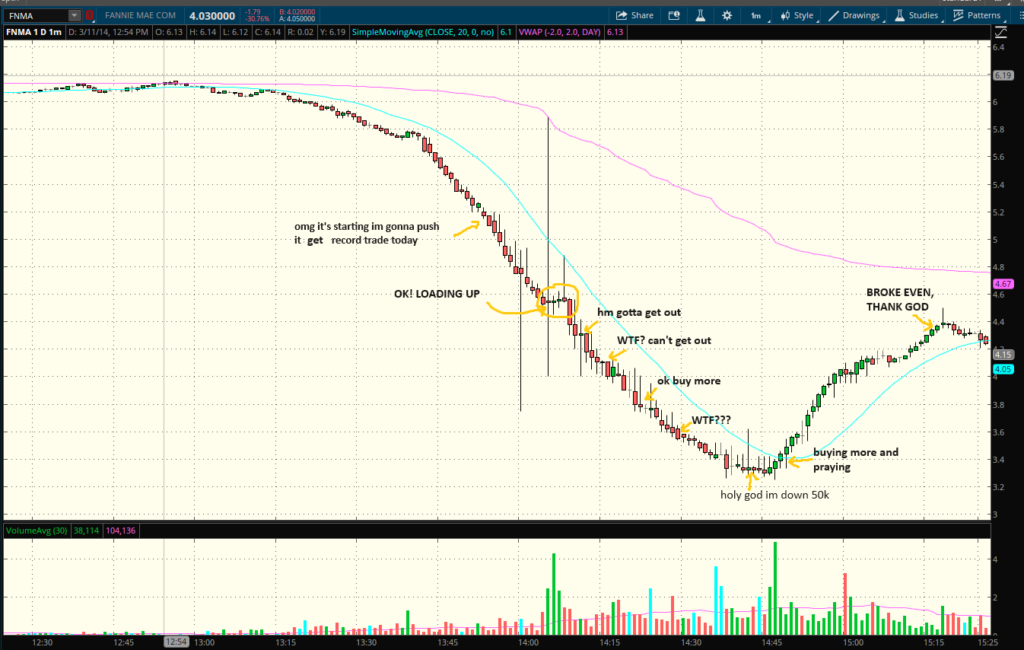

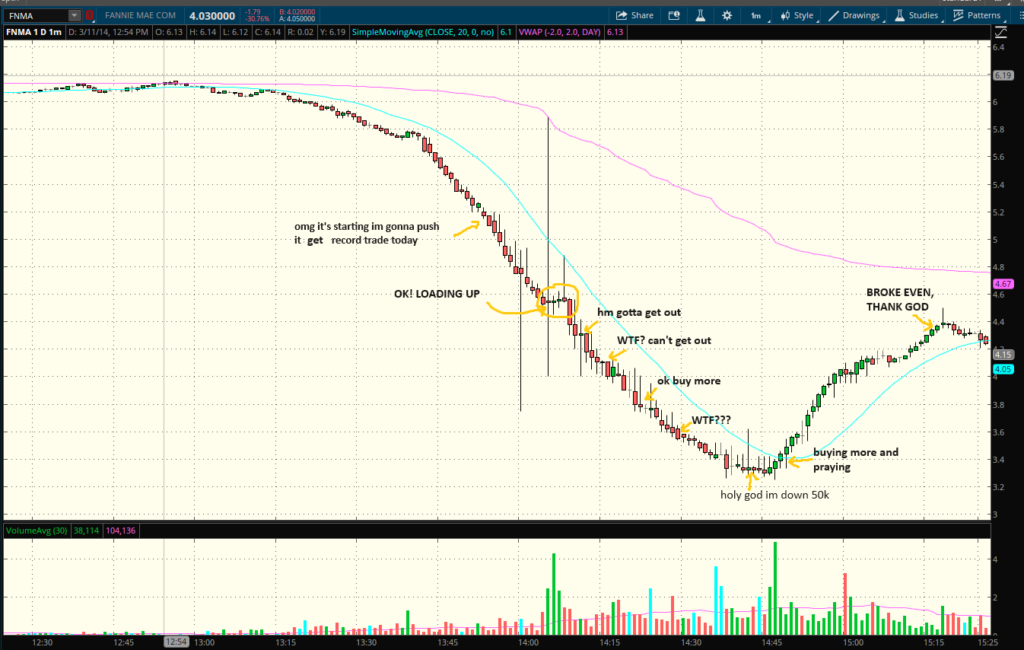

The highest buying and selling inventory for the corporate to date, FNMA, was gearing up for one more vital surge in March 2014. Clockwork had already reaped over $70,000 in income from buying and selling this inventory, but he felt like he had barely scratched the floor. There hadn’t even been an enormous A+ bounce setup but, akin to the one the place his good friend Pete raked in $33,000 final 12 months. That was, till now, with FNMA on one other frenzied runup from $1 to $6, fueled by main hedge funds like Pershing Sq. and Fairholme. Now he was readying himself for what he thinks can be an enormous commerce.

On March eleventh, FNMA begins to waterfall underneath $6. Clockwork makes his first entry when the primary bid soaks at 4.50. He’s loading up but it surely looks as if he’s getting crammed approach too rapidly. One thing feels off. The bid drops and he tries to hit out however he can’t. There’s a brand new wrinkle within the FNMA algo’s that’s throwing off all of the scalpers who had beforehand crushed the inventory–as soon as the bid fails to carry, the ARCA ask cuts beneath the bid by 10 cents and shuts everybody out from speedy fills. Now everybody’s jammed up and making an attempt to get out on the identical time. Clockwork’s unable to get out and taking surprising drawdown. He decides to do one thing he’s by no means carried out earlier than: maintain the bag and add to his shedding place. However the inventory continues to blow by means of each held bid try and this simply exacerbates his ache. His unrealized loss reaches -$50,000–as soon as an unthinkable quantity for essentially the most constant winner on the agency. Lastly round $3.20, there’s some stabilization. He buys the final bit he can muster, the inventory lastly turns, and he rides the bounce again to interrupt even. Catastrophe averted.

A couple of minutes after the shut, he tells his buying and selling buds that he drew down $50,000!!!! and that he felt he’d have a coronary heart assault any second!!! and that not having the ability to hit out of a inventory once you wish to is tremendous fucking scary!!! He desires to emphasise simply how traumatic it was for him. A second after that, Victor summons Pete to this workplace. Clockwork has the sense that Pete misplaced fairly a bit of cash on this FNMA commerce however he doesn’t know the way a lot.

The subsequent day, he’s simply sitting alone with unmanned buying and selling rigs to his left and proper. Seems he’s now the final dealer remaining from MBC’s summer season 2011 coaching class. He’s curious how a lot Pete misplaced however he’s too afraid to ask. He decides the most effective plan of action is to only not point out it and transfer ahead. He sends a gchat:

Hey P-To what shares are you as we speak?

(To be continued in Half 2–the following 10 years of Clockwork’s adventures in low float shares, volatility halts, covid markets, and different prop buying and selling bullshit.)

It is a new sequence known as Portait of a Dealer. The primary one among this sequence is about my good good friend at MBC Securities, Clockwork, who began with me within the coaching class of summer season 2011. It is going to reference a variety of what occurred in Prop Dealer Collection, which I counsel studying first, though I do attempt reference something related. Extra writer’s notes within the footnote:

Portrait of a Dealer as a Younger Man

Rising up, Stephen appreciated to play multiplayer on-line position taking part in video games (MMORPGs). He loved immersing himself in a digital ecosystem the place he may work together with different gamers all world wide. Stephen had advanced previous the purpose of feeling satisfaction from the “regular approach” to get pleasure from video games, which was to defeat bosses and full quests. He as a substitute discovered himself hooked on the financial subset of the sport–that’s to say, he appreciated to farm gadgets after which commerce them on the net market or on Ebay.

So Stephen would grind away for gadgets all evening lengthy and this took a variety of time away from learning for college. His dad and mom had been your typical straight-laced Asian dad and mom who emigrated from Taiwan in 2006. They needed Stephen to go to highschool, work onerous, and turn into a pharmacist. So naturally, they instructed him to cease gaming a lot and get again to the books. So now he can’t discover as a lot time for gaming however he nonetheless needed to make some coin. So he determined… let’s simply skip the hours of laborious in-game farming and simply dive straight to {the marketplace} itself. He shifted his method: simply scoop up gadgets already farmed by another person at low cost costs when there was an excessive amount of stock. Hold hand-written notes on merchandise gross sales to look at traits. Then flip the merchandise for larger costs when provide dries up. He ended up tripling his small checking account on the time by simply rapidly flipping gadgets as a intermediary. Early on we are able to see Stephen didn’t wish to pursue conventional professions, he needed to be available in the market–shopping for low and promoting excessive.

In a while Stephen would attend UC Berkeley as an economics main. With newfound independence residing in faculty dorms, he once more discovered himself spending approach an excessive amount of gaming. This time, he was into Dota–the favored Warcraft III customized mod that might later ignite a decade-long frenzy into MOBA video games. There was no financial facet to Dota, he moreso loved the competitors of sooner, extra direct team-vs-team gameplay. His grades had been mediocre and he didn’t actually assume a lot about life after commencement. He had a obscure concept that he would simply comply with what different econ or enterprise majors pursued–possibly get into banking or attempt to get an MBA. It wasn’t actually motivating till he found the inventory market. In his third 12 months, Stephen met a household good friend who had doubled his account by buying and selling choices on triple-levered monetary ETF’s FAZ and FAS, which prompted Stephen to open up his personal retail buying and selling account. After only a quick interval dabbling in choices methods, he knew: that’s what I wish to do after I graduate. He figured that the most effective path to really learn to commerce can be by means of mentorship at knowledgeable buying and selling agency–whichever one would take him. He utilized to all the highest buying and selling corporations, names like Susquehanna, Optiver, Trillium, Jane Road, and First New York. None of them gave him a response.

As a substitute, he solely received accepted by a small equities agency with a middling repute–a agency known as MBC Securities. Not solely would this third-rate agency not pay him any wage, they had been really going to *cost him* cash for taking the place. They known as it a tuition price for educating him the best way to commerce and for Stephen, mentioned tuition price can be $6,000. He omitted this truth to his dad and mom and tried to legitimize it by calling it a “Wall Road dealer” job. Although this place appeared suspect, his selection was both MBC or a number of the conventional finance jobs he utilized to as a backup. He had one supply from Charles Schwab to do commerical banking in Jackson, Mississippi for a $40,000 annual wage. Eh.

There aren’t any Asians in Mississippi. I’m not going there. New York is my dream. I’m simply going to go for it.

Portrait of a Dealer as a Rookie

Within the spring of 2011, I crossed paths with Stephen on-line whereas taking part in Dota purely by likelihood. Initially, it wasn’t me however my cousin who teamed up with him in a randomly generated match. They saved profitable and saved taking part in collectively, in order that they added one another as chat buddies. As they bonded over Dota, being each fourth-year faculty college students, additionally they mentioned their post-graduation futures. Stephen talked about his intention to begin buying and selling at MBC Securities—the identical agency I used to be headed to, a truth my cousin knew. Subsequently, my cousin launched me to Stephen, making him the primary individual from our coaching class that I met. The moniker I bestowed upon him within the Prop Dealer Collection is a nod to this encounter—Clockwork, impressed by a playable hero in Dota. The nickname additionally aptly describes his outstanding buying and selling consistency–which you’ll quickly examine.

Three months later, Clockwork has transitioned right into a CBOE-registered MBC/Y5 dealer on a bustling New York Metropolis buying and selling ground. The primary month is all in regards to the coaching program and the demo. It’s about ingratiating oneself into MBC’s agency tradition–work onerous, learn to commerce responsibly, do your job and get into good trades. Victor, MBC’s managing associate, units the expectation that we needs to be worthwhile merchants inside 3 years. However Clockwork has payments to pay and restricted help and a uncooked starvation to win straight away. He desires to be worthwhile as quickly doable. He makes a behavior to ask inquiries to everybody he perceives to be extra knowledgable about markets. Our head dealer Tuco. Our ground supervisor, CJ. After which me as a result of I sat subsequent to him.

One of many first belongings you discover about Clockwork is his response velocity, honed from years of gaming. Within the coaching program, we might be taught a easy scalp known as the “Mush” commerce. The commerce is fairly easy, there’s a giant order at a complete quantity degree on a inventory–say $5.00. As the massive order at 5.00 will get eaten up and quantity will increase, the dealer makes an attempt to snipe the previous couple of remaining shares earlier than the order is gone and the inventory ticks by means of the extent. The algo will probably elevate the bid a number of cents larger over the entire and you’ll promote into the power. It’s an especially low threat commerce. Timing is essential–too early and also you’re caught with a place earlier than any momentum happens and should need to hit out, too late and also you’re consuming the slippage and getting a worth above the entire. By 2011, this commerce was much less about earning money and extra about understanding the mechanics of studying order stream after which reacting to it. Clockwork rapidly developed glorious timing and beloved to mush shares. He took satisfaction in making 5 cents in 5 seconds. It was frequent apply for him to kind by means of 100 inventory symbols on the extent II in the course of a day to seek out Mush commerce alternatives.

Everybody available in the market has a facet of the market that that feels innately related to them. Some folks like to research information. Some like elementary analysis. Some folks wish to chart. They draw their trendlines and overlay all their transferring averages and indicators into the charting interface. Scoot Brownler, the umbrella buying and selling agency’s chief technical officer, would get up at 6:30am every single day and begin ripping by means of charts. You may inform that he loves that facet of being a dealer. Clockwork? He beloved to commerce–that means, he likes to push buttons to get out and in. He would normally commerce all day from open to shut, outpacing the whole coaching class in complete shares traded and most inventory symbols traded. If he was down $100, he’d chip away with $20-30 features to get again to even, after which get to gross optimistic. For him, being crimson on the day was simply a possibility to seek out extra trades to get inexperienced.

To make an all-too-fitting analogy, honing oneself as a dealer kind of resembles the early levels of character constructing in an MMORPG. You’ve got a finite quantity of ability factors and all these completely different attributes to place all of your factors into. Pushed by a ardour for lively buying and selling, Clockwork invested virtually all his ability factors into scalping.

Portrait of a Dealer as a Marginal Dealer

Frequent state of affairs: a inventory breaks over a key degree or vary and we’re buying and selling it. We all know our entry and we all know our stops, however the fuzzy half is the expectation of the place the inventory will go and whether or not we are able to maintain it to that time.

Clockwork: This inventory could make a brand new excessive as we speak. I simply purchased extra.

He then “mushes” 2000 shares by means of the important thing breakout degree. A couple of minutes later, the inventory retraces again to entry level.

Clockwork: I offered most of it into that push.

Pete: You’re already out?! what occurred to the inventory making a brand new excessive?

Clockwork: 10-cent market, need to promote rapidly. I can rebuy it right here at identical worth now.

Pete: However it’s a worse commerce now. It simply confirmed you that it may’t break from its vary.

Clockwork: Yeah however not earlier than I make one other 10 cents.

That dialog, one which we will need to have had a thousand instances, describes the place we had been at in 2012. We are able to scalp to gather small margins however it may’t scale all that a lot. By 2011, the lively day buying and selling group predominantly centered on this one large query: May day merchants nonetheless make cash scalping towards HFT? Contemplate the timeline of great market construction modifications ranging from 1996, when the SOES bandits made their presence recognized and began the golden age of day buying and selling. In 2001, the NYSE transitions to decimal pricing, then in 2002, the NASDAQ implements SuperMontage, adopted by NYSE hybridization in 2006. Many of those modifications, one after the other, would part worthwhile scalpers out of the market. By 2011, the rise of HFT had rendered the market remarkably environment friendly on the micro timeframe, diminishing many of the previous dependable performs from the scalper’s bag. Maxing out all of 1’s ability factors into scalping within the 12 months 2012 could not have been the optimum growth plan.

To reply to these modifications, the brand new “meta”at MBC grew to become one thing administration had labeled “Trades2Hold”. As a substitute of scalping 5-10 cents, you’ll goal to trip the whole intraday pattern for a number of factors. However the Trades2Hold fashion was thought-about place buying and selling and Clockwork already put all his ability factors into scalping. Consequently, a problematic behavior had emerged–get used to creating 5-10 cents on a regular basis and that’s all you attempt to make. The breakaway strikes on momentum shares that may make your whole month that you just had been supposed to carry till the shut–he saved lacking out. They’re too unstable. Too spready. Too excessive priced, nominally. Require wider stops. Miss the most effective entry. After which when he was lucky sufficient to get into shares that had breakaway strikes, what occurred then? He offered too early into preliminary power, as a result of that’s what scalpers do. As an observer, I discover it didn’t trouble him an excessive amount of–at the very least on the surface. If I offered what would’ve been a monster achieve approach too early, I’d get mad.

Clockwork–properly, he accepted who he was. Whereas many on the desk struggled to attempt to adapt to the brand new Trades2Hold meta, he would principally keep on with his weapons and proceed scalping. He earned a repute on the desk as a cautious dealer (learn: piker), dabbling solely in low margin trades. To the uninitiated, ‘piker’ may sound like a disparaging label meant to mock merchants reluctant to take vital dangers. Nonetheless, Clockwork’s technique was underpinned by a steadfast resolve to complete every buying and selling day in revenue, irrespective of how modest. This disciplined method bore fruit when he celebrated a outstanding streak of 30 out of 30 days within the inexperienced from April to Could 2012. At 4 pm, because the closing bell chimed, he would reliably finish the day with a inexperienced PnL, like clockwork. After accounting for cut up and buying and selling charges (usually much more for top frequency scalpers), the cumulative income amounted to only a few thousand {dollars}, however his means to by no means lose was a testomony to his consistency and willpower.

He had buying and selling expertise. He had prudent threat administration. He had consistency. Victor had been touting him as one of many agency’s finest younger merchants, even dedicating a chapter to him in his newest guide, “The Gameplan”. He was then promoted to Junior Dealer with a better revenue cut up. Regardless of his finest efforts, his general earnings energy was nonetheless removed from having the ability to match even the meager $40,000 wage he may have effortlessly collected as a standard banker in Jackson, Mississippi. He’s simply lacking that one last item… one last item earlier than making the essential leap from subsistence-level marginal dealer to a persistently worthwhile dealer with life-changing earnings potential.

Portrait of a Dealer as a Creating CPT

It’s March of 2013, days earlier than the merger between MBC Securities and Western Buying and selling Group (WTG). Issues weren’t nice. Neither of us had even netted $10,000 within the prior 12 months regardless of buying and selling thousands and thousands of shares every month and spending 8 hours within the workplace every day grinding tape. NYC hire funds begin to eat away at our meager financial savings and disillusionment begins to kick in. The preliminary glamour and promise of being a ‘Wall Road Dealer’ was carrying off rapidly.

We had a dialog about the place we had been at. We had been caught.

Pete: We barely make something by scalping every single day. Have a look at how a lot of our revenue will get eaten up by cut up, fee, desk and information charges, and bullshit like that. We’re going to expire of cash. Can’t hold occurring like this.

Clockwork: We’d be making extra working at McDonald’s then we do buying and selling proper now. That may be very, very unhappy.

Everybody else in our coaching class had now left. On their approach out, a lot of our colleagues harbored a adverse sentiment about their expertise at MBC Securities–it doesn’t appear doable to make actual cash there. Clicking buttons for 5-10 cents at a time…half of it eaten by charges and cut up… it’s not a sustainable enterprise mannequin. The Trades2Hold meta couldn’t discover any footing as no one had developed a dependable technique to seize bigger features. There weren’t any merchants at MBC demonstrating constant profitability past subsistence wage ranges and even the managing companions struggled to make cash. Possibly we received tricked into coming right here by this buying and selling agency that promotes themselves by way of social media and solely makes cash off their schooling income. Clockwork discovered himself at a crossroads. If you’re confronted with the ever looming risk of failure, how do you select to deal with it?

Pete: Let’s simply step up our measurement and both make some huge cash or we blow up. Then we may transfer on. I’ll transfer again to California, I’ll get an actual job or go to regulation faculty.

Clockwork: Haha that’s proper, we both make some huge cash or we go dwelling. No extra of this tough work all day to barely make any cash. I at all times have my supply to be a banker in Jackson, Mississippi.

Generally we deal with humor. We put the fact out within the open–blow up your account and get fired. The “Wall Road Dealer” dream you’ve romanticized since graduating? POOF. It’s gone. You gotta go dwelling. Stay along with your dad and mom. Return to highschool or get an actual job. If Clockwork had a string of unhealthy trades, he’d inform me one thing alongside the strains of…

So we’d giggle it off and hold buying and selling somewhat than dwell on the robust questions. However Clockwork had much more resolve behind all of the goofing round. He despatched an e mail to Victor, after a troublesome day the place he round-tripped what would’ve been his private finest PnL. For an extremely constant scalper, a big spherical journey in PnL is anathema. Don’t let winners flip into losers–that’s the scalper’s creed. On this e-mail, Clockwork selected to replicate on his bigger objectives somewhat than dwell on the day’s PnL.

I got here throughout this image whereas shopping on the Web, which I believed was value sharing. As proven on the pie chart, 90 p.c of the inhabitants lives within the Consolation Zone. They're common, residing a mediocre life. They're settling only for survival. They're depressed, drained, fearful, and sometimes ask, “What if I can’t?” These descriptions are spot on. I’m going to be very sincere, I determine myself with a pair descriptions talked about above. Generally I’m fearful. Generally I doubt whether or not I can do it. However in the long run, I managed to remain within the recreation and fought to overcome the most important enemy, myself. So, what do I have to do to get out of the 90 p.c, and turn into the highest 10 p.c? What traits do they possess? They're fearless. They've goals. They're assured, at all times pondering “I can do it.” The sky is their restrict. They've perception and fervour. They search wealth, success, monetary freedom, success, and pleasure. What makes these 10 p.c so particular is that they’re not mentally confined. They give the impression of being to get higher every day. They know they will get a lot better. I’m nonetheless very younger. My precedence needs to be seeking to be taught as a lot as I can, not how a lot I could make within the subsequent week or two. I wouldn’t say I’m presently the ten p.c exterior the 90 p.c now. However I might say that I've improved lots. Evaluating myself with after I began, I've grown to be a greater threat taker. I've strived to step exterior of my consolation zone. I’m not settling like earlier than. I’m extra fearless than earlier than. And I've larger goals than earlier than. But, I nonetheless have lots to enhance and attain. Day by day is a studying day for me. [Clockwork breaks down a trade he made in ADSK for a few paragraphs] I used to be somewhat bit depressed that I gave again my private finest. However truthfully, what's that $250 going to imply to me in my buying and selling profession? I feel I made the suitable selection for not settling. Now I do know I’m able to a brand new private finest. Sooner or later I’m certain that that new private finest will come.

He nonetheless held an optimism that he would make it. Possibly he simply humored me after I felt down.

After the agency’s transition to WTG, Clockwork centered on his major goal: rising his threat tolerance. He approached this purpose with warning, avoiding the temptation to indiscriminately make ‘YOLO bets’ on each single play. As a substitute, he adopted a methodical method, anchored in two elementary practices:

1. Meticulously journaling and reviewing every commerce, aiming to outline the core components of his finest trades

2. Evaluating his trades primarily based on the insights gleaned from these critiques, and adjusting his measurement accordingly—allocating extra to the highest-rated (A) trades, whereas being extra conservative with B and C graded trades

Clockwork’s playbook was principally centered on scalping for vary breaks the place he may commerce within the route of the preliminary momentum and use tight stops. Nonetheless, he step by step refined his inventory choice standards, figuring out the shared traits of the most effective vary break performs. Eradicate illiquid crap. Discover shares that transfer. Attempt to add to winners after which maintain onto them somewhat longer than he was comfy with. His easy method bore fruit in Could 2013 when Clockwork achieved the best month-to-month PnL amongst all MBC Junior Merchants, incomes $8,133. This enchancment bolstered his conviction that reaching six-figure features was not a matter of if, however when.

His secondary purpose was to increase his playbook with completely different methods. His answer was to easily emulate different worthwhile merchants by figuring out their finest methods by way of the WTG linked blotter system. This trait—eschewing the have to be the solitary genius in favor of embracing and appreciating efficient methods from others—is invaluable for any dealer. Our mutual good friend Tommy would usually stroll by Clockwork’s station to take a look at all his positions, after which comment “you’re like a spider with a finger in each pie.” It was quite common to placed on a brand new place after which seconds later you’d see Clockwork mirroring the commerce.

Jimmy discovered a spread break play? He’s in. Eagle’s shorting AAPL? He’s in. Riggs is buying and selling the Russell rebalance? He’s in. Mr. West doubles down on a plummeting inventory, taking a ton of ache? Effectively, he could not dive in headfirst, however he retains a eager eye on the inventory, ready for a possible setup to purchase it safely.

The dealer he copied essentially the most? Clearly it might be the dealer sitting immediately subsequent to him.

I made the Fannie Mae commerce and that modified every part. MBC Securities was going to present merchants entry to commerce OTCBB shares for the primary time. Clockwork noticed how a lot cash I made in a day and he knew… he’s gotta get into that shit straight away. That’s the factor that may make him a bonafide CPT.

If PTO could make that sort of cash, I do know I could make it too.

Clockwork will get entry to the OTC platform beginning in August. OTC buying and selling is a good match for him as a result of there aren’t any HFTs. He doesn’t have to remodel his mindset and go towards his pure tendencies. He will get to be himself–click on buttons, scalp speedy strikes in each instructions, and rack up instantaneous income as if it’s all only a online game. Better of all, he has the right mentor for this technique. So Clockwork empties all his remaining ability factors into OTC buying and selling after which he prays that there are nonetheless sufficient alternatives within the 12 months for him to take benefit.

From August ahead, every single day between us includes speaking store in regards to the mechanics of buying and selling these OTC penny shares. On one inventory, we are going to discover quantity has elevated and there’s order stream coming in and we all know it’s time to commerce extra continuously. Generally we discover it’s uneven and there’s a looser unfold so higher to attend. We discuss our fills on ECNs vs. market maker routes. We discuss what hits the scanner and what sectors are scorching. On the massive days the place we play essentially the most unstable strikes, we discuss by means of how the tape slows down so we all know when to promote and lock in features. Retail merchants commerce these OTC names and so they have ideas about the place their shares will go of their most optimistic eventualities–FNMA may go to $25 if the Treasury lets them earn! Blah blah blah–they’ll spam it throughout social media. If you commerce actively for a residing, you may’t depend on that dreamland final result to hit. It’s day-to-day and the main target is on all of the little issues. Clockwork’s now centered on tape-reading performs on unstable OTC names which might be up/down 40-100% intraday, the place he can scalp enormous strikes with good timing and execution.

After a pair tune-up months, Clockwork finds his footing buying and selling liquid OTC names like FNMA and AAMRQ in October. He ends the month with a private file PnL of $42,844–sufficient to crack the WTG top-10 for the primary time in his profession. He closes the 12 months robust with further 5-figure months in November and December, ending the 2013 calendar 12 months with $118,415. That’s ok for second place amongst all MBC merchants.

He’s excited. That is what he’s been ready for–an precise worthwhile scalping technique in the suitable market, the place one accumulate 5-6 determine months without having to take ache. It was only the start.

Portrait of a Dealer as a Breakthrough CPT

In 2014, the Pot Shares grew to become en vogue and the OTC craze reached a peak on the MBC Securities desk. Penny shares would commerce from a number of cents to a couple {dollars} and supply superb alternatives for expert merchants. Quantity surged and spreads tightened, an important recipe for OTC scalpers. Clockwork would commerce out and in of those shares all day, racking up thousands and thousands of shares for the month. At one level, his speedy scalping grew to become so efficient that the market makers threatened to deactivate OTC routing for the whole agency. They known as it ‘poisonous order stream’ and there was a complete ordeal about agreeing to sure stipulations on canceling orders. They’re simply mad he’s taking their cash. He completed the February 2014 with one other private file, tallying $81,811 in a month.

From making a $1000 in a month to creating $81,811 in a month over the course of a 12 months. Bonanza! He’s an authorized CPT now. The very best is but to return.

The highest buying and selling inventory for the corporate to date, FNMA, was gearing up for one more vital surge in March 2014. Clockwork had already reaped over $70,000 in income from buying and selling this inventory, but he felt like he had barely scratched the floor. There hadn’t even been an enormous A+ bounce setup but, akin to the one the place his good friend Pete raked in $33,000 final 12 months. That was, till now, with FNMA on one other frenzied runup from $1 to $6, fueled by main hedge funds like Pershing Sq. and Fairholme. Now he was readying himself for what he thinks can be an enormous commerce.

On March eleventh, FNMA begins to waterfall underneath $6. Clockwork makes his first entry when the primary bid soaks at 4.50. He’s loading up but it surely looks as if he’s getting crammed approach too rapidly. One thing feels off. The bid drops and he tries to hit out however he can’t. There’s a brand new wrinkle within the FNMA algo’s that’s throwing off all of the scalpers who had beforehand crushed the inventory–as soon as the bid fails to carry, the ARCA ask cuts beneath the bid by 10 cents and shuts everybody out from speedy fills. Now everybody’s jammed up and making an attempt to get out on the identical time. Clockwork’s unable to get out and taking surprising drawdown. He decides to do one thing he’s by no means carried out earlier than: maintain the bag and add to his shedding place. However the inventory continues to blow by means of each held bid try and this simply exacerbates his ache. His unrealized loss reaches -$50,000–as soon as an unthinkable quantity for essentially the most constant winner on the agency. Lastly round $3.20, there’s some stabilization. He buys the final bit he can muster, the inventory lastly turns, and he rides the bounce again to interrupt even. Catastrophe averted.

A couple of minutes after the shut, he tells his buying and selling buds that he drew down $50,000!!!! and that he felt he’d have a coronary heart assault any second!!! and that not having the ability to hit out of a inventory once you wish to is tremendous fucking scary!!! He desires to emphasise simply how traumatic it was for him. A second after that, Victor summons Pete to this workplace. Clockwork has the sense that Pete misplaced fairly a bit of cash on this FNMA commerce however he doesn’t know the way a lot.

The subsequent day, he’s simply sitting alone with unmanned buying and selling rigs to his left and proper. Seems he’s now the final dealer remaining from MBC’s summer season 2011 coaching class. He’s curious how a lot Pete misplaced however he’s too afraid to ask. He decides the most effective plan of action is to only not point out it and transfer ahead. He sends a gchat:

Hey P-To what shares are you as we speak?

(To be continued in Half 2–the following 10 years of Clockwork’s adventures in low float shares, volatility halts, covid markets, and different prop buying and selling bullshit.)

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)