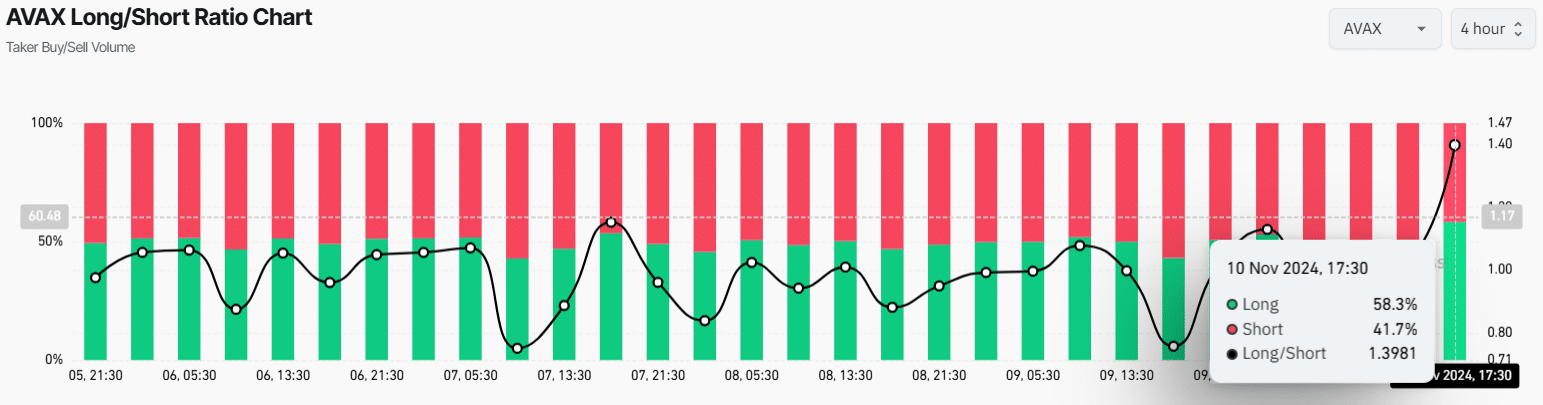

- AVAX’s Lengthy/Brief ratio stood at 1.40, suggesting robust bullish sentiment.

- 58.3% of prime AVAX merchants held lengthy positions at press time, whereas 41.7% held quick positions.

Amid the continued bullish market sentiment, Avalanche [AVAX] has already gained a formidable 40%, and regardless of this, it was poised for additional notable upside momentum.

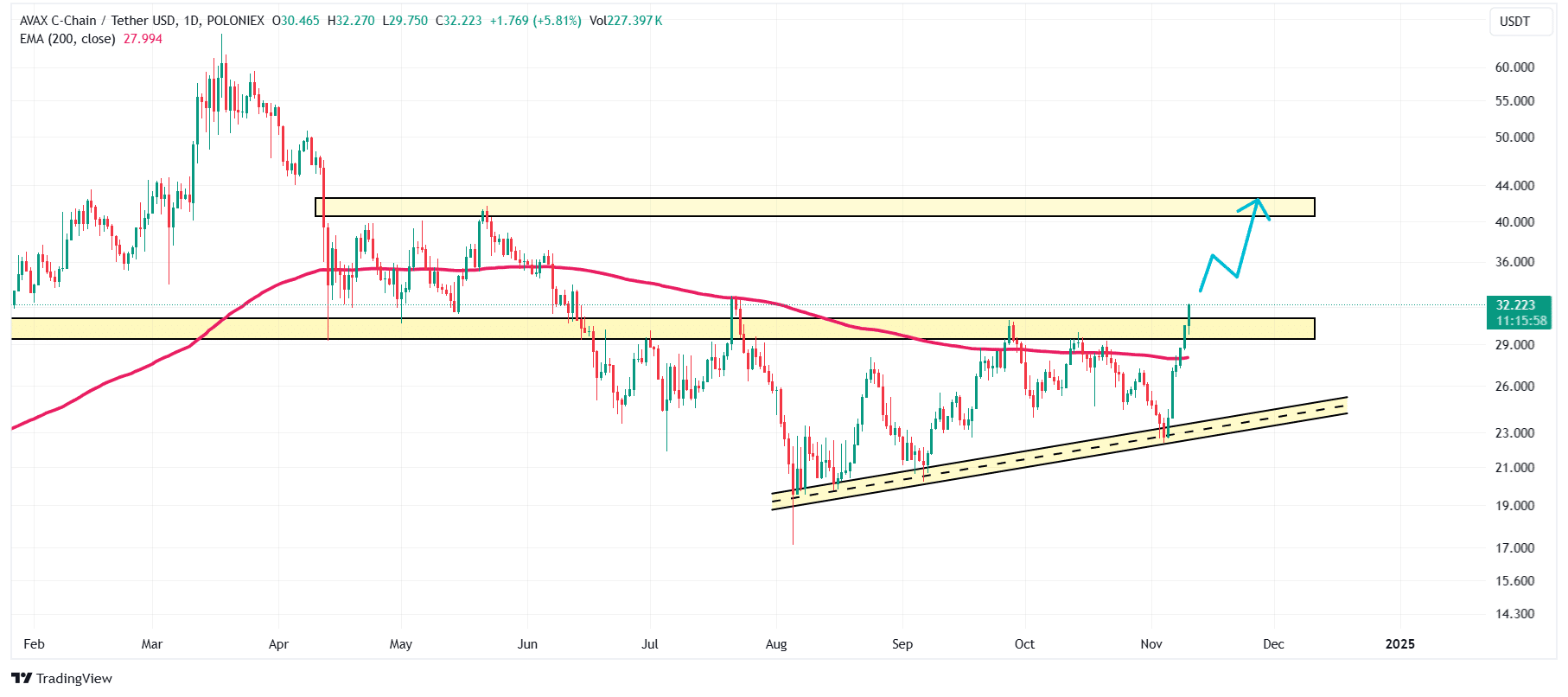

Like main cryptocurrencies, the AVAX day by day chart introduced bullish value motion, suggesting an ideal shopping for alternative.

Avalanche technical evaluation and key ranges

In line with AMBCrypto’s technical evaluation, AVAX has damaged out from a powerful resistance degree of $30 and is now heading towards the subsequent resistance degree.

With the current value surge, the asset has already breached the resistance of the 200 Exponential Shifting Common (EMA) on the day by day time-frame, shifting the sentiment from a downtrend to an uptrend.

Based mostly on historic value momentum, if AVAX closes a day by day candle above the $32 degree, there was a powerful chance it might soar by 35% to succeed in the $42.5 degree within the coming days.

Given the present market circumstances, it seems the asset might simply obtain this degree with out dealing with important difficulties.

AVAX is bullish, on-chain

In line with the analytics agency Coinglass, AVAX’s Lengthy/Brief ratio stood at 1.40, as of the time of writing. This ratio recommended additionally robust bullish sentiment amongst merchants.

Moreover, its Open Curiosity soared by 13.6% over the previous 24 hours, indicating strong participation from merchants following the current breakout.

On the time of writing, 58.3% of prime AVAX/USDT merchants held lengthy positions, whereas 41.7% held quick positions.

Thus, it appeared that bulls and whales had been dominating the asset, which might lead to a notable upside rally within the coming days.

Is your portfolio inexperienced? Try the AVAX Revenue Calculator

At press time, AVAX was buying and selling close to $32.05, having gained over 9.6% prior to now 24 hours.

Throughout the identical interval, its buying and selling quantity surged by 26%, indicating robust participation from merchants and buyers amid the bullish sentiment.

![Why Avalanche [AVAX] is about for 35% rally, key components reveal](https://sarkariresultbihar.info/wp-content/uploads/2024/11/Chandan-AVAX-1000x600.webp-750x375.webp)

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-120x86.jpg)

![Cosmos [ATOM]: Merchants ought to look ahead to this key worth motion](https://sarkariresultbihar.info/wp-content/uploads/2024/11/News-Articles-FI-Editors-2024-11-21T100128.179-1000x600-350x250.jpg)