Candlesticks are an enormous matter of dialog amongst merchants… and for good motive!

However whereas some candlesticks can inform you numerous about what the market is making an attempt to do…

…others could appear utterly irrelevant to future actions.

They are often complicated generally, proper?

Properly, that’s why I’m masking a candlestick sample which is usually a critically potent buying and selling device:

The Inverted Hammer!

Immediately, I’ll enable you perceive how one can use it in the proper conditions at simply the proper time.

On this article, you’ll cowl:

- What precisely the inverted hammer is

- Some methods I wish to commerce the inverted hammer

- Sensible examples of how one can commerce the inverted hammer

- Limitations on the inverted hammer

Are you prepared?

Then let’s dive in!

What’s the Inverted Hammer? (Bearish Sign)

The inverted hammer candlestick sample is a robust device utilized by merchants to establish potential pattern continuations – particularly downtrends.

Now wait, I do know what you’re pondering!

“Isn’t the inverted hammer thought of bullish?”

Properly, the textbooks may say so – however let me clarify why I imagine it’s truly a a lot better bearish indicator.

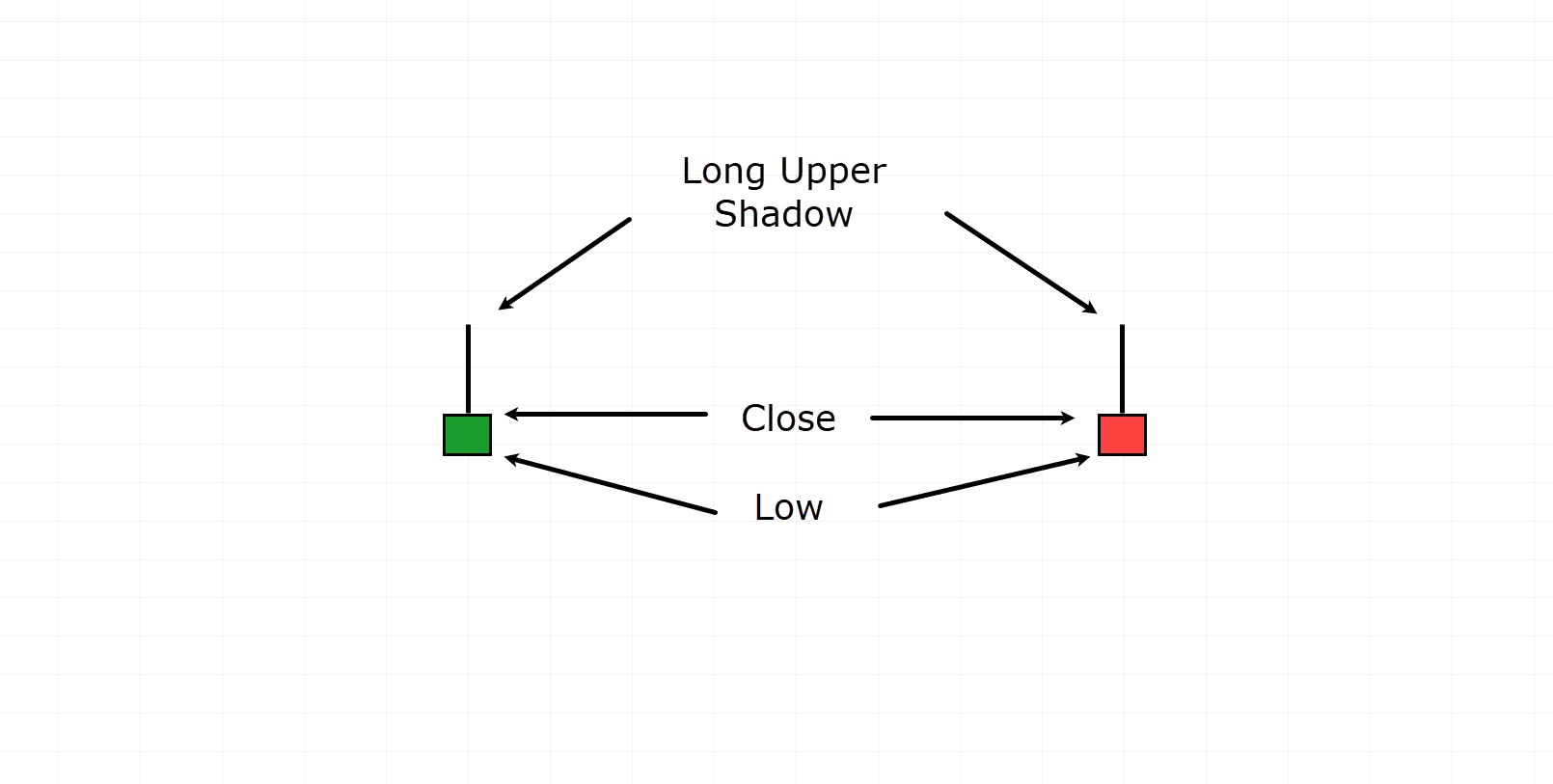

Check out a diagram to see what it seems like…

Instance of an inverted hammer:

It’s a candlestick with a small physique close to the underside, an extended higher shadow reaching upward, and hardly any decrease shadow.

Discovering an inverted hammer on the finish of a downtrend is essential, nevertheless it’s additionally an enormous deal on the high of ranges – the place resistance has been seen earlier than…

It may possibly recommend that the bulls made an try to regulate the market however failed to keep up it all through the candle.

The colour of the candlestick, whether or not inexperienced or pink, additionally displays the value motion through the buying and selling session.

A green-bodied inverted hammer means the closing worth was larger than the opening worth.

A red-bodied inverted hammer reveals the alternative.

Whereas inexperienced suggests some bullish momentum, I nonetheless take into account it a bearish candlestick.

…with pink candles suggesting a stronger continuation sign.

Consider them as little tales the market is making an attempt to inform us.

What does it inform you?

The consumers unsuccessfully tried to take management of the downtrend.

They got here flooding into the market session, solely to be met with stronger promoting stress.

Let’s delve deeper into how one can commerce them!

The best way to Commerce the Inverted Hammer

This may be approached in two important methods, with each offering some further confidence I have to make the commerce!

Utilizing the Inverted Hammer as a Bearish Sign

This entails recognizing the inverted hammer as an early sign {that a} downward pattern may proceed…

…or that consumers are weakening on the high of a variety.

When this sample kinds on the backside of a downtrend, it means that promoting stress continues to be coming in even because the bulls attempt to unsuccessfully carry the value.

In search of further affirmation indicators is essential right here, although.

As an example, merchants could look forward to a pattern line to be revered…

Or observe the continuation of market construction with a brand new decrease low and decrease excessive forming.

Utilizing the inverted hammer as a bearish sign means figuring out the sample and verifying it by way of entry triggers – to be as positive as you possibly can!

Utilizing the Inverted Hammer as an Entry Set off

This methodology provides merchants a exact technique to open trades – wanting on the bearish momentum proven by the sample.

When the inverted hammer is proven, you possibly can usually enter brief positions at areas of worth with a view to revenue from attainable pattern continuations or vary reversals.

The inverted hammer is commonly used as an entry candle for trades at vital help zones or vary highs the place the value fails to interrupt resistance.

Basically, merchants can maximize income and tighten cease losses by ready for an inverted hammer because the entry set off.

You possibly can deal with danger by inserting stop-loss orders above the wick of the inverted hammer or above the help zone that has been damaged.

Nevertheless, it’s vital to acknowledge market situations, basic components, and unexpected occasions can all affect how nicely the inverted hammer works as an entry set off…

…so don’t put all of your eggs in a single basket.

Now that you just perceive some methods to make use of the inverted hammer, let’s look at some actual buying and selling examples to bolster the ideas!

Buying and selling Examples

Vary Instance

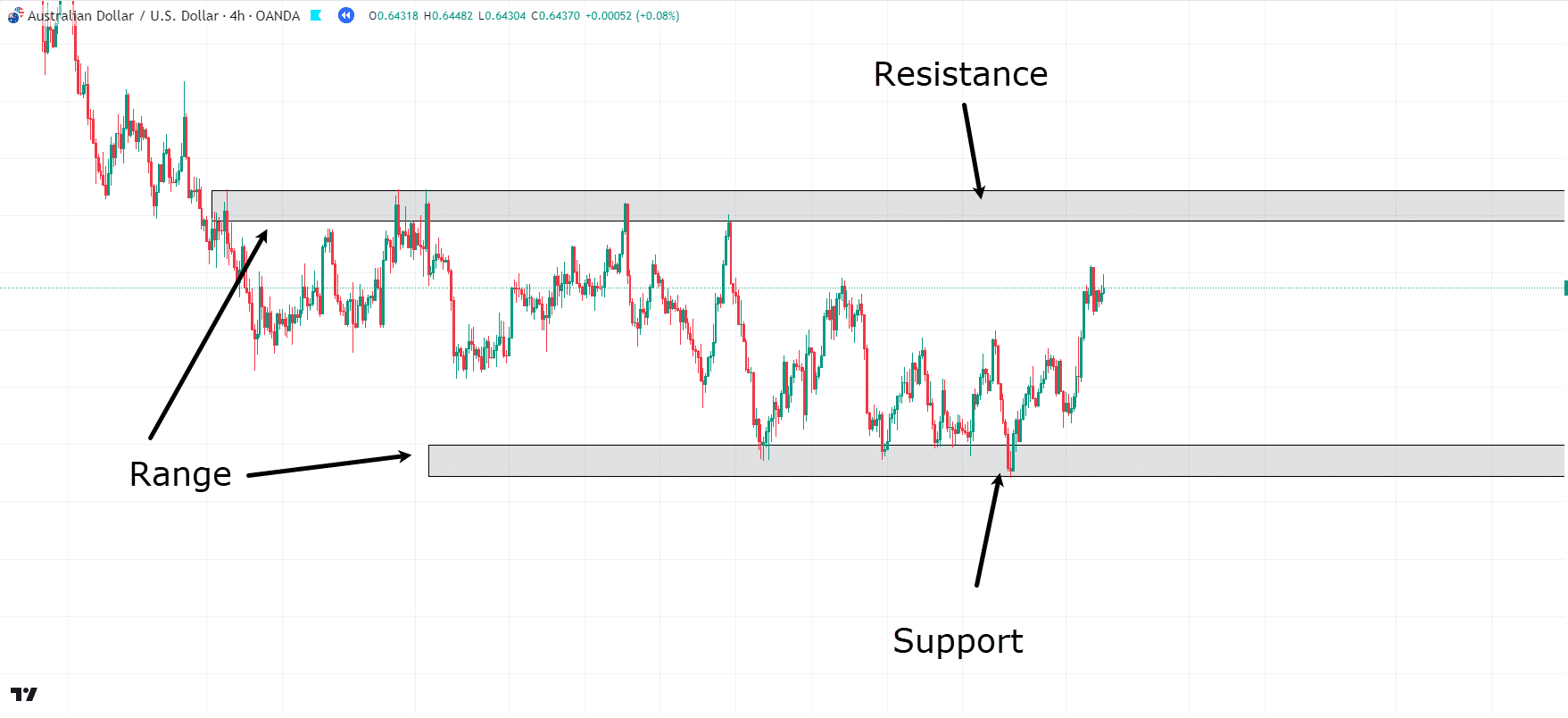

Check out this chart…

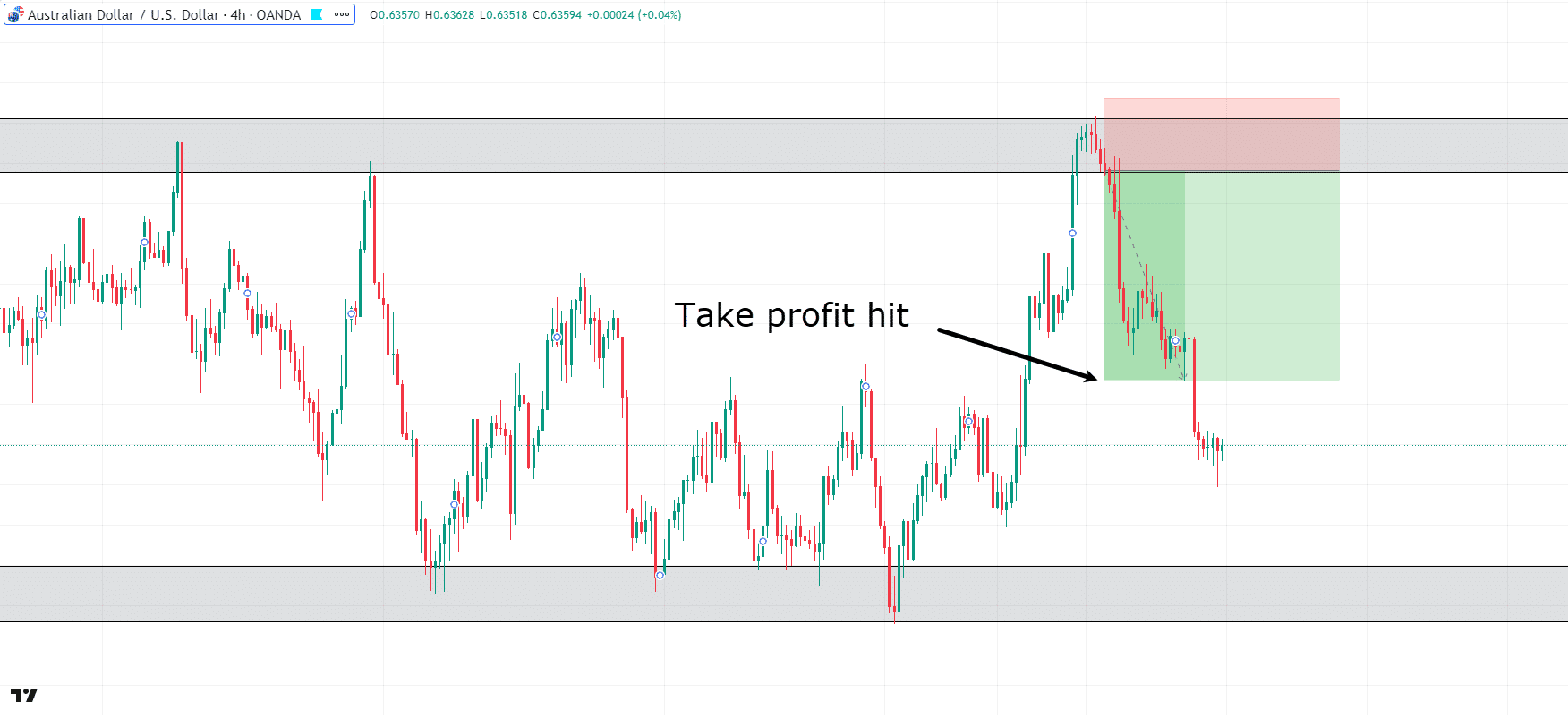

AUD/USD 4-Hour Chart Vary:

Worth has clearly begun forming a variety, the place worth has met a resistance degree a number of instances and in addition begun forming help on the backside.

It’s secure to say that resistance and help are each areas of worth.

Let’s check out what happens subsequent, then…

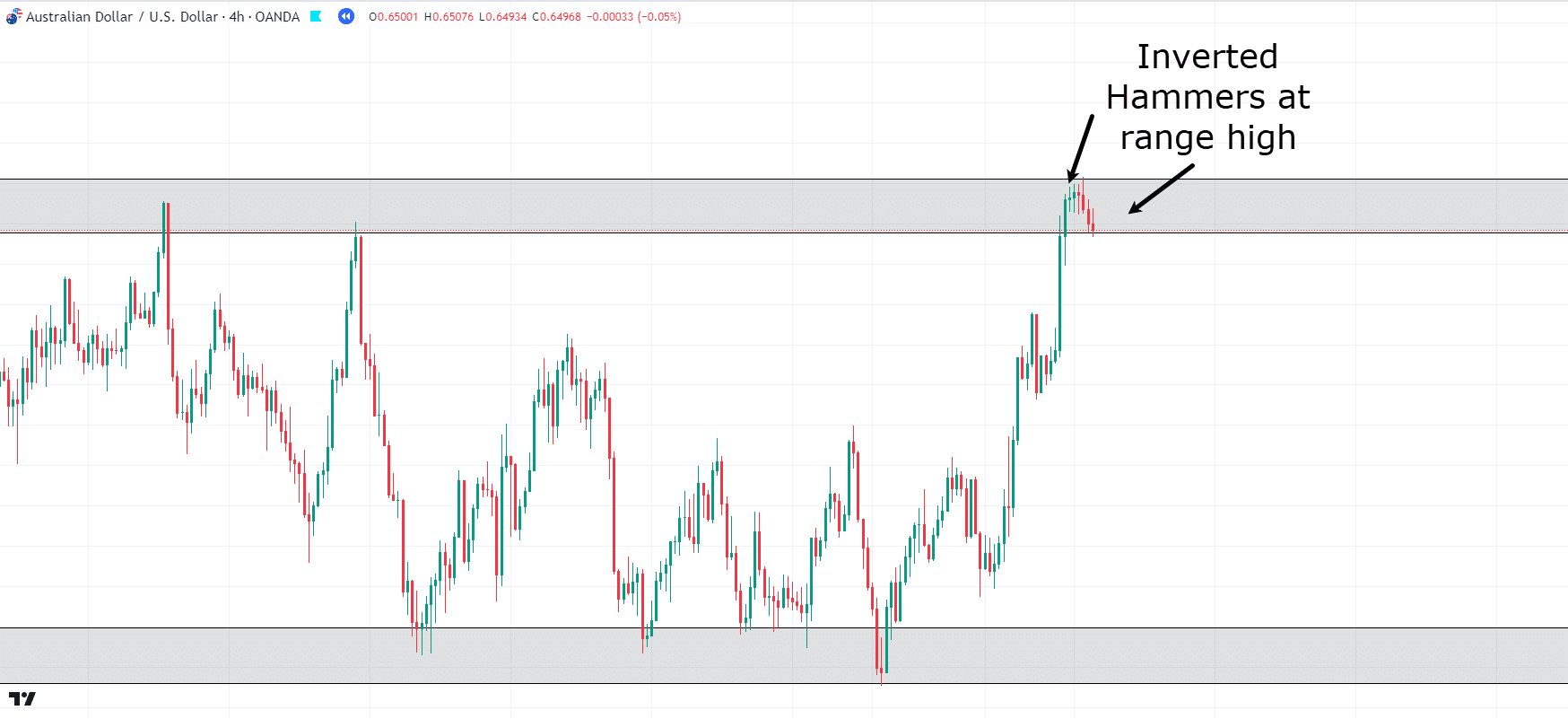

AUD/USD 4-Hour Chart Inverted Hammer:

As the value comes into the realm of worth, you possibly can see it begins to stall…

Not solely that, however Inverted Hammers start to kind within the zone – are you able to see?

In different phrases, worth has reached an space the place it has been rejected a number of instances prior to now.

As consumers try and push by way of the resistance, they encounter sturdy promoting stress, resulting in the formation of inverted hammers.

There’s a possible commerce alternative right here, let’s have a look…

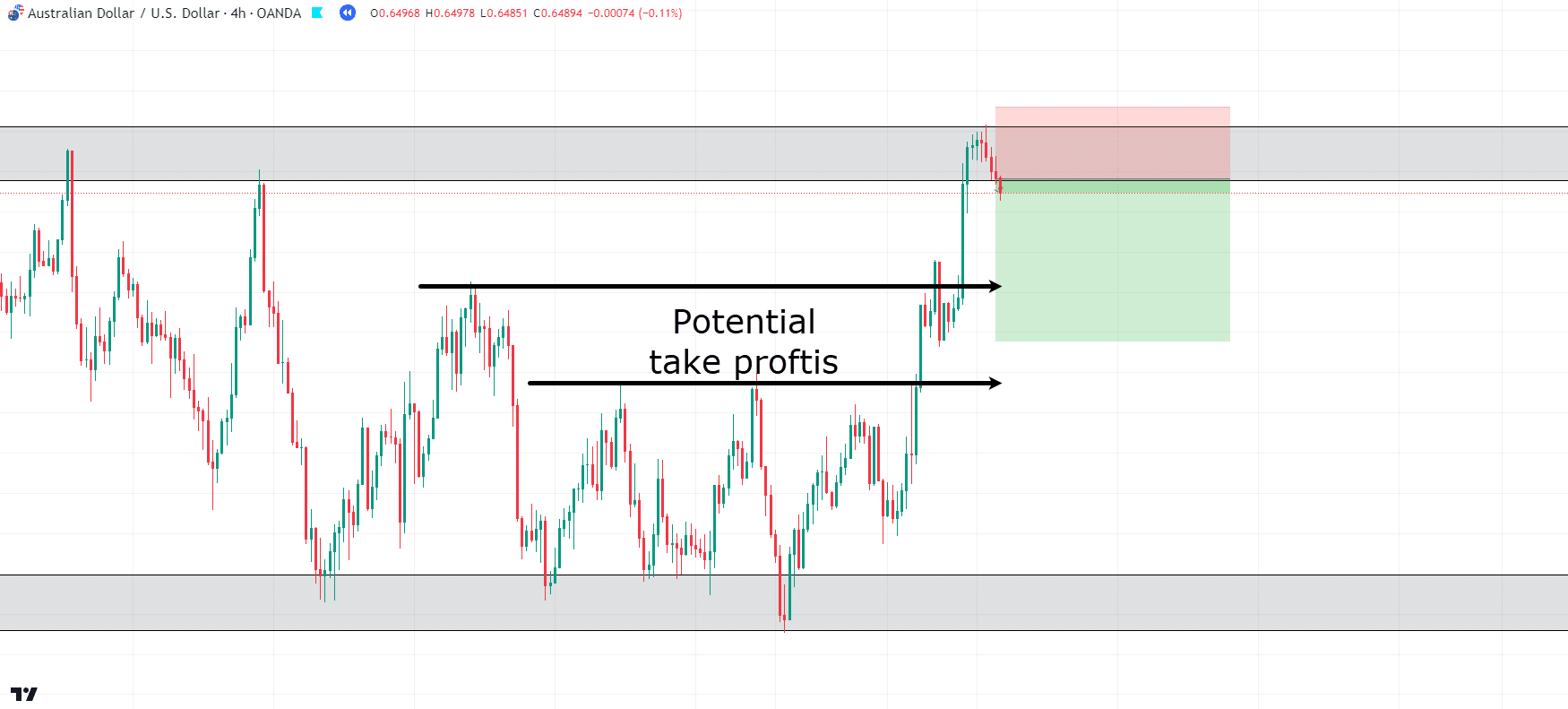

AUD/USD 4-Hour Chart Inverted Hammer:

As worth rejects the resistance, let’s take into account inserting our cease above the zone.

The gap above the zone actually is dependent upon your danger tolerance!

For a better potential reward, you may place it near the wick of the inverted hammer…

…for a safer commerce, give it some respiration room above the zone.

Potential take income could possibly be set at any of the earlier highs, which can act as help and resistance flip zones.

If you happen to’re aiming for extra reward, you could possibly goal the vary low as nicely…

AUD/USD 4-Hour Chart Take Revenue:

As seen within the chart, the value fell from the entry space and rapidly approached the completely different take revenue targets.

Despite the fact that this commerce didn’t hit the vary low, it is very important perceive how vital it’s to search out key candle buildings at key worth areas on the chart.

Now, let’s discover one other instance, this time specializing in the breach of help ranges…

Break and Retest

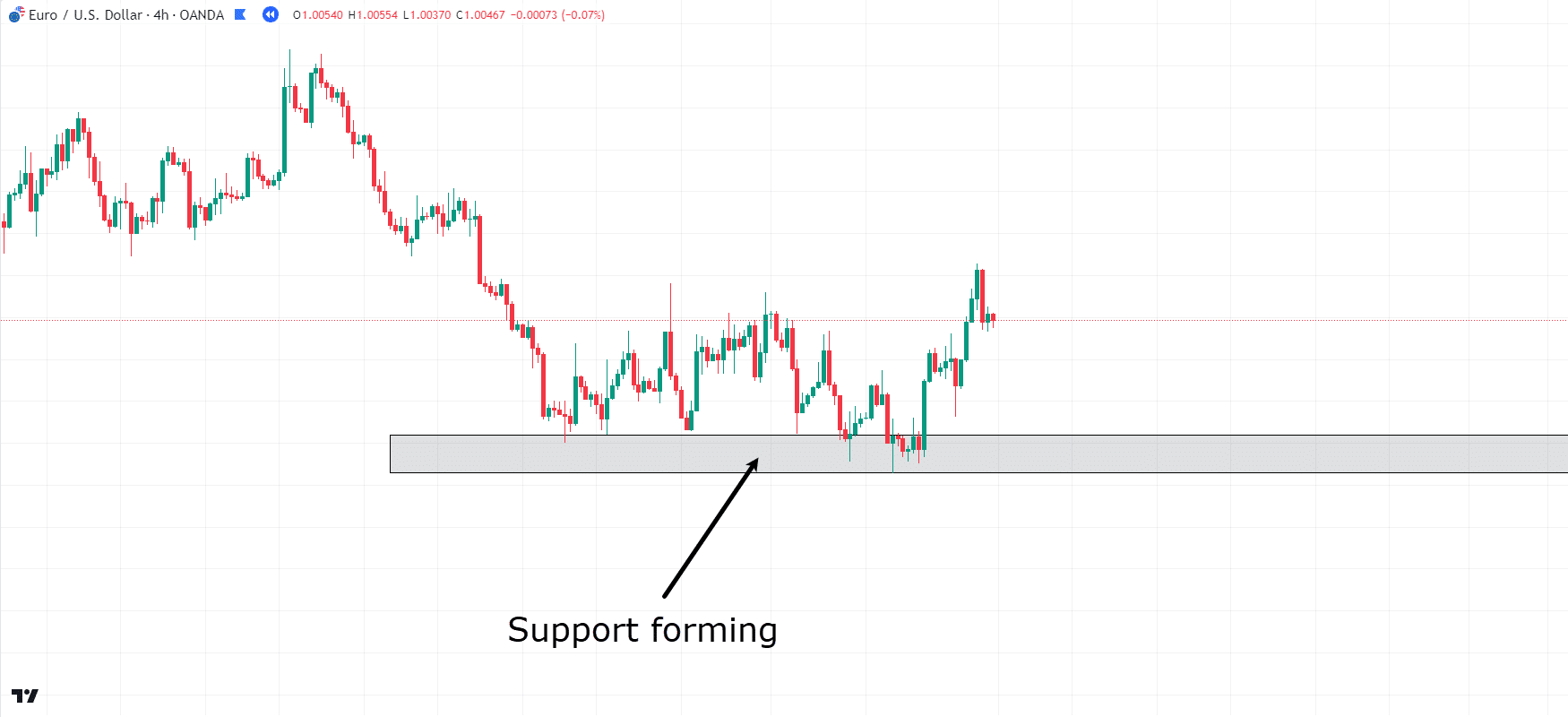

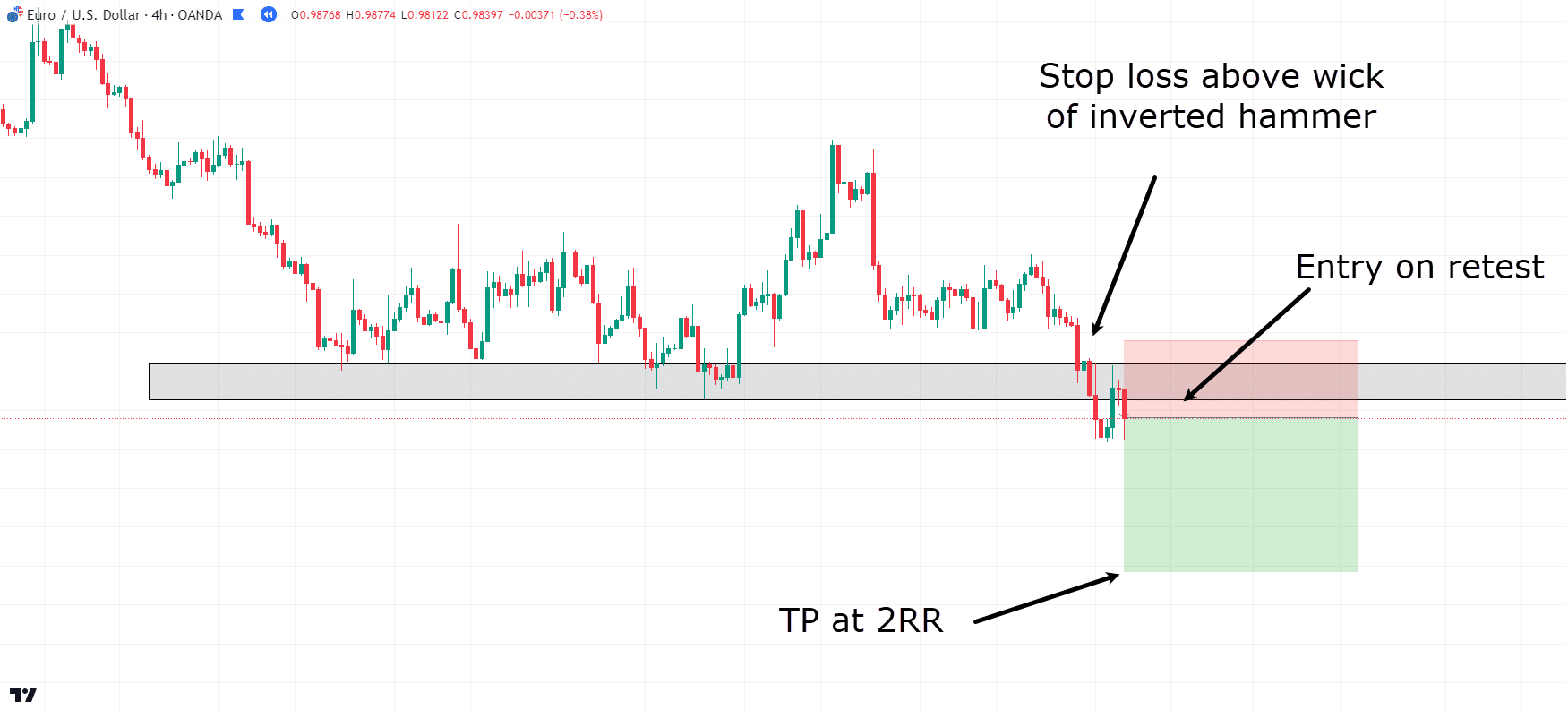

EUR/USD 4-Hour Chart Help:

On this EUR/USD chart, you possibly can observe that the value has began to ascertain a help degree.

Regardless of a number of assessments of this degree, the value persistently returns to this zone comparatively swiftly…

EUR/USD 4-Hour Chart Inverted Hammer:

As the value comes again to the zone once more, one thing fascinating happens!

A robust bearish momentum candle swiftly enters the zone, adopted by an Inverted Hammer….

Once you evaluate this with the earlier check, you may say,

“Properly, there was a bearish momentum candle there too, although…”

…and also you’d be proper!

Nevertheless, the candle after that bearish candle was a hammer candle adopted by a number of smaller hammers.

Are you able to see how the narrative differs this time?

The story unfolds with a bearish momentum candle displaying little rejection because it enters the help zone….

On the next candle, bulls try and push worth out of the help zone and generate bullish momentum…

…however they meet extra promoting stress, driving the value again down close to the candle’s open worth!

Truly, the broader market context means that worth repeatedly returns to this zone with none vital bullish follow-through on the rebounds.

Primarily based on this, it appears probably that the value will go down.

Nevertheless, earlier than coming into a commerce, it’s a good suggestion to attend for additional affirmation…

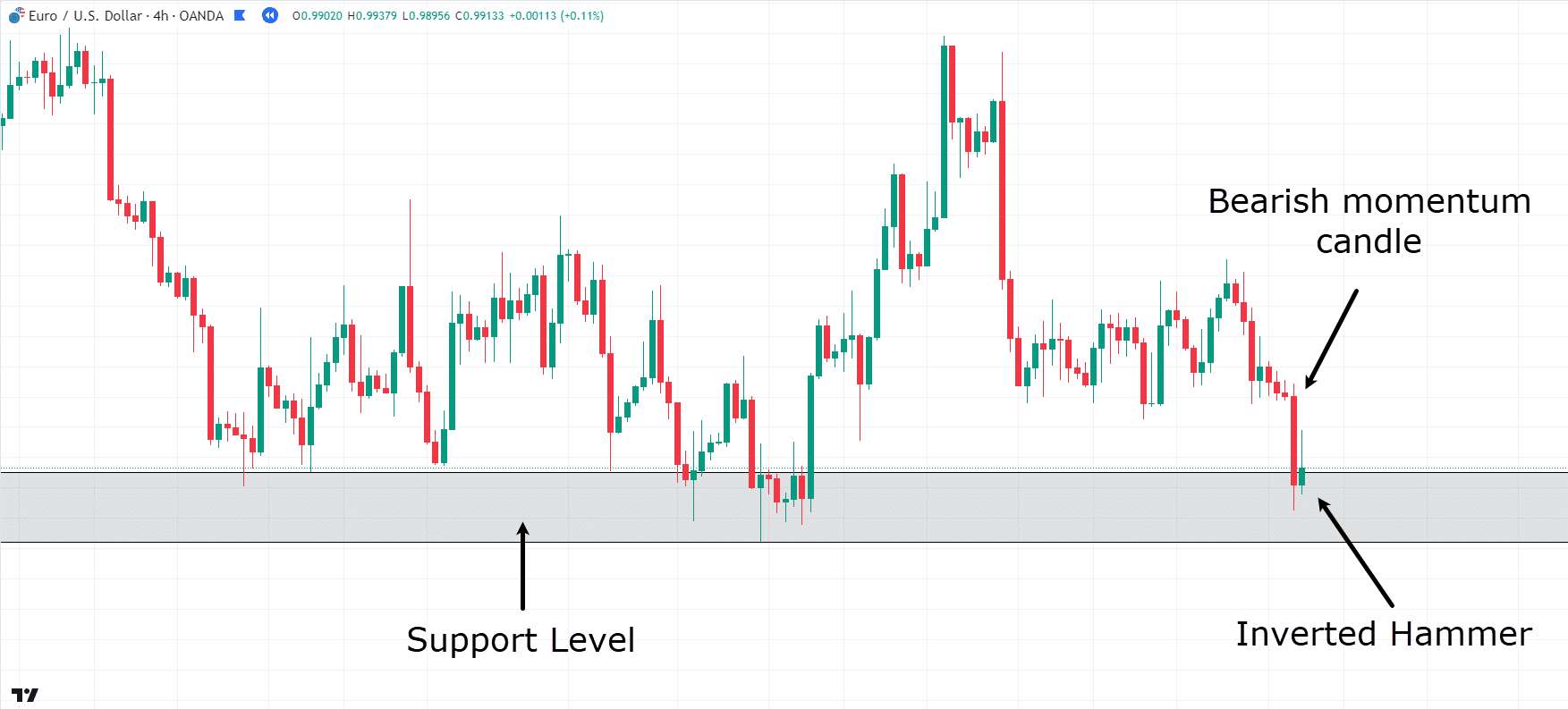

EUR/USD 4-Hour Chart Help Break:

Now that worth has definitively damaged the help degree!

Following the inverted hammer, one other bearish candle plunged deep into the zone earlier than the next candle breached and rejected the zone, too.

At this chance, some merchants may be tempted to enter a brief commerce, trying to beat the market and safe a premium worth…

Nevertheless, for the sake of argument, let’s train persistence and look forward to worth to maneuver away from the zone earlier than retesting it…

EUR/USD 4-Hour Chart Entry:

After just a few extra candles, you possibly can observe that worth makes a number of makes an attempt to reclaim the zone.

So, what are the components for contemplating a commerce right here?

- Worth has revisited a help degree that seems to be weakening.

- Entry into the zone occurred by way of a bearish momentum candle adopted by the inverted hammer.

- The sequence of candlesticks means that consumers tried to enter the market however did not generate any vital momentum.

- Help has been breached and subsequently rejected, now appearing as resistance on the opposite aspect.

These components present substantial proof that the value could proceed decrease, wouldn’t you agree?

For this commerce, the cease loss might be positioned above the wick of the unique inverted hammer. Targets for this instance shall be set at a 2RR…

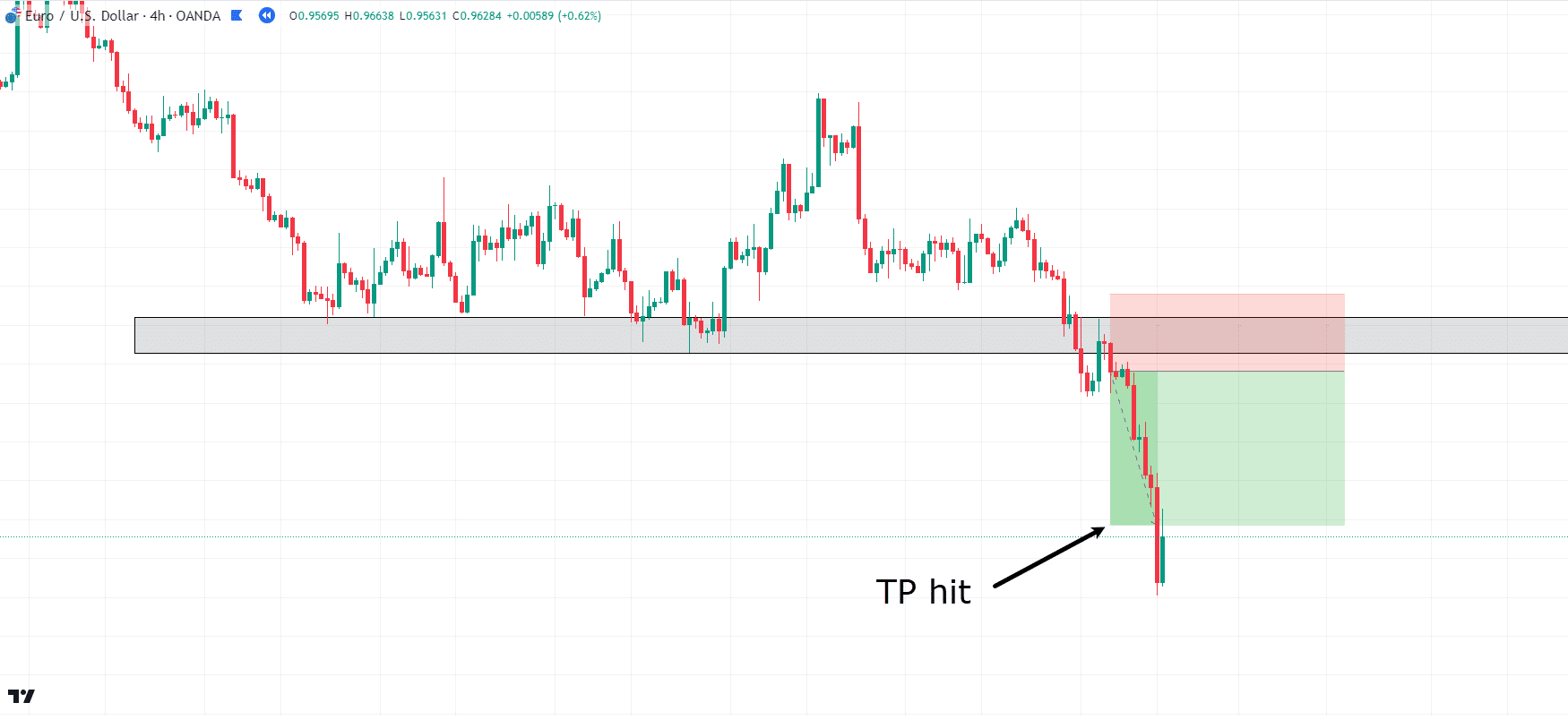

EUR/USD 4-Hour Chart Take Revenue:

Properly, take a look at that!

Simply as anticipated, the value fell because the consumers have been unable to maintain any shopping for momentum…

See how while you analyze the market as an entire, and piece collectively all of the little bits of proof the market offers you, you may make better-informed buying and selling choices?

Let’s take a look at one final instance to distinction precisely this level…

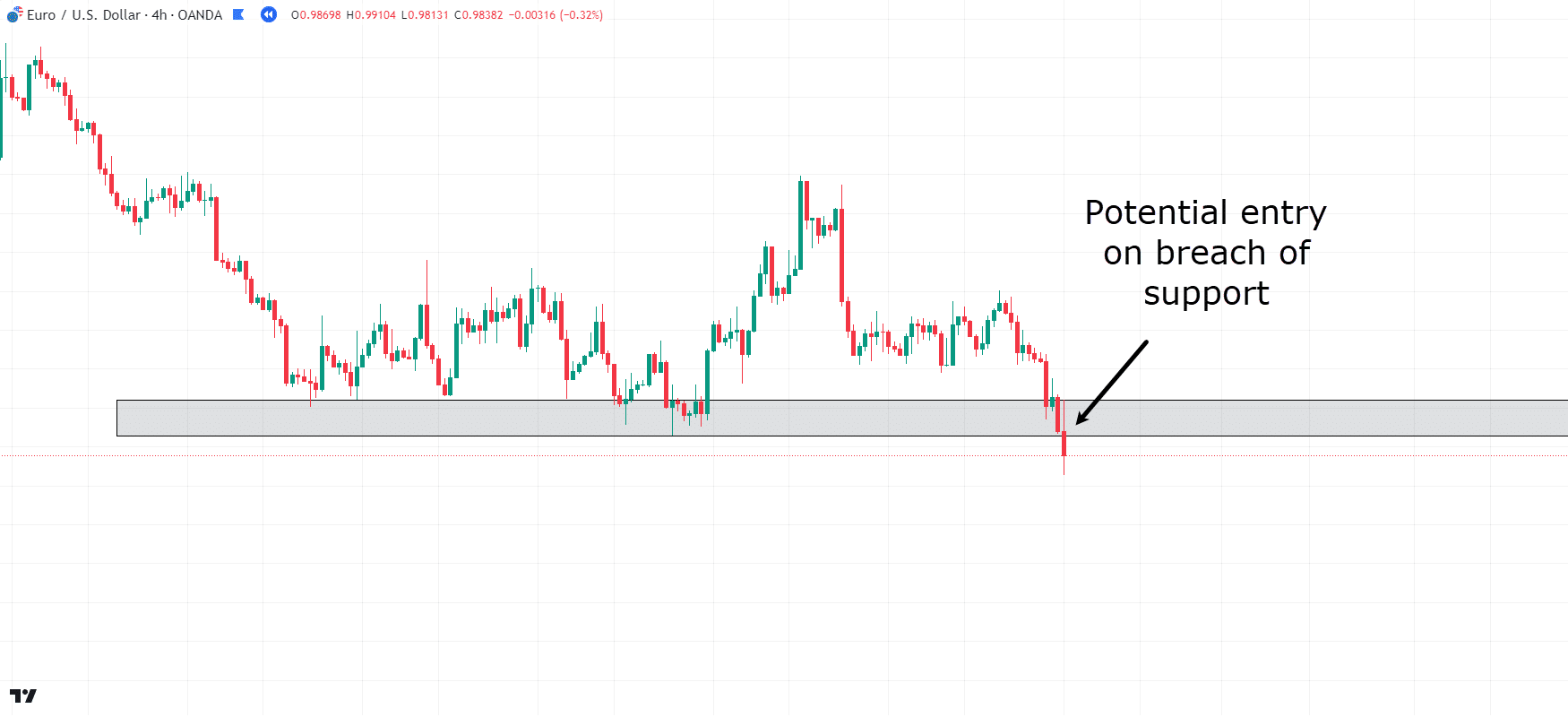

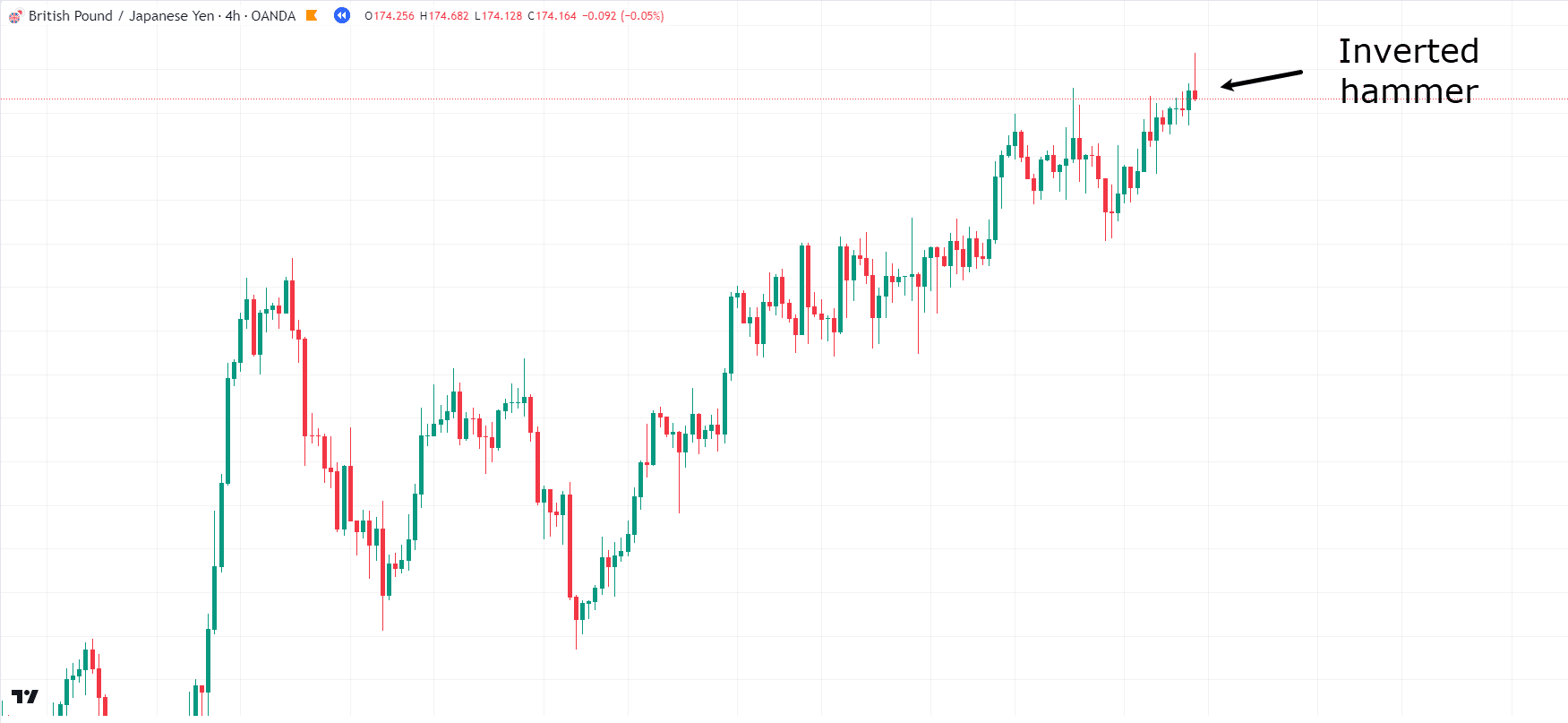

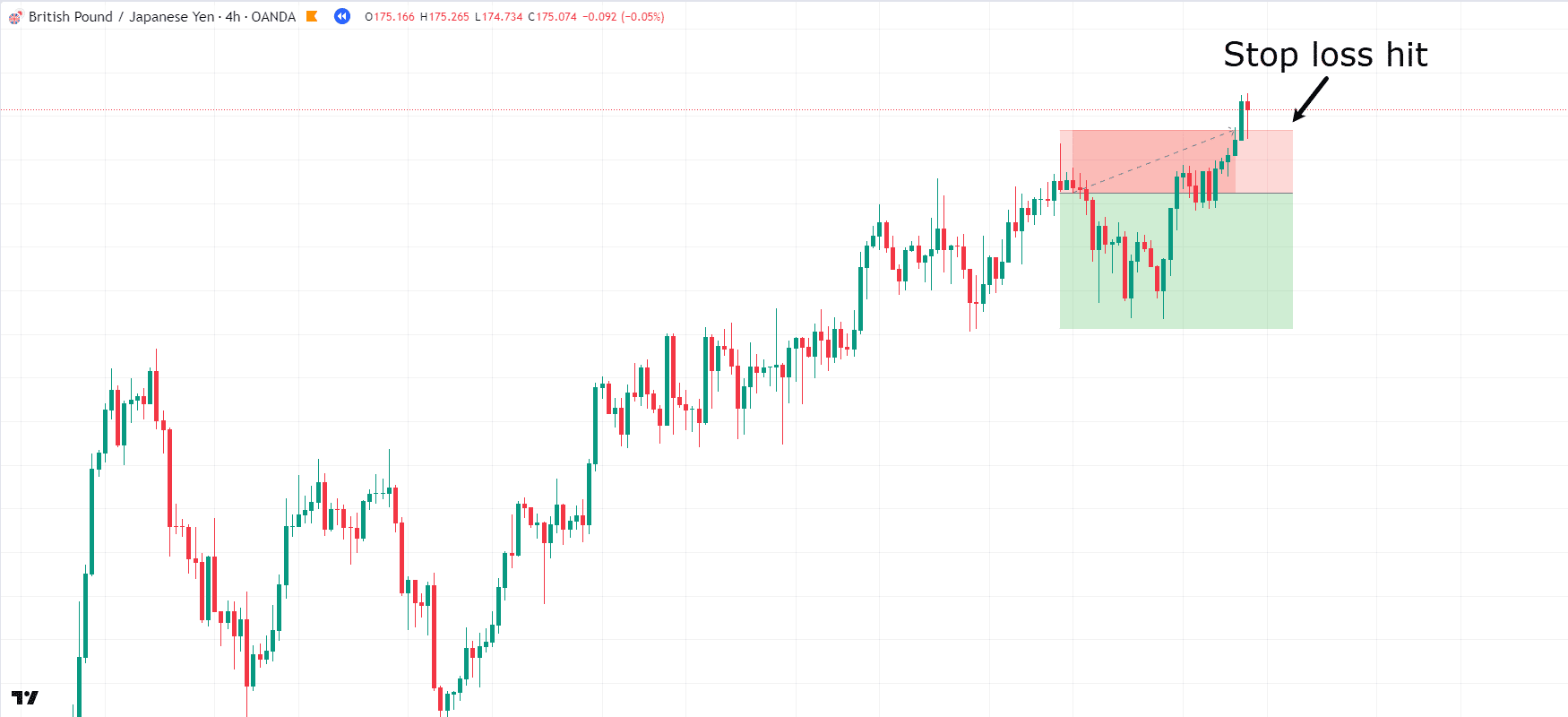

GBP/JPY 4-Hour Chart:

As you possibly can see, worth has printed a number of inverted hammers on this little cluster of candles…

GBP/JPY 4-Hour Chart Entry:

Let’s say for argument’s sake, you took this commerce since you noticed the Inverted Hammer occurring.

Entry on the candle and potential take income at 2RR…

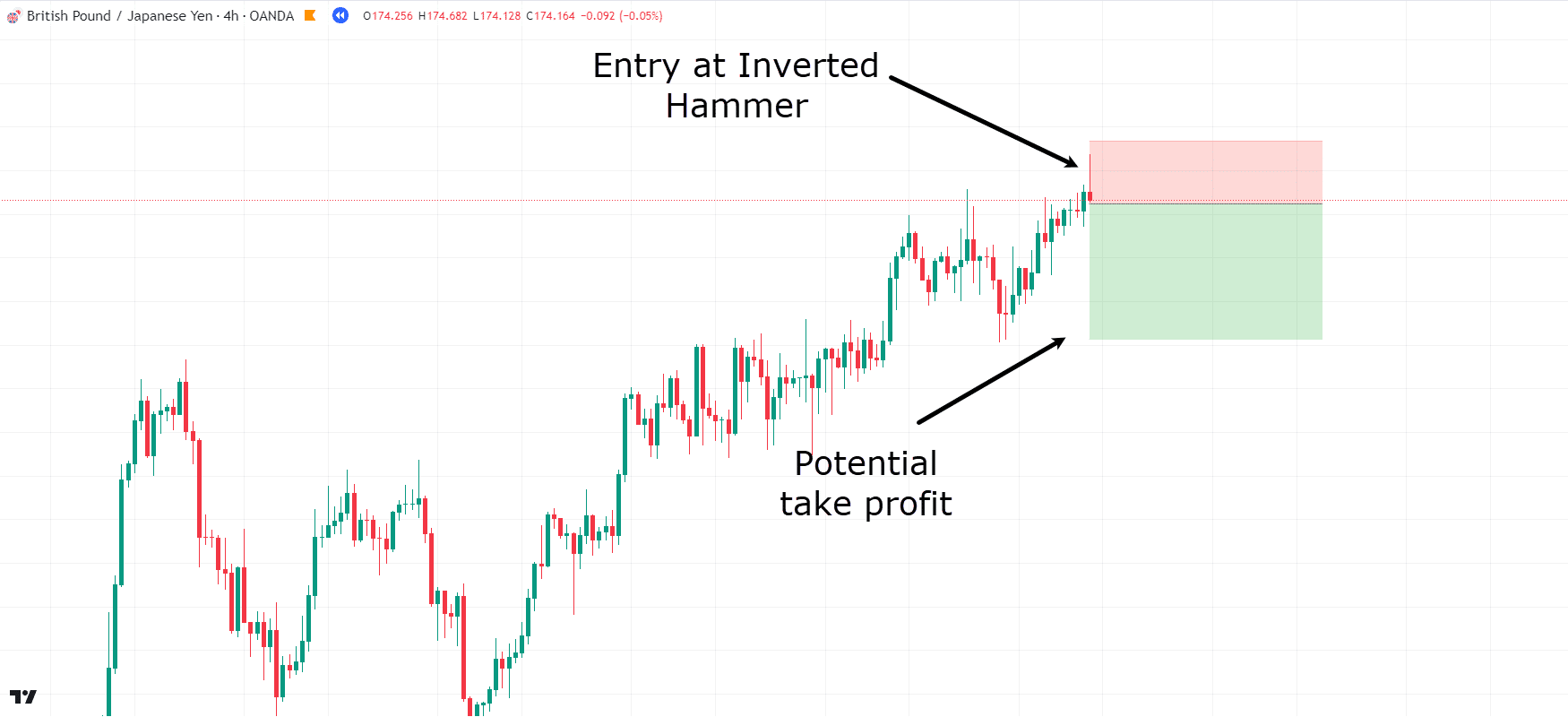

GBP/JPY 4-Hour Chart Cease Loss:

Oh no!

…Why did this occur?

The inverted Hammer sample fashioned and worth did go in your favour!

However let’s take a step again for a second…

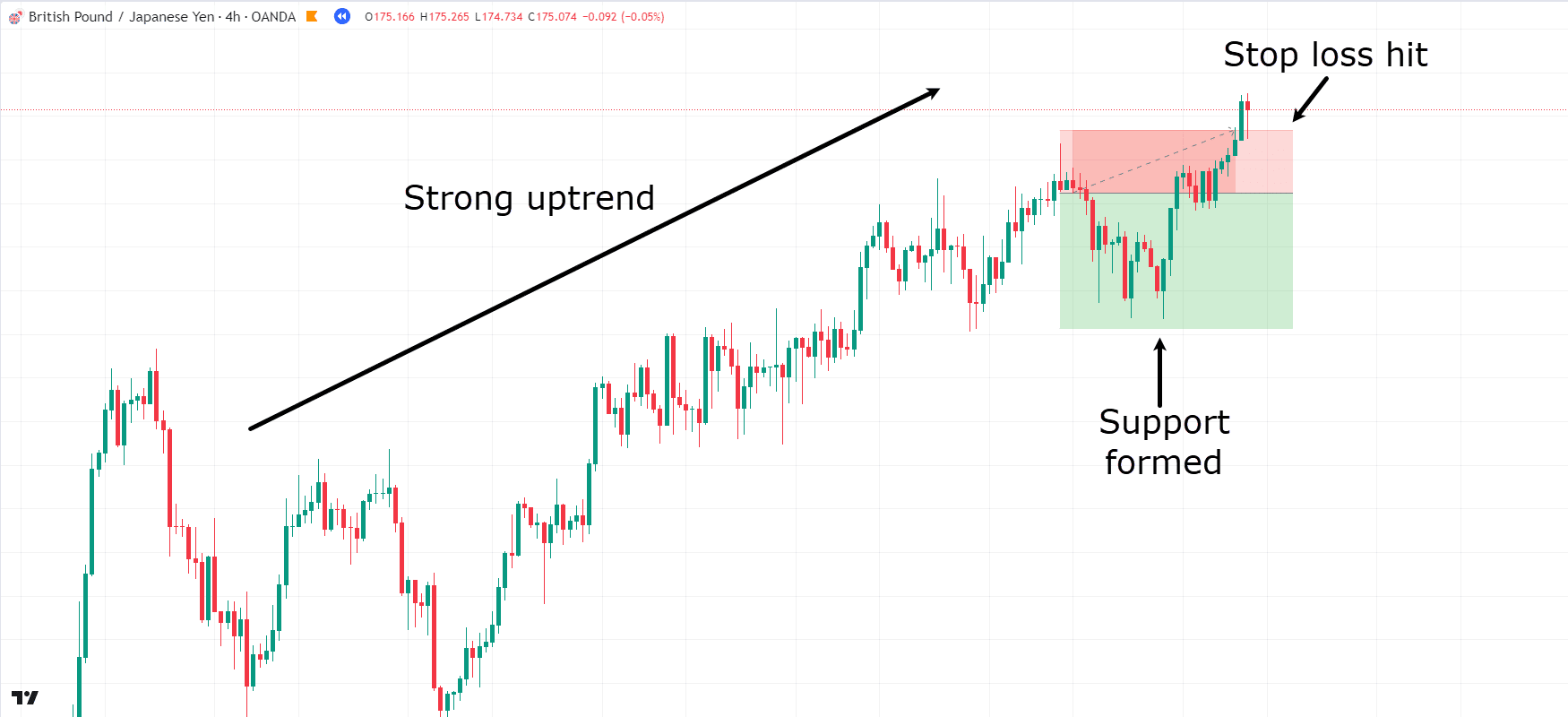

GBP/JPY 4-Hour Chart Rationalization:

Once you analyze this state of affairs, just a few issues start to come out.

Worth is definitely in a robust uptrend with little to no signal of that momentum slowing…

…not like earlier examples, there are not any actual key areas of worth on which this commerce was primarily based!

Though the value initially moved in favor of the commerce, it will definitely got here all the way down to a chart space and started treating it as help.

These bullish candlesticks on the help degree occurred a number of instances, indicating that the value was struggling to go decrease.

Whereas this might have been a possibility to shut the commerce early, the commerce itself lacked any strong market evaluation.

As an alternative, it was primarily based solely on a candlestick sample forming randomly on the chart, fairly than incorporating a number of arguments for a brief commerce.

As such, when buying and selling the Inverted Hammer, it’s vital to think about the market outlook as an entire, fairly than solely specializing in the candlestick sample itself.

This plugs into some limitations of the Inverted Hammer!

Limitations of the Inverted Hammer

You should concentrate on the constraints of this sample and train warning when incorporating it into your buying and selling methods!

Can’t be utilized in Isolation

One of many major limitations of the inverted hammer is that it can’t be relied upon as a standalone buying and selling sign.

Whereas the sample does present precious perception into potential bearish continuation, it’s important to spice up its evaluation with further technical indicators and affirmation indicators.

Relying solely on the inverted hammer with out contemplating different components equivalent to market context, pattern power, and quantity can improve the chance of false indicators…

…and result in poor buying and selling outcomes!

You must all the time use the inverted hammer as a part of an total buying and selling technique – incorporating loads of data to validate your commerce alternatives.

Have to be utilized in the proper space of the market

One other limitation of the inverted hammer is counting on its context inside the broader market pattern.

When the sample seems throughout a downtrend, it could imply that the pattern is prone to proceed in a bearish path.

Nevertheless, when it seems throughout different market situations, it isn’t as vital.

When determining what the inverted hammer means as a buying and selling sign, it is advisable to take into consideration the place it’s and the way the market is shifting round it.

Potential for short-lived bearish motion

You must do not forget that any bearish continuation indicated by the inverted hammer could also be short-lived.

Indications that bulls have begun making an attempt to step into the market can generally provide the heads up that the transfer decrease could not proceed for lengthy!

Elements equivalent to market volatility, basic developments, or surprising information occasions can all have an affect.

As such, you need to take care, carefully monitoring worth motion that follows an inverted hammer – correctly assessing the power of any motion.

Conclusion

In conclusion, the inverted hammer is a precious device for predicting continuation actions out there and might function a fantastic entry set off in your trades.

When used within the appropriate context of the market and with different technical evaluation, the inverted hammer supplies merchants with an edge to anticipate market outcomes.

To summarize, on this article, you’ve:

- Realized what the inverted hammer is

- Mentioned the bearish nature of the Inverted hammer

- Explored the alternative ways to commerce the inverted hammer

- Reviewed sensible examples utilizing charts

- Recognized the restrictions when utilizing the inverted hammer

Congratulations on uncovering one other device for profitable buying and selling!

Through the use of the Inverted Hammer to enhance your different technical evaluation you might be nicely in your technique to profitability!

Now – I’m keen to listen to your ideas on the inverted hammer…

Do you presently use this candlestick sample in your buying and selling?

Are you able to see why I view it as a bearish candlestick sample fairly than a bullish candlestick sample?

How a lot success have you ever had with it?

Share your ideas and experiences within the feedback under!

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)